- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7760

Earnings Tell The Story For IMV Corporation (TSE:7760) As Its Stock Soars 28%

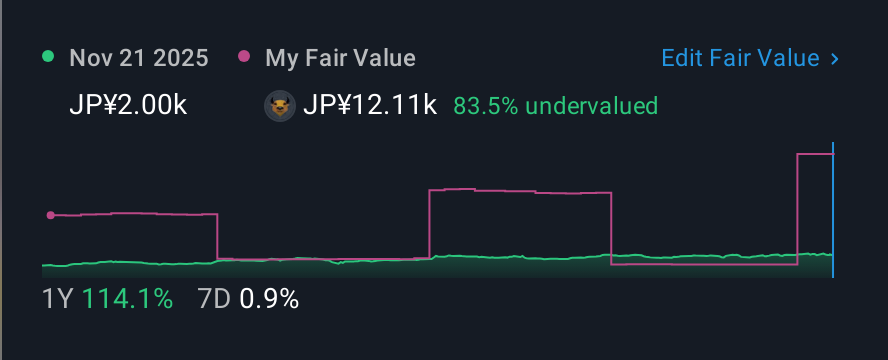

IMV Corporation (TSE:7760) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last month tops off a massive increase of 245% in the last year.

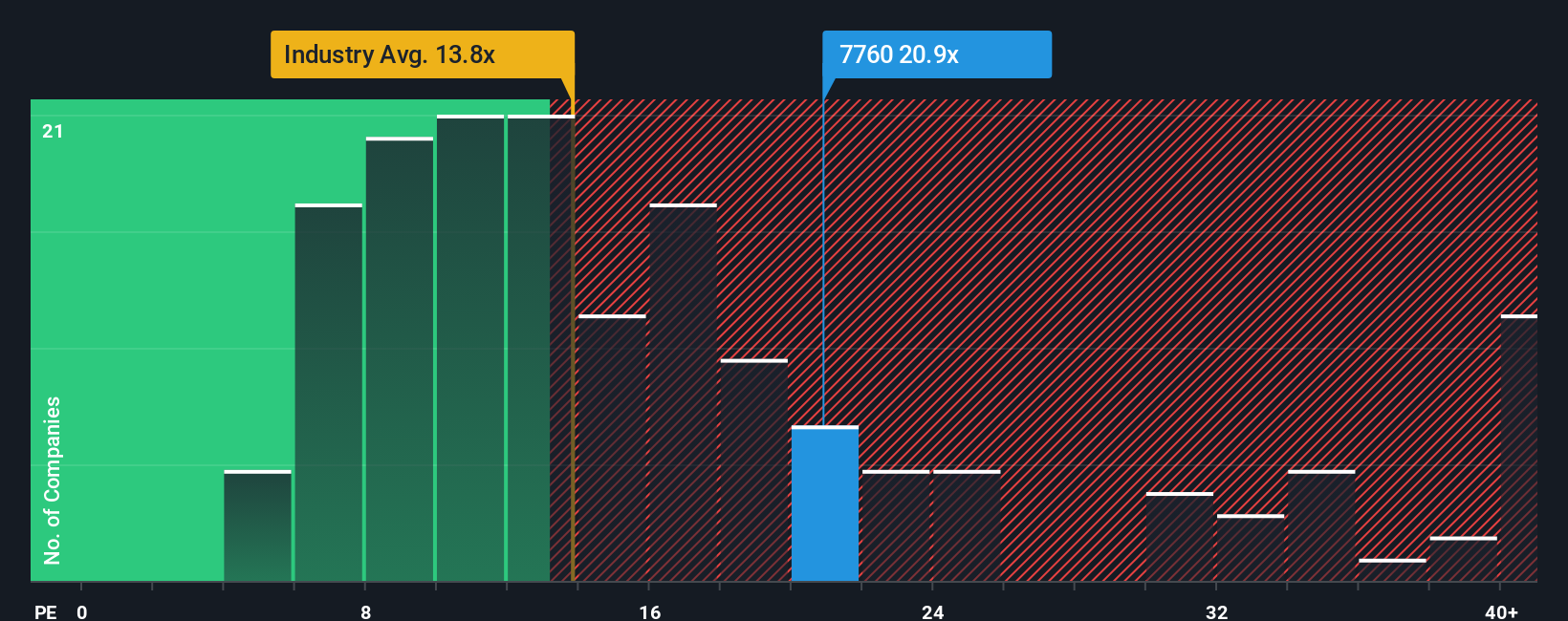

Since its price has surged higher, IMV's price-to-earnings (or "P/E") ratio of 20.9x might make it look like a sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 14x and even P/E's below 10x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

We'd have to say that with no tangible growth over the last year, IMV's earnings have been unimpressive. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for IMV

How Is IMV's Growth Trending?

IMV's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 74% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 10% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that IMV's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

The large bounce in IMV's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that IMV maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for IMV that you should be aware of.

You might be able to find a better investment than IMV. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7760

IMV

Manufactures and sells vibration simulation systems and measuring systems in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives