- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:4014

Discovering Undiscovered Gems with Promising Potential This January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets are navigating a complex landscape characterized by fluctuating consumer confidence and mixed economic indicators. While major stock indexes have experienced moderate gains, the backdrop of declining manufacturing data and rising treasury yields suggests a cautious environment for investors, particularly in the small-cap segment. In this setting, identifying promising stocks involves looking for those with strong fundamentals and resilience to broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Scientific and Medical Equipment House (SASE:4014)

Simply Wall St Value Rating: ★★★★★☆

Overview: Scientific and Medical Equipment House Company specializes in the maintenance and contracting of medical devices, as well as trading in medical equipment and materials, with a market cap of SAR 1.53 billion.

Operations: The company generates revenue primarily from maintenance and operation services, contributing SAR 739.72 million, followed by medical equipment sales and post-sale maintenance services at SAR 91.64 million. Additionally, the construction segment adds SAR 51.77 million to its revenue streams. The net profit margin is a key financial metric for the company.

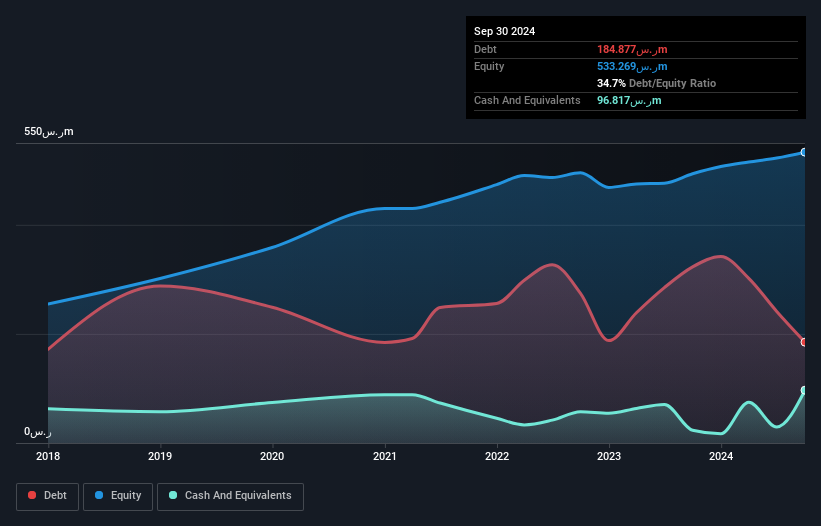

Scientific and Medical Equipment House, a smaller player in its field, recently reported third-quarter sales of SAR 218.39 million, up from SAR 211.79 million the previous year, although net income fell to SAR 12.78 million from SAR 17.17 million. Despite a challenging five-year earnings decline of nearly 26% annually, the company has shown impressive recent growth with a staggering annual earnings increase of over fourfold compared to industry standards. With a satisfactory net debt-to-equity ratio at 16.5%, it trades significantly below estimated fair value by almost 96%, indicating potential undervaluation in the market.

Nitto Fuji Flour MillingLtd (TSE:2003)

Simply Wall St Value Rating: ★★★★★★

Overview: Nitto Fuji Flour Milling Co., Ltd. is a Japanese company that focuses on the manufacturing and sale of flour products, with a market capitalization of ¥61.46 billion.

Operations: Nitto Fuji generates revenue primarily through the sale of flour products in Japan. The company has a market capitalization of ¥61.46 billion, indicating its significant presence in the industry.

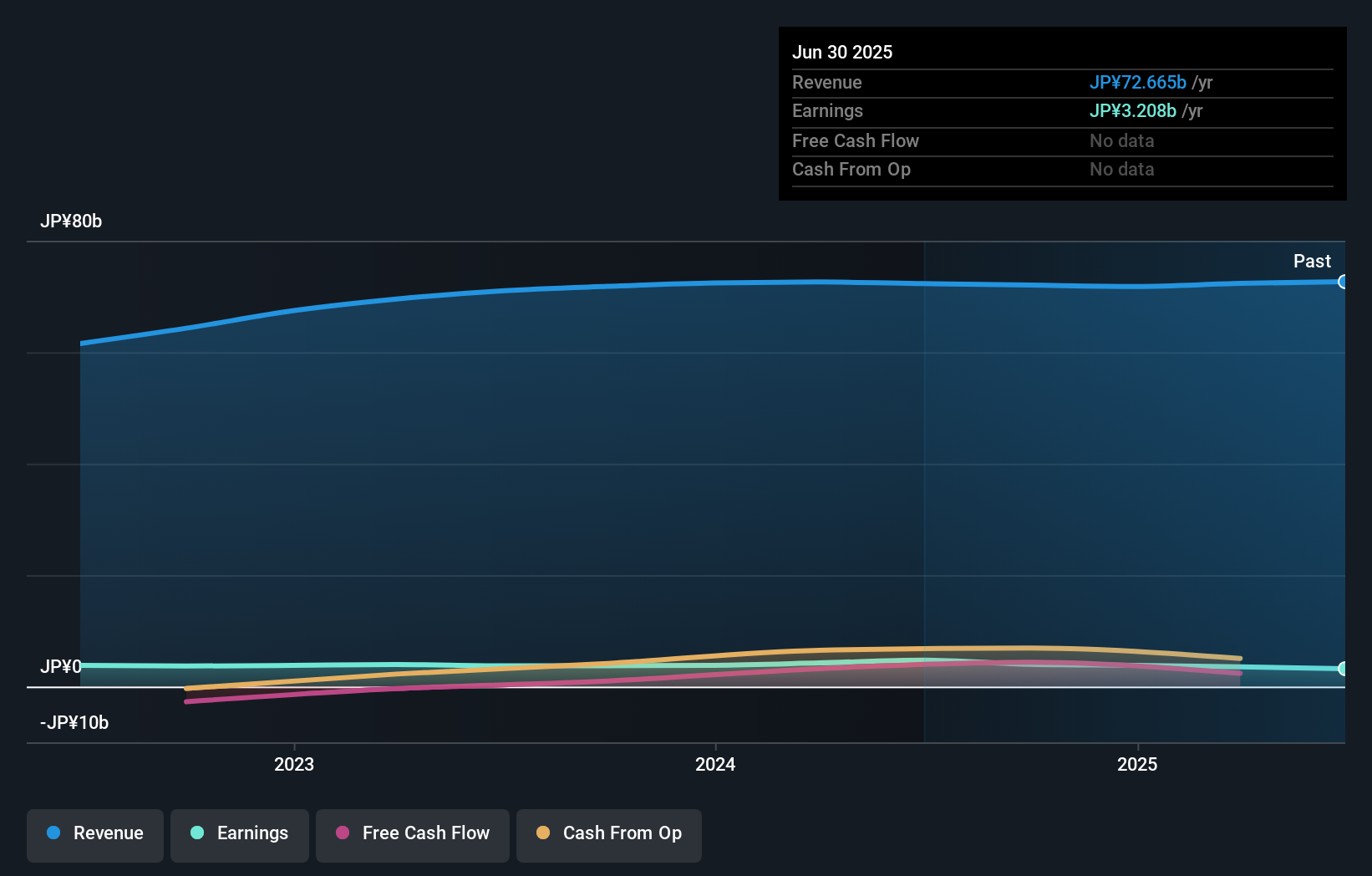

Nitto Fuji, a compact player in the food sector, is trading at 88.8% below its estimated fair value, indicating potential undervaluation. Over the past five years, earnings have grown at an annual rate of 4.7%, although recent growth of 7.5% lags behind the broader food industry’s 19.5%. The company boasts high-quality earnings and has improved its financial health by reducing its debt-to-equity ratio from 2.6 to 0.9 over five years, suggesting prudent management of liabilities and a focus on strengthening balance sheet metrics while maintaining positive free cash flow status amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of Nitto Fuji Flour MillingLtd.

Gain insights into Nitto Fuji Flour MillingLtd's past trends and performance with our Past report.

Ryoden (TSE:8084)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ryoden Corporation is involved in the sale of factory automation systems, cooling and heating systems, information and communication technologies, facilities systems, and electronics both in Japan and internationally, with a market cap of ¥54.10 billion.

Operations: Ryoden generates revenue primarily from Electronics (¥149.31 billion) and Factory Automation Systems (¥49.93 billion), with X-Tech contributing ¥7.51 billion. The company experiences a segment adjustment of ¥32.10 billion, impacting its overall financial performance.

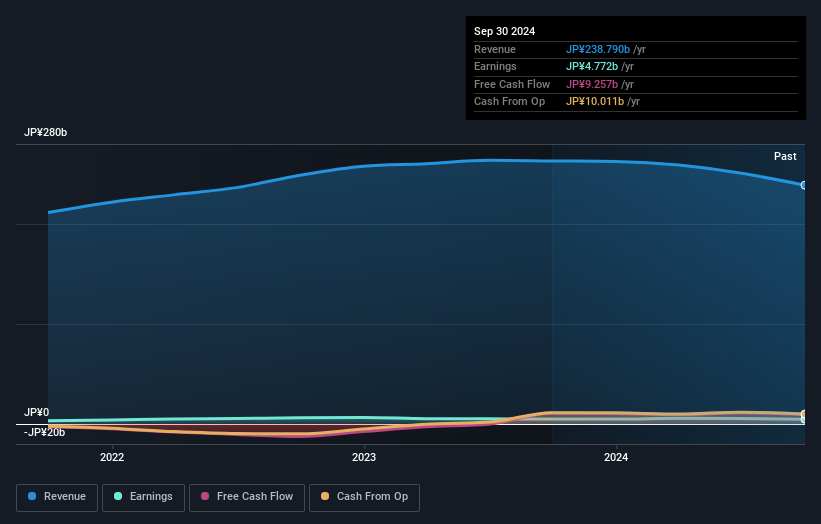

Ryoden, a promising player in the electronics sector, is trading at 56.3% below its estimated fair value, showcasing potential for value seekers. Despite high-quality past earnings and a positive free cash flow of ¥11.25 billion as of June 2024, challenges remain with recent guidance revisions lowering expected net sales to ¥218 billion and operating profit to ¥5.5 billion due to inventory adjustments and economic conditions in China. The debt-to-equity ratio has increased from 0.8 to 4.6 over five years, indicating rising financial leverage but remains manageable with more cash than total debt on hand.

- Navigate through the intricacies of Ryoden with our comprehensive health report here.

Assess Ryoden's past performance with our detailed historical performance reports.

Summing It All Up

- Explore the 4637 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4014

Scientific and Medical Equipment House

Provides technological solutions and services for healthcare and catering projects in the Kingdom of Saudi Arabia.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion