- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7762

Citizen Watch (TSE:7762) Valuation After Upgraded Earnings Outlook and Dividend Hike

Reviewed by Simply Wall St

Citizen Watch (TSE:7762) just updated its guidance for the year ending March 2026, citing strong sales momentum in its core brands and a lift in profitability from higher e-commerce prices. The company also raised its interim dividend, which signals growing confidence in its outlook.

See our latest analysis for Citizen Watch.

After revising its outlook upward, Citizen Watch has caught the market’s attention, with the share price surging 36% year-to-date and momentum building sharply over the past quarter. This strong run adds to an impressive 44% total shareholder return in just the last year. The renewed optimism about both short-term and long-term prospects follows higher sales and profitability updates.

If you’re interested in discovering what else might be accelerating, consider broadening your search with a look at fast growing stocks with high insider ownership.

With shares on a tear and management raising forecasts, investors now face a key question: Is Citizen Watch undervalued despite recent gains, or is the market already pricing in all the future growth?

Price-to-Earnings of 12.9x: Is it justified?

Citizen Watch currently trades at a price-to-earnings (P/E) ratio of 12.9x, just below the Japanese market average of 13.7x and lower than peers in the electronic industry. This suggests that, relative to earnings, the market is not attributing an especially high growth premium to the stock's recent momentum.

The price-to-earnings ratio measures what investors are willing to pay today for a company's recent earnings. It is one of the most direct signals of the market’s confidence in future profitability. For Citizen Watch, a lower P/E can indicate caution regarding the sustainability of recent gains or a disconnect between future growth expectations and share price.

Compared to the Japanese electronic industry average of 14.0x and a peer average of 17.7x, Citizen Watch's P/E signals a discount. The current ratio is also below our estimate of the fair price-to-earnings ratio of 14.2x, hinting at some headroom for re-rating if the company delivers ongoing profit growth.

Explore the SWS fair ratio for Citizen Watch

Result: Price-to-Earnings of 12.9x (UNDERVALUED)

However, stagnant annual net income growth and a current share price that is above analyst targets could present headwinds to continued outperformance.

Find out about the key risks to this Citizen Watch narrative.

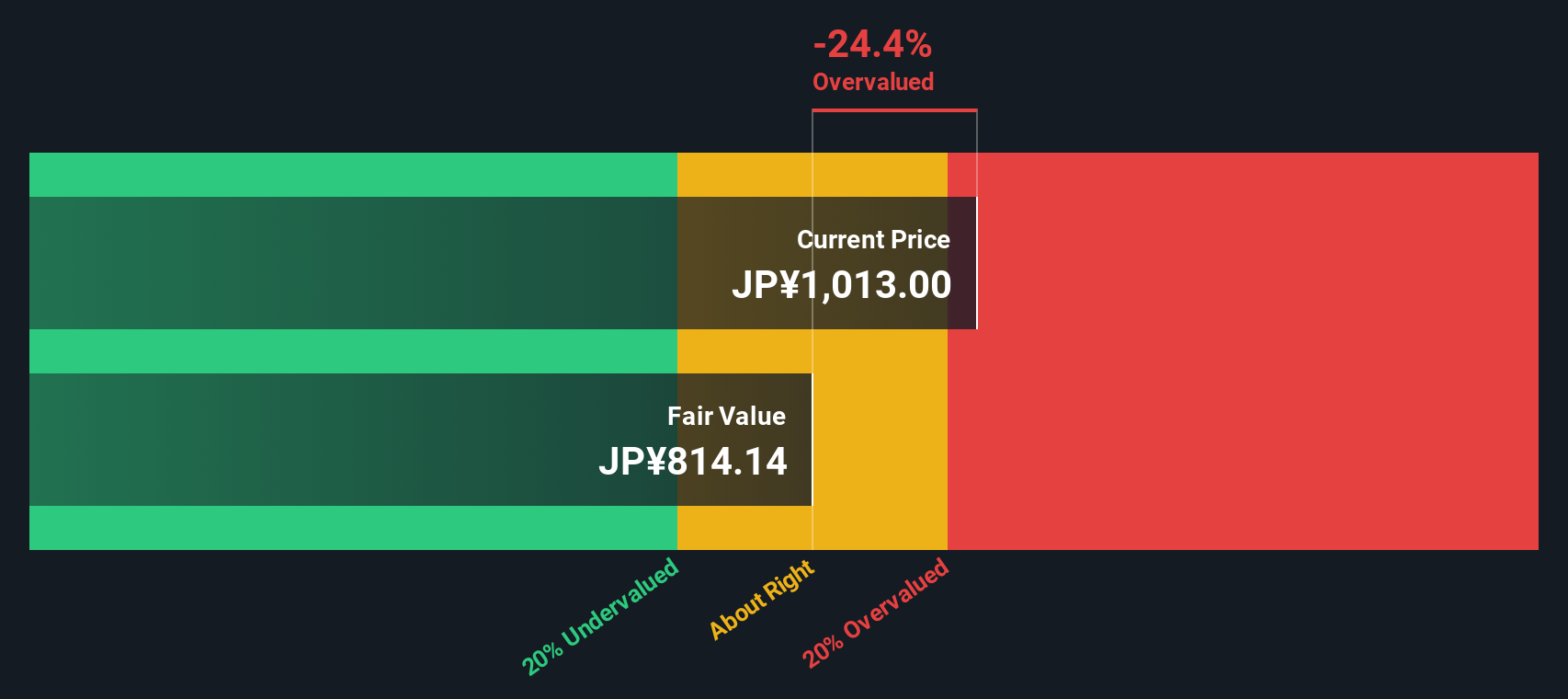

Another View: Discounted Cash Flow Raises Questions

While a low price-to-earnings ratio presents Citizen Watch as undervalued compared to its peers and the broader market, our DCF model offers a different perspective. Based on its long-term cash flow potential, the shares currently trade significantly above our estimate of fair value. Could this gap indicate increased risk if growth slows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Citizen Watch for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Citizen Watch Narrative

If you’d like to dig deeper and see the numbers for yourself, you can create a personalized outlook and narrative in just a few minutes, Do it your way.

A great starting point for your Citizen Watch research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Maximize your portfolio’s potential with hand-picked stocks tailored for future growth, income, and breakthrough innovation, all just a click away.

- Tap into the potential for double-digit returns with these 919 undervalued stocks based on cash flows featuring companies trading below their intrinsic value.

- Boost your income streams by checking out these 16 dividend stocks with yields > 3% offering consistent yields above 3% from financially solid businesses.

- Ride the wave of technological disruption with these 25 AI penny stocks packed with firms at the forefront of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7762

Citizen Watch

Manufactures and sells watches and related components worldwide.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives