- Japan

- /

- Capital Markets

- /

- TSE:8595

Undiscovered Gems And 2 Other Small Cap Stocks with Strong Potential

Reviewed by Simply Wall St

As global markets continue to navigate the implications of recent policy changes and economic indicators, major U.S. indices have shown resilience, with large-cap stocks generally outperforming their smaller counterparts. Despite this trend, small-cap stocks remain a vital component of the market landscape, often offering unique opportunities for growth as they can be more agile in adapting to changing conditions. In this environment, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and the ability to capitalize on emerging trends such as AI advancements or shifts in trade policies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Miwon Chemicals | 0.22% | 11.24% | 14.59% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Korea Ratings | NA | 0.84% | 0.92% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| iMarketKorea | 29.86% | 5.28% | 1.62% | ★★★★★☆ |

| Danang Port | 23.72% | 10.58% | 9.22% | ★★★★★☆ |

| An Phat Bioplastics | 62.46% | 9.85% | 4.38% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Sumou Real Estate (SASE:4323)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumou Real Estate Company, with a market cap of SAR 2.65 billion, operates in Saudi Arabia focusing on the construction of residential and non-residential properties through its subsidiaries.

Operations: Sumou Real Estate generates revenue primarily from two segments: Real Estate Project Management, contributing SAR 92.76 million, and Contracting and Real Estate Projects, accounting for SAR 304.42 million. The company's financial performance is influenced by these core activities within the Saudi Arabian market.

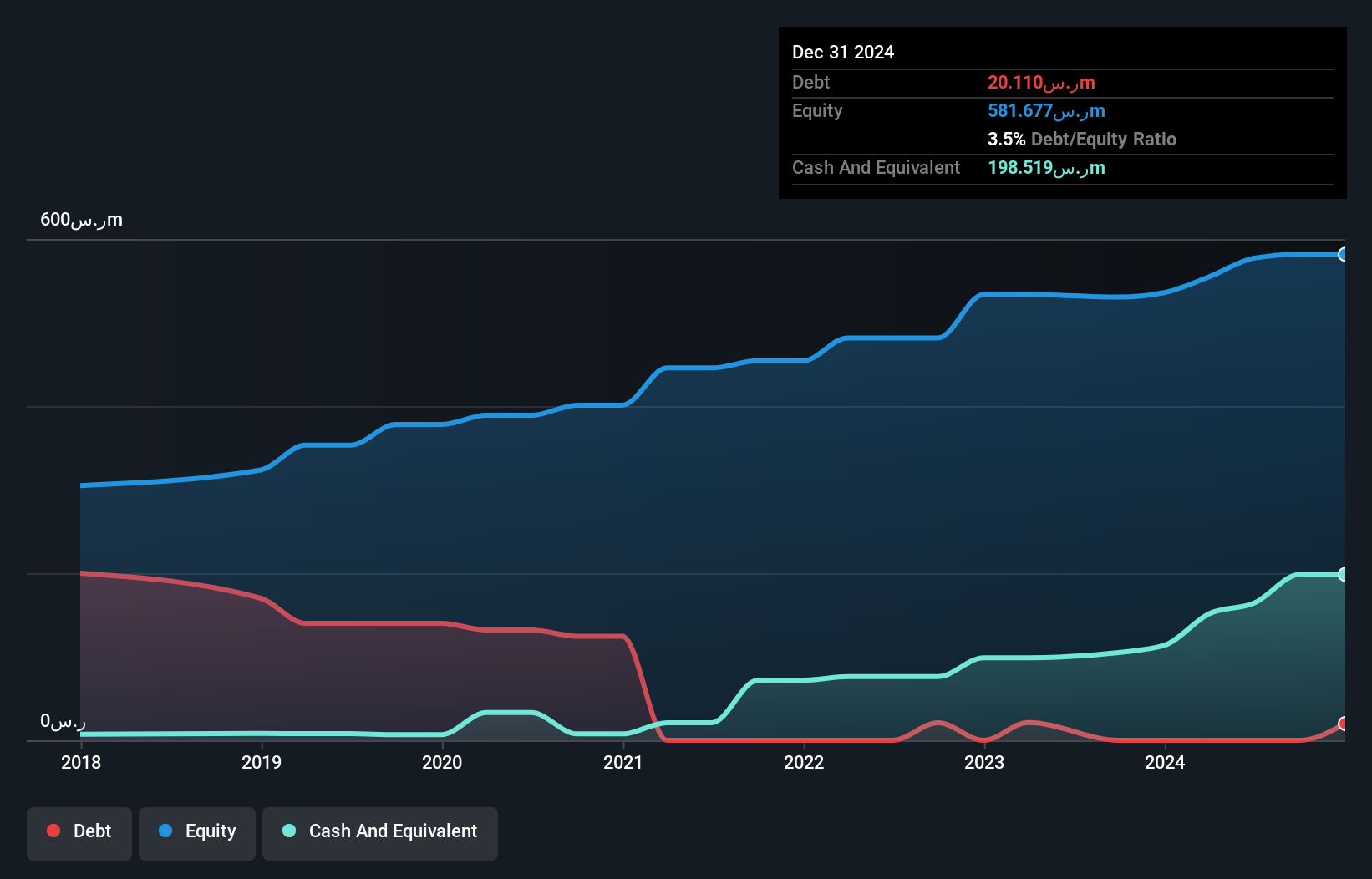

Sumou Real Estate, a player in the real estate sector, has shown resilience with its debt-free status, contrasting its 37% debt to equity ratio five years ago. The company reported third-quarter sales of SAR 109.33 million, up from SAR 74.57 million the previous year. Net income reached SAR 29.78 million compared to last year's SAR 28.63 million, although basic earnings per share dipped slightly to SAR 0.6 from SAR 0.76 previously. With earnings growth of 15% outpacing industry norms and trading at an estimated value discount of around 18%, Sumou seems well-positioned for potential future gains in this competitive market landscape.

- Get an in-depth perspective on Sumou Real Estate's performance by reading our health report here.

Explore historical data to track Sumou Real Estate's performance over time in our Past section.

Canon Electronics (TSE:7739)

Simply Wall St Value Rating: ★★★★★★

Overview: Canon Electronics Inc. is engaged in the development, production, and sale of precision machines and instruments, as well as electric and electronic machines and instruments both in Japan and globally, with a market capitalization of ¥107.36 billion.

Operations: Canon Electronics generates revenue primarily from the sale of precision machines and electric and electronic instruments. The company operates internationally, contributing to its financial performance with a market capitalization of ¥107.36 billion.

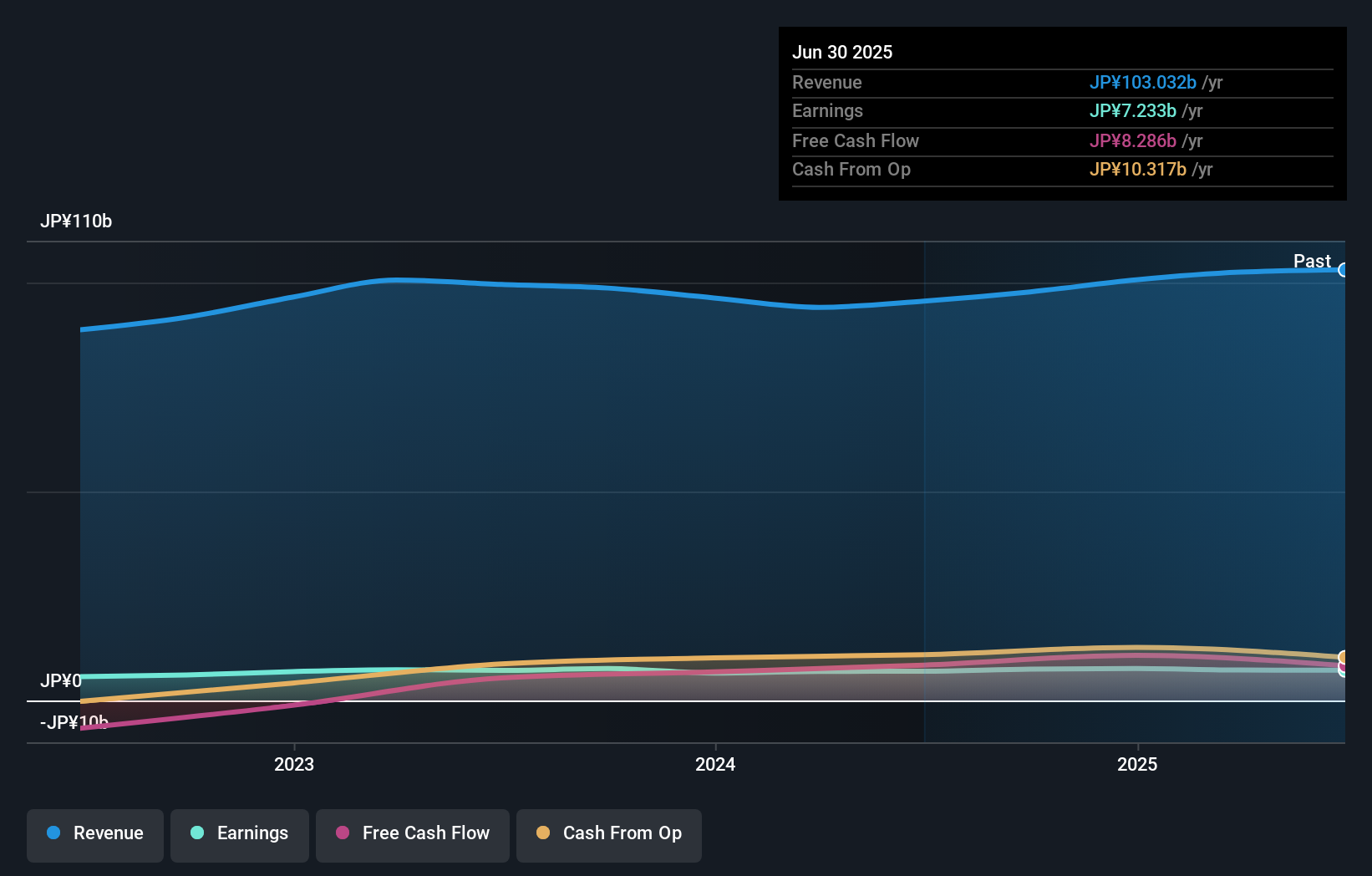

Canon Electronics, a nimble player in the electronics sector, boasts an impressive 16.6% earnings growth over the past year, outpacing the industry average of -0.1%. The company is trading at 28.2% below its estimated fair value, suggesting potential undervaluation. With high-quality earnings and no debt on its books for five years, Canon Electronics appears financially robust. It generates positive free cash flow and remains profitable without concerns about cash runway limitations. Recent announcements include a ¥35 dividend per share set for December 2024 and upcoming fiscal results slated for January 29, 2025, which could provide further insights into performance trends.

- Dive into the specifics of Canon Electronics here with our thorough health report.

Examine Canon Electronics' past performance report to understand how it has performed in the past.

JAFCO Group (TSE:8595)

Simply Wall St Value Rating: ★★★★★☆

Overview: JAFCO Group Co., Ltd., formerly JAFCO Co., Ltd., is a company involved in venture capital and private equity investment, with a market cap of ¥123.54 billion.

Operations: JAFCO Group generates revenue primarily through its venture capital and private equity investments. The company focuses on identifying and funding promising startups and businesses, aiming to generate returns from successful exits or growth in the value of its investments.

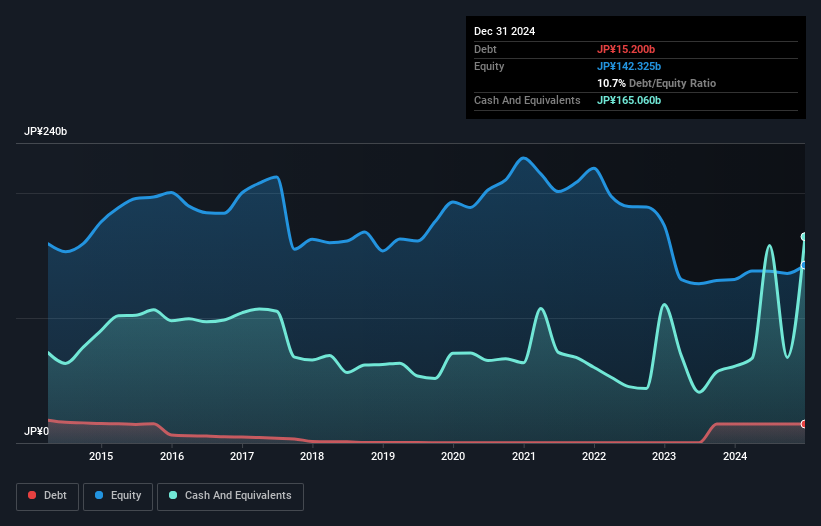

JAFCO Group stands out with an impressive earnings growth of 3970% over the past year, far surpassing the Capital Markets industry average of 27.6%. This performance positions it well within its sector, trading at a favorable value—46.5% below estimated fair value. The debt to equity ratio has increased from 0.1% to 10.7% over five years, yet the company holds more cash than its total debt, indicating financial stability. Despite these strengths, future earnings are projected to grow modestly at 3.66% annually, suggesting potential but cautious optimism for investors eyeing this niche player in capital markets.

- Take a closer look at JAFCO Group's potential here in our health report.

Assess JAFCO Group's past performance with our detailed historical performance reports.

Key Takeaways

- Reveal the 4682 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8595

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives