- Japan

- /

- Electronic Equipment and Components

- /

- TSE:8154

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments and economic indicators, with U.S. stocks nearing record highs and European equities gaining momentum, investors are increasingly focused on opportunities that offer stability amid uncertainty. In this environment, dividend stocks stand out as a compelling option for those seeking consistent income and potential growth, making them worthy of consideration in today's dynamic market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.98% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

JICHODOLtd (TSE:3597)

Simply Wall St Dividend Rating: ★★★★★★

Overview: JICHODO Co., Ltd. specializes in the planning, manufacturing, and sale of uniforms both in Japan and internationally, with a market cap of ¥27.01 billion.

Operations: JICHODO Co., Ltd. generates revenue primarily through its Manufacture and Sale of Apparel segment, which accounts for ¥15.90 billion.

Dividend Yield: 5.3%

JICHODOLtd. offers a high and reliable dividend yield of 5.28%, placing it in the top 25% of dividend payers in the JP market. The company's dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 56.5% and a low cash payout ratio of 37.9%. Despite recent declines in profit margins, its dividends remain well-covered by both earnings and cash flows, ensuring sustainability for investors seeking income stability.

- Click to explore a detailed breakdown of our findings in JICHODOLtd's dividend report.

- Upon reviewing our latest valuation report, JICHODOLtd's share price might be too pessimistic.

SAXA (TSE:6675)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SAXA, Inc., with a market cap of ¥16.92 billion, develops, manufactures, and sells equipment and components for information and communication systems in Japan through its subsidiaries.

Operations: SAXA, Inc. generates revenue from its Information and Communication System Equipment and Parts segment, totaling ¥38.70 billion.

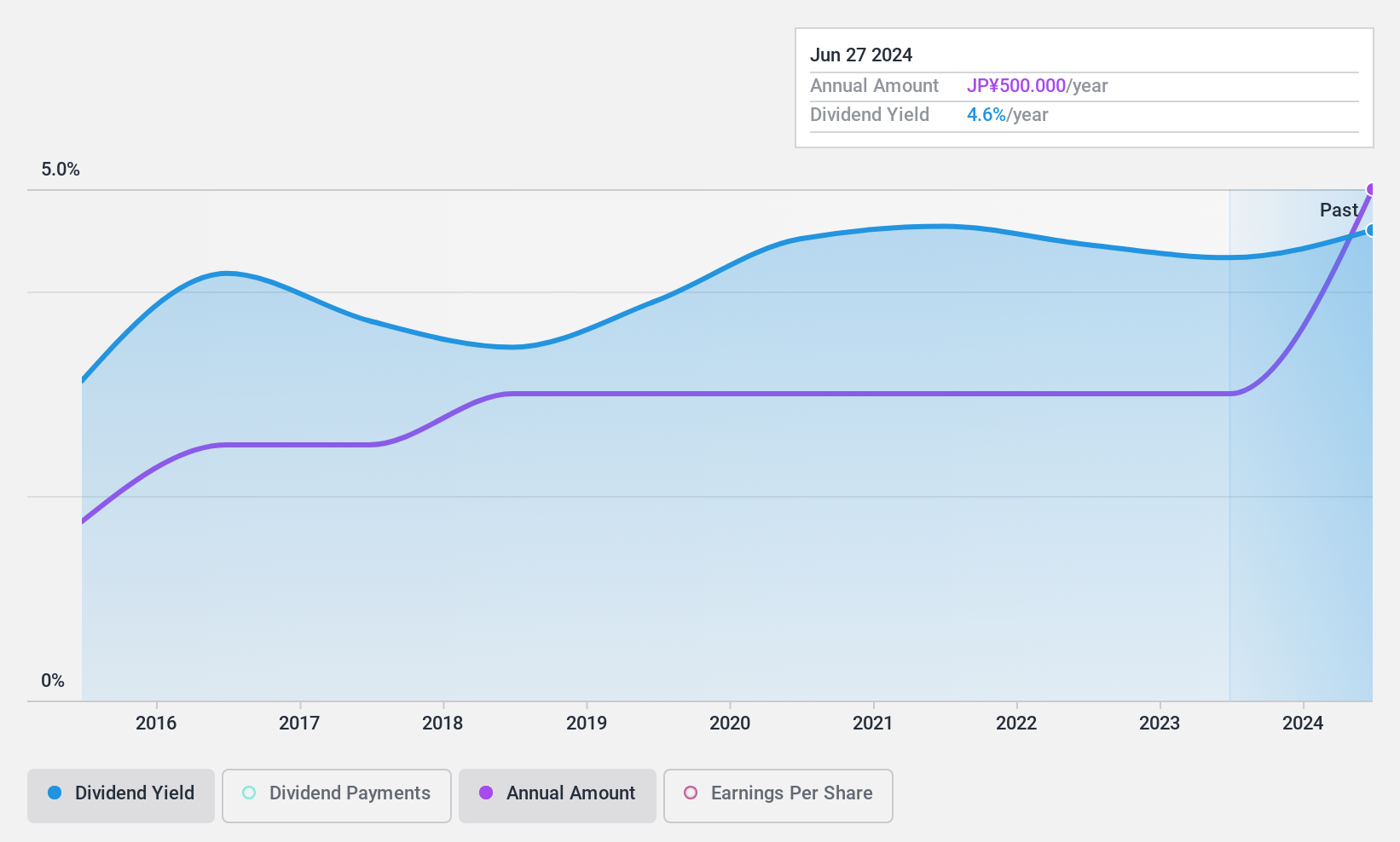

Dividend Yield: 4.6%

SAXA's dividend yield of 4.6% ranks among the top 25% in the JP market, yet its dividends have been volatile and unreliable over the past decade. While its payout ratio of 32.6% suggests earnings coverage, a high cash payout ratio of 341.3% indicates poor cash flow support, raising sustainability concerns. Despite trading at a favorable price-to-earnings ratio compared to peers, earnings are expected to decline by an average of 5.1% annually over three years, impacting future dividend stability.

- Unlock comprehensive insights into our analysis of SAXA stock in this dividend report.

- Our valuation report unveils the possibility SAXA's shares may be trading at a discount.

Kaga ElectronicsLtd (TSE:8154)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kaga Electronics Co., Ltd. is engaged in selling electronic parts, semiconductors, PCs, and peripherals across Japan, North America, Europe, and Asia with a market cap of ¥144.58 billion.

Operations: Kaga Electronics Co., Ltd. generates revenue primarily from Electronic Components at ¥460.16 billion and Information Equipment at ¥52.66 billion, with additional contributions from Software amounting to ¥4.48 billion.

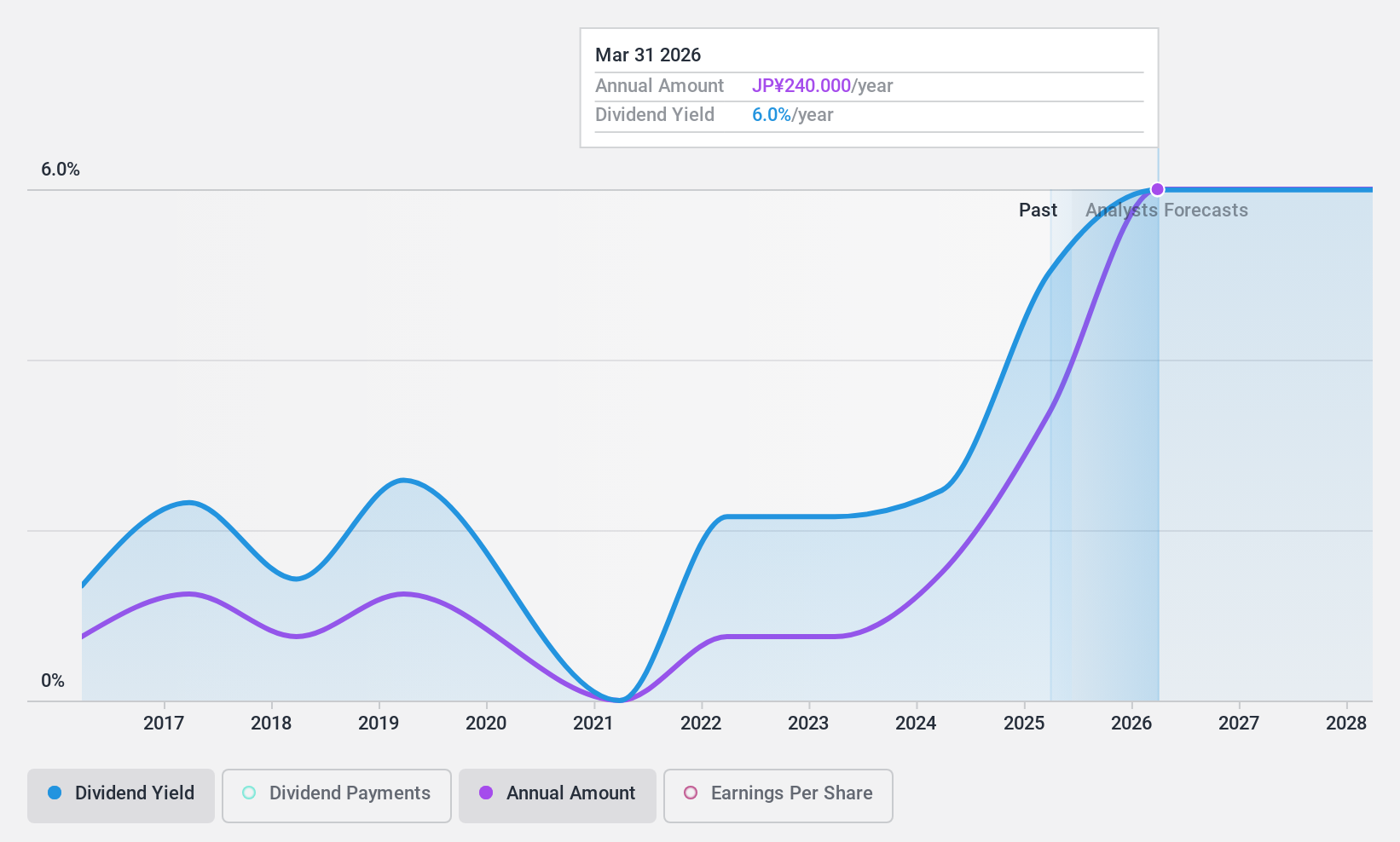

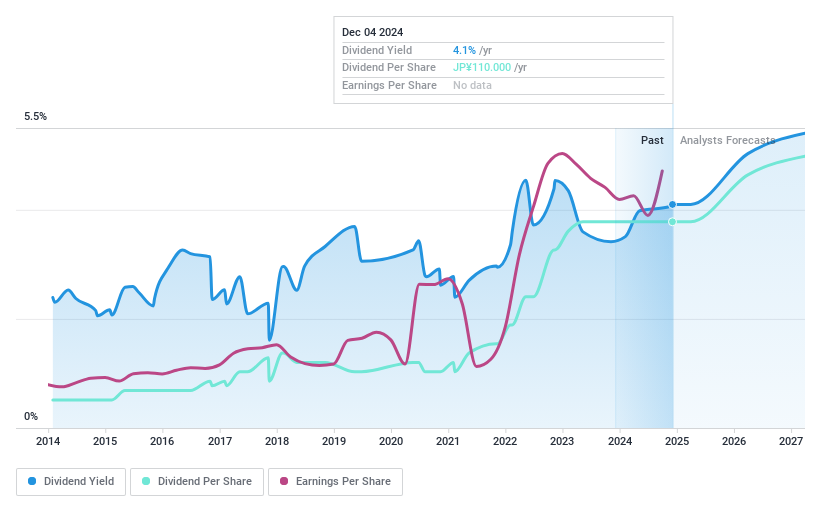

Dividend Yield: 3.9%

Kaga Electronics offers a dividend yield of 3.92%, placing it in the top 25% of Japanese dividend payers. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 34.2% and 20.3% respectively, indicating sustainability despite a historically volatile track record over the past decade. Recent executive changes could influence future strategy, but currently, Kaga trades at a significant discount to its estimated fair value, enhancing its appeal for value-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Kaga ElectronicsLtd.

- Our valuation report here indicates Kaga ElectronicsLtd may be undervalued.

Summing It All Up

- Navigate through the entire inventory of 1949 Top Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kaga ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8154

Kaga ElectronicsLtd

Sells electronics parts, semiconductors, PCs, and peripherals in Japan, North America, Europe, and Asia.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion