- Japan

- /

- Tech Hardware

- /

- TSE:7751

Is Lowered Guidance Amid Tariffs and Uncertainty Altering the Investment Case for Canon (TSE:7751)?

Reviewed by Sasha Jovanovic

- Canon Inc. recently lowered its full-year 2025 earnings forecast, now expecting net sales of ¥4.62 trillion and operating profit of ¥451 billion, attributing the revision to delays in business negotiations and increased tariffs amid global economic uncertainty.

- While Canon still anticipates continued growth in sales and profits during the year-end season, the downward guidance highlights the impact of challenging macroeconomic and geopolitical factors on the company's outlook.

- We'll explore how ongoing tariff pressures and concerns over global economic uncertainty may shape Canon's investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Canon's Investment Narrative?

To be a Canon shareholder right now, you’d want to believe in the company’s ability to keep delivering innovative products and steady shareholder returns, even as global headwinds intensify. The latest revision to Canon’s full-year 2025 forecast, driven by negotiation delays and higher tariffs, has sharpened the focus on near-term challenges. Previously, many viewed Canon’s end-of-year product launches, dividend policy, and recent share buybacks as key catalysts in supporting the stock. With fresh guidance now reflecting additional tariff pressures and economic uncertainty, the risk profile has shifted: short-term earnings could be more volatile than expected, and momentum from product releases may need to offset these headwinds. That said, the adjustment in operating profit and earnings guidance looks relatively modest compared to some past swings, and Canon’s efforts to boost sales and operational efficiency can still play a stabilizing role. How these changes play out over the coming quarters could reshape opinions on Canon’s resilience.

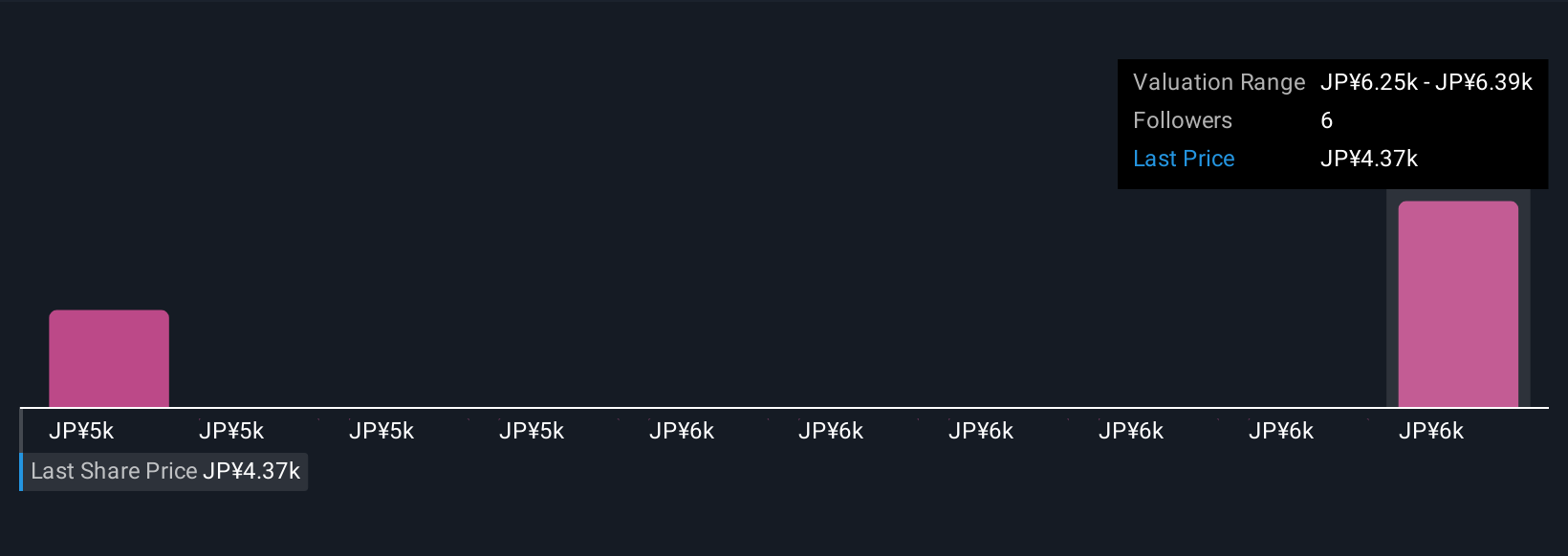

But amid all this, rising tariffs are a moving target all investors need to consider. Despite retreating, Canon's shares might still be trading 32% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Canon - why the stock might be worth just ¥5040!

Build Your Own Canon Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canon research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Canon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canon's overall financial health at a glance.

No Opportunity In Canon?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7751

Canon

Manufactures and sells office multifunction devices (MFDs), laser and inkjet printers, cameras, medical equipment, and lithography equipment in Japan, the Americas, Europe, and Asia and Oceania.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives