As global markets navigate a complex landscape marked by interest rate adjustments and geopolitical developments, Asia's economic environment presents unique opportunities for investors seeking stability and growth. In this context, dividend stocks in the region can offer attractive income streams, especially as central banks like the Bank of Japan maintain steady rates amid hopes for economic stimulus.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.41% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.85% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.01% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.96% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.02% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.56% | ★★★★★★ |

| Daicel (TSE:4202) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.35% | ★★★★★★ |

Click here to see the full list of 1043 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Sinotruk (Hong Kong) (SEHK:3808)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinotruk (Hong Kong) Limited is an investment holding company involved in the research, development, manufacture, and sale of heavy-duty trucks, medium-heavy duty trucks, light duty trucks, buses, and related parts both in Mainland China and internationally with a market cap of approximately HK$75.98 billion.

Operations: Sinotruk (Hong Kong) Limited generates revenue from several segments, including Heavy Duty Trucks at CN¥85.87 billion, Engines at CN¥14.46 billion, Light Duty Trucks and Others at CN¥11.64 billion, and Finance services contributing CN¥1.32 billion.

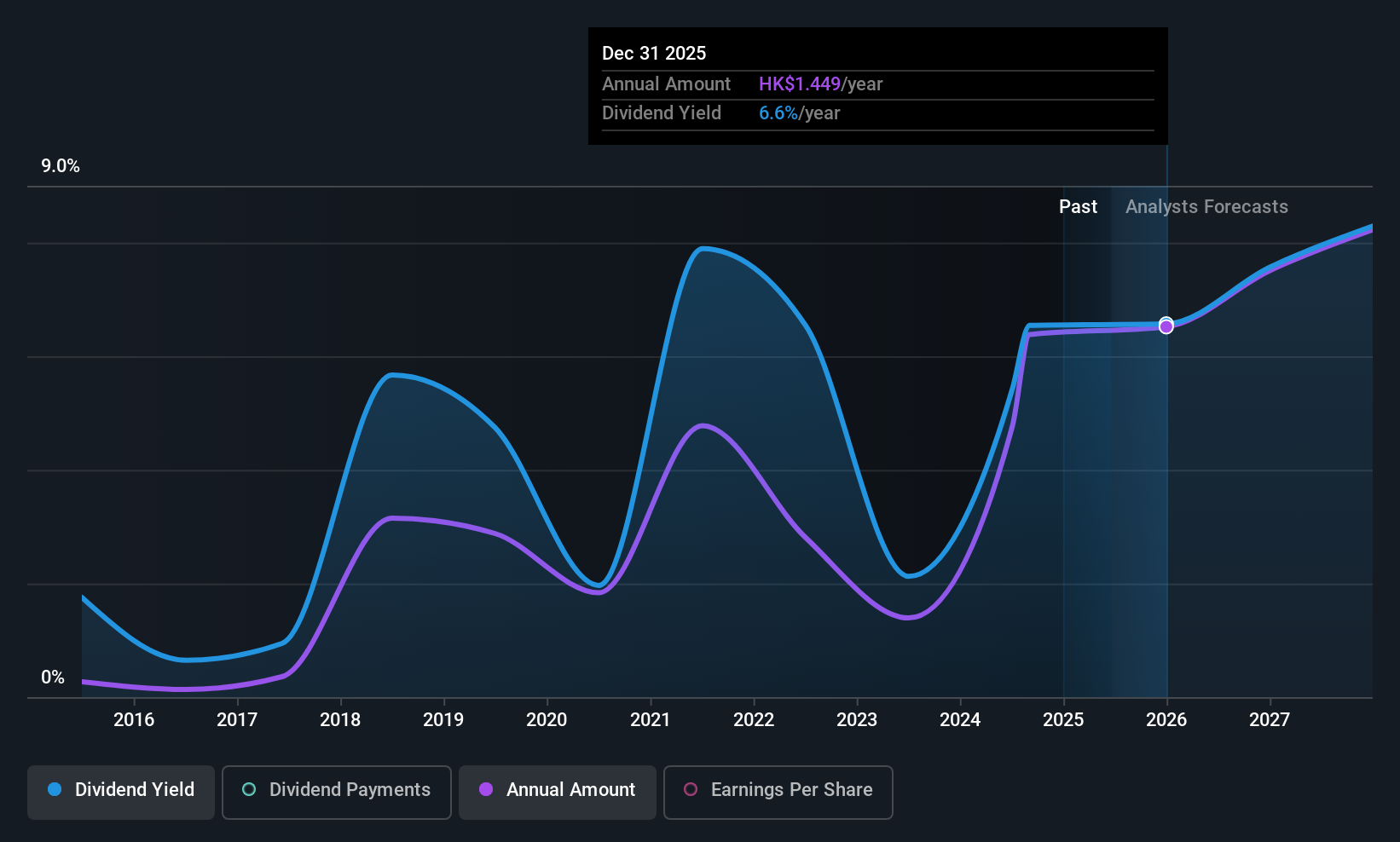

Dividend Yield: 4%

Sinotruk (Hong Kong) offers a mixed dividend profile. While its dividend payments have been volatile over the past decade, recent increases indicate growth potential. The company's payout ratios are sustainable, with earnings and cash flows covering dividends at 54.3% and 48.8%, respectively. Despite trading at a significant discount to estimated fair value, Sinotruk's dividend yield is lower than top-tier payers in Hong Kong, making it a cautious choice for income-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Sinotruk (Hong Kong).

- According our valuation report, there's an indication that Sinotruk (Hong Kong)'s share price might be on the cheaper side.

Nippon Fine Chemical (TSE:4362)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Fine Chemical Co., Ltd. operates in the manufacturing and sale of fine chemical, cosmetic, and industrial chemical products both in Japan and internationally, with a market cap of ¥58.68 billion.

Operations: Nippon Fine Chemical Co., Ltd.'s revenue is derived from its fine chemical, cosmetic, and industrial chemical product segments.

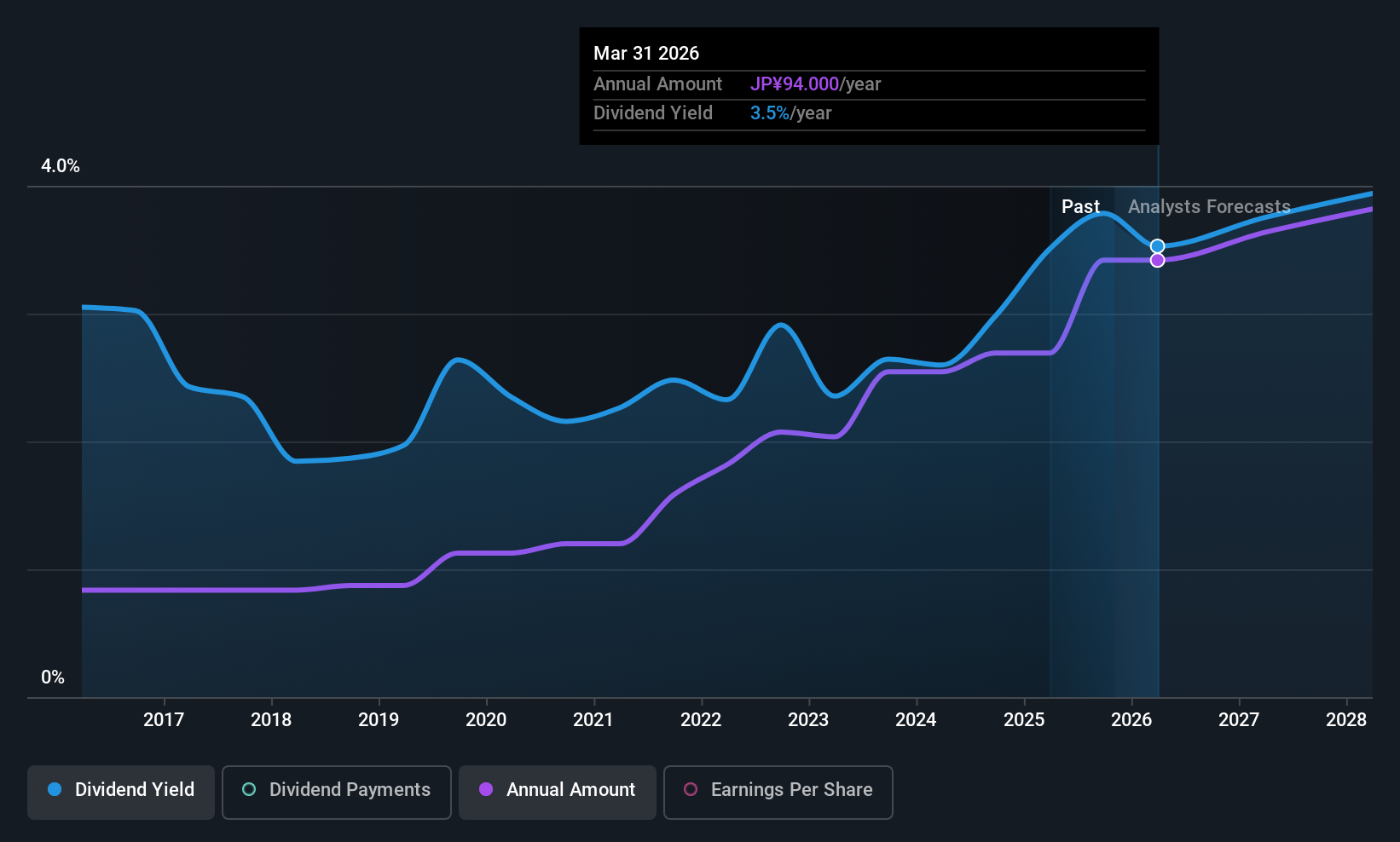

Dividend Yield: 3.5%

Nippon Fine Chemical's dividend profile is characterized by stability and reliability, with consistent payments over the past decade. However, despite a low payout ratio of 18%, dividends are not well-covered by free cash flows due to a high cash payout ratio of 115.4%. Recent share buybacks totaling ¥1.99 billion may impact future payouts positively. The dividend yield is slightly below top-tier Japanese payers, while its price-to-earnings ratio suggests undervaluation in the market context.

- Take a closer look at Nippon Fine Chemical's potential here in our dividend report.

- Our valuation report unveils the possibility Nippon Fine Chemical's shares may be trading at a premium.

Daitron (TSE:7609)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daitron Co., Ltd. is an electronic engineering trading company involved in electronic equipment, components, and manufacturing equipment businesses both in Japan and internationally, with a market cap of ¥51.24 billion.

Operations: Daitron Co., Ltd. generates revenue through its Overseas segment, which contributes ¥28.28 billion, the Domestic Sales Business at ¥68.36 billion, and the Domestic Manufacturing Business with ¥12.14 billion in sales.

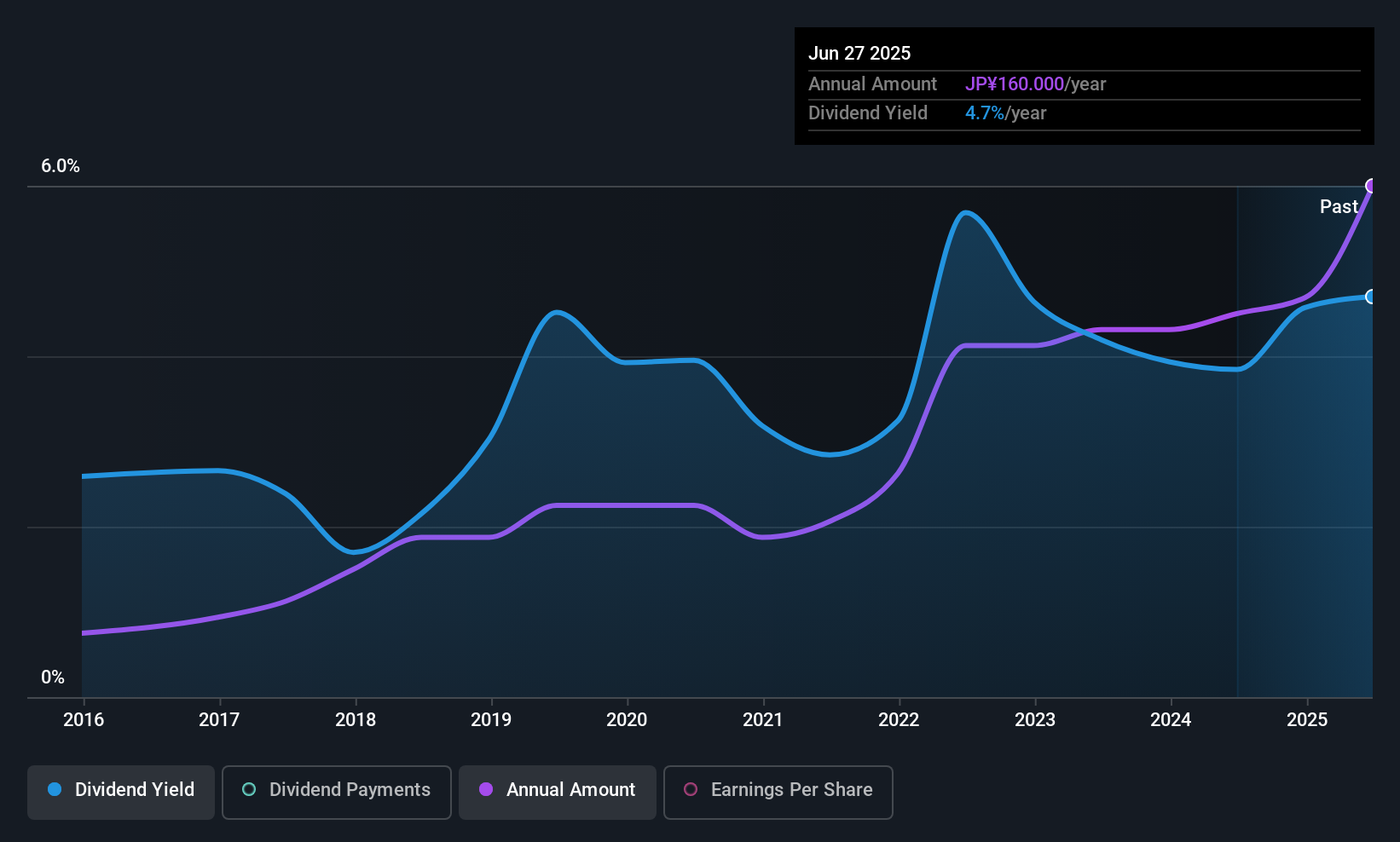

Dividend Yield: 3.3%

Daitron's dividend yield of 3.29% falls short of the top quartile in Japan, yet its dividends are well-supported by earnings and cash flows, with payout ratios at 36.6% and 20.7%, respectively. Despite past volatility in dividend payments, there's been growth over the last decade. Trading significantly below estimated fair value suggests potential market undervaluation, but investors should weigh this against its unstable dividend history when considering long-term income strategies.

- Click here and access our complete dividend analysis report to understand the dynamics of Daitron.

- The valuation report we've compiled suggests that Daitron's current price could be quite moderate.

Where To Now?

- Get an in-depth perspective on all 1043 Top Asian Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3808

Sinotruk (Hong Kong)

An investment holding company, engages in the research, development, manufacture, and sale of heavy-duty trucks (HDT), medium-heavy duty trucks, light duty trucks (LDT), buses, and related parts and components in Mainland China and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives