- Japan

- /

- Electronic Equipment and Components

- /

- TSE:8159

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism following the Federal Reserve's recent rate cut and ongoing economic uncertainties, investors are keeping a close eye on dividend stocks as a potential source of stability and income. In such an environment, selecting strong dividend-paying stocks can be particularly appealing, as they often represent companies with solid fundamentals and the ability to generate consistent cash flow even amidst broader market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.30% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★☆ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

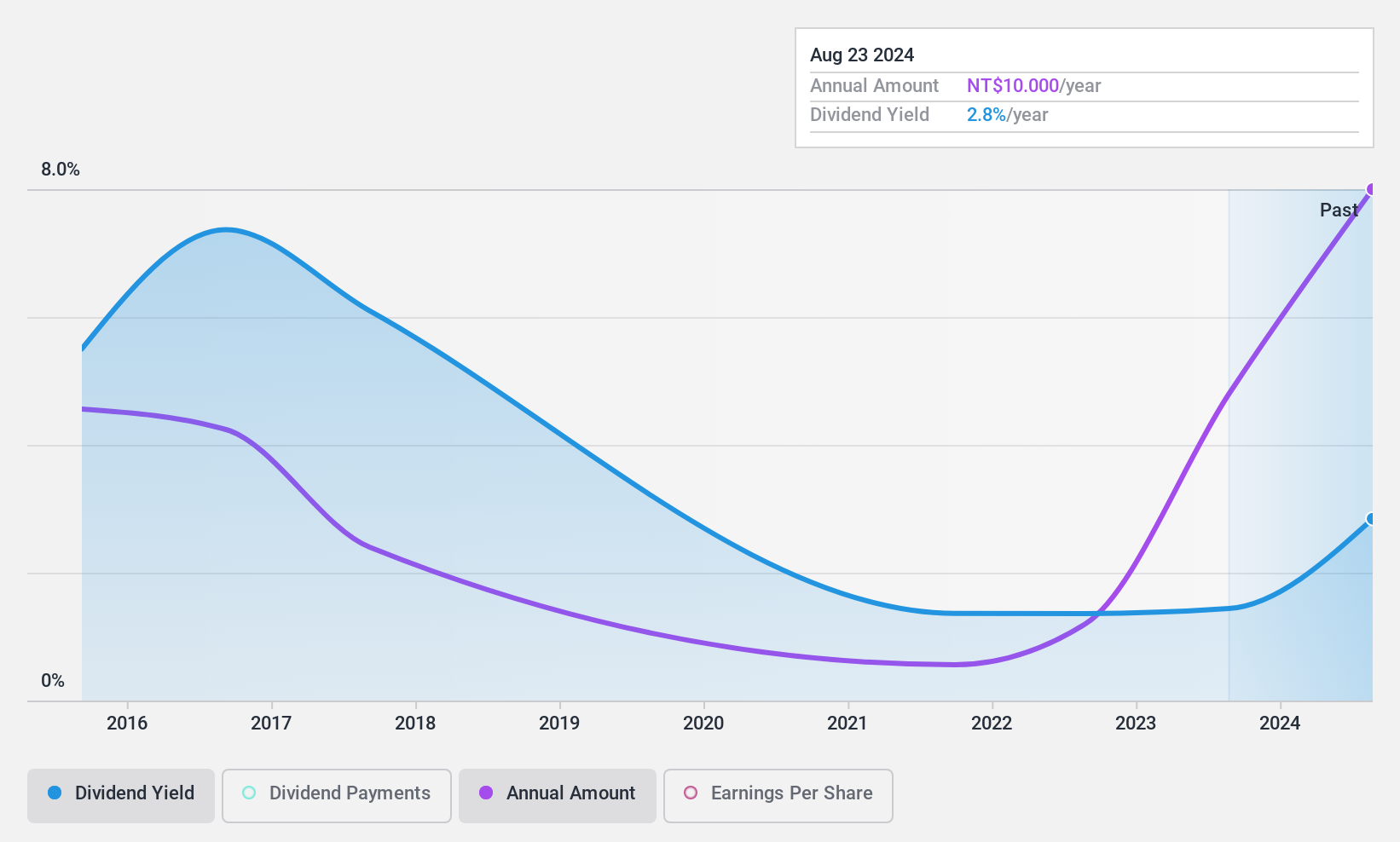

AIC (TPEX:3693)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AIC Inc. offers OEM/ODM, commercial off-the-shelf, and server and storage solutions across the United States, Asia, and Europe with a market cap of NT$14.27 billion.

Operations: AIC Inc.'s revenue is primarily derived from its Computers and Related Spare Parts Department, totaling NT$8.79 billion.

Dividend Yield: 3%

AIC's recent earnings report shows a slight decline in quarterly sales and net income, but an improvement in nine-month figures. Despite volatile dividends over the past decade, AIC has managed to increase its payouts. The dividend yield is below the top tier of Taiwan's market, yet a low payout ratio suggests sustainability. With a price-to-earnings ratio under the market average, AIC offers potential value for investors seeking dividend growth despite past inconsistencies.

- Get an in-depth perspective on AIC's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of AIC shares in the market.

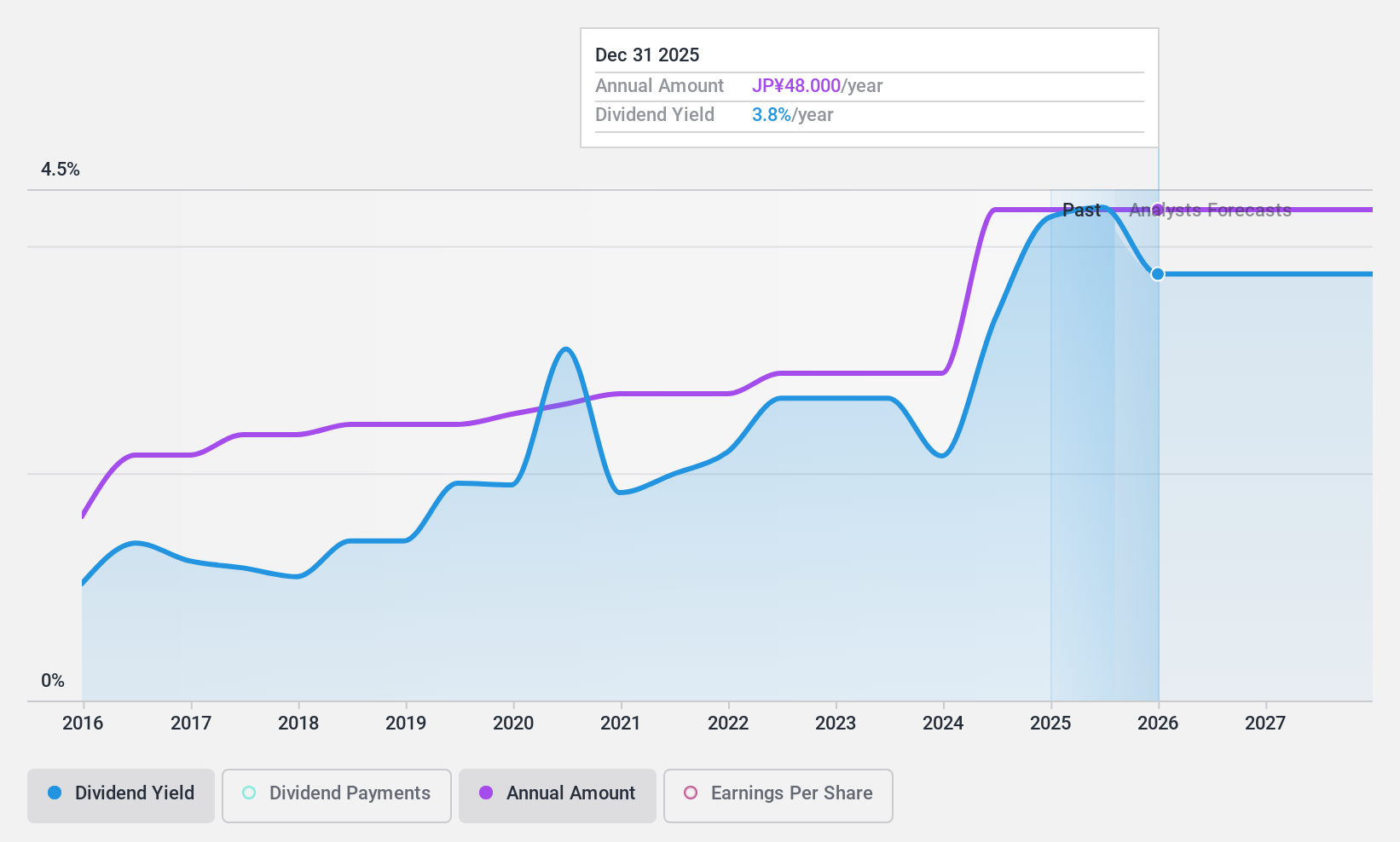

SIIX (TSE:7613)

Simply Wall St Dividend Rating: ★★★★★★

Overview: SIIX Corporation is involved in the sale and distribution of electronic components both in Japan and internationally, with a market cap of ¥54.86 billion.

Operations: SIIX Corporation generates revenue from various regions, with ¥103.89 billion from Japan, ¥27.16 billion from Europe, ¥76.21 billion from the Americas, ¥85.60 billion from Greater China, and ¥115.45 billion from Southeast Asia.

Dividend Yield: 4.1%

SIIX Corporation offers a compelling dividend profile with stable and growing payments over the past decade. Its dividends are well-covered by earnings and cash flows, given a low payout ratio of 44.6% and a cash payout ratio of 18.4%. Trading at good value relative to peers, SIIX's dividend yield stands at 4.12%, placing it in the top quartile of Japan's market for dividend payers, suggesting an attractive option for income-focused investors.

- Unlock comprehensive insights into our analysis of SIIX stock in this dividend report.

- According our valuation report, there's an indication that SIIX's share price might be on the cheaper side.

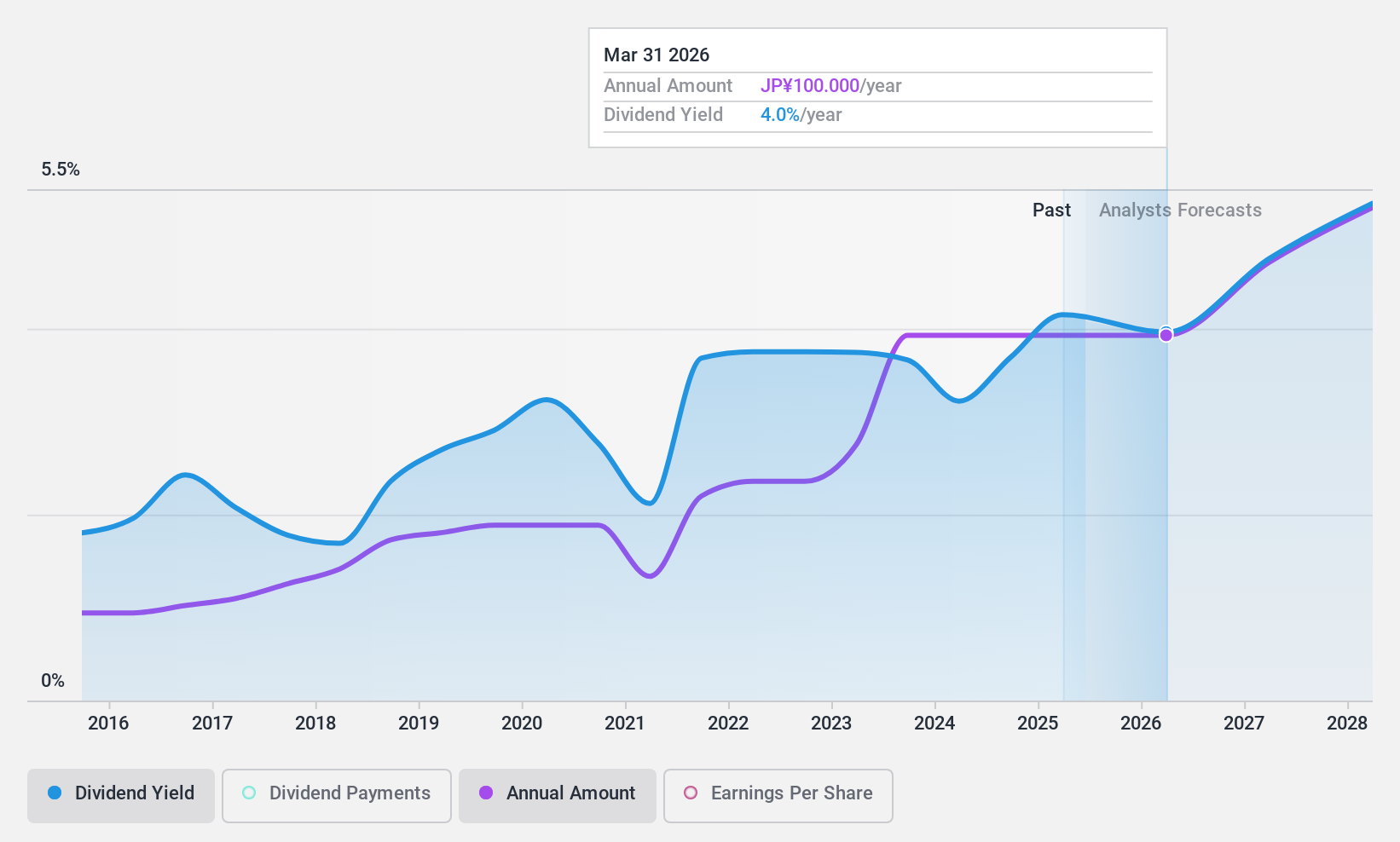

Tachibana Eletech (TSE:8159)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tachibana Eletech Co., Ltd. is a technology-driven trading company operating in Japan and internationally, with a market cap of ¥62.57 billion.

Operations: Tachibana Eletech Co., Ltd. generates its revenue through diverse technology-driven trading operations both domestically and internationally.

Dividend Yield: 3.7%

Tachibana Eletech's dividend profile shows mixed stability, with a low payout ratio of 17.7% and cash payout ratio of 22.8%, indicating dividends are well-covered by earnings and cash flows despite past volatility. The recent dividend announcement maintained JPY 50 per share, reflecting consistency but not growth. Trading significantly below estimated fair value, the stock presents good relative value though its yield of 3.75% is slightly below Japan's top tier for dividend payers.

- Click here and access our complete dividend analysis report to understand the dynamics of Tachibana Eletech.

- Our valuation report here indicates Tachibana Eletech may be undervalued.

Key Takeaways

- Click here to access our complete index of 1959 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tachibana Eletech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8159

Tachibana Eletech

Operates as a technology-driven trading company in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives