- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7760

Earnings Not Telling The Story For IMV Corporation (TSE:7760) After Shares Rise 30%

Despite an already strong run, IMV Corporation (TSE:7760) shares have been powering on, with a gain of 30% in the last thirty days. The annual gain comes to 153% following the latest surge, making investors sit up and take notice.

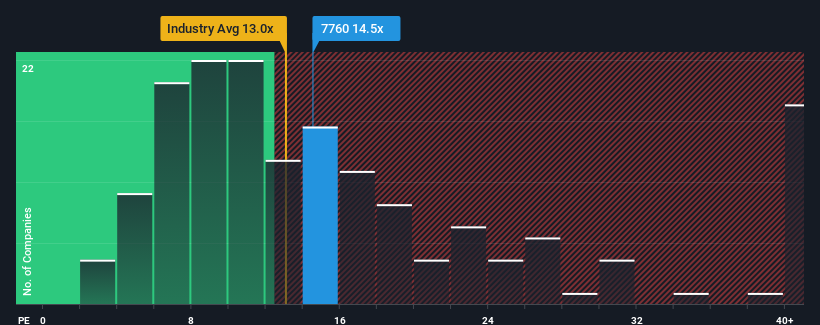

Although its price has surged higher, it's still not a stretch to say that IMV's price-to-earnings (or "P/E") ratio of 14.5x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

IMV certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for IMV

Is There Some Growth For IMV?

The only time you'd be comfortable seeing a P/E like IMV's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 24% last year. The strong recent performance means it was also able to grow EPS by 55% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 4.6% per annum during the coming three years according to the only analyst following the company. Meanwhile, the rest of the market is forecast to expand by 9.6% per annum, which is noticeably more attractive.

In light of this, it's curious that IMV's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From IMV's P/E?

Its shares have lifted substantially and now IMV's P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that IMV currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 1 warning sign for IMV that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7760

IMV

Manufactures and sells vibration simulation systems and measuring systems in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives