- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7505

Here's Why We Think Fuso Dentsu (TSE:7505) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Fuso Dentsu (TSE:7505), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Fuso Dentsu with the means to add long-term value to shareholders.

View our latest analysis for Fuso Dentsu

Fuso Dentsu's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. Fuso Dentsu's EPS skyrocketed from JP¥156 to JP¥223, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 43%.

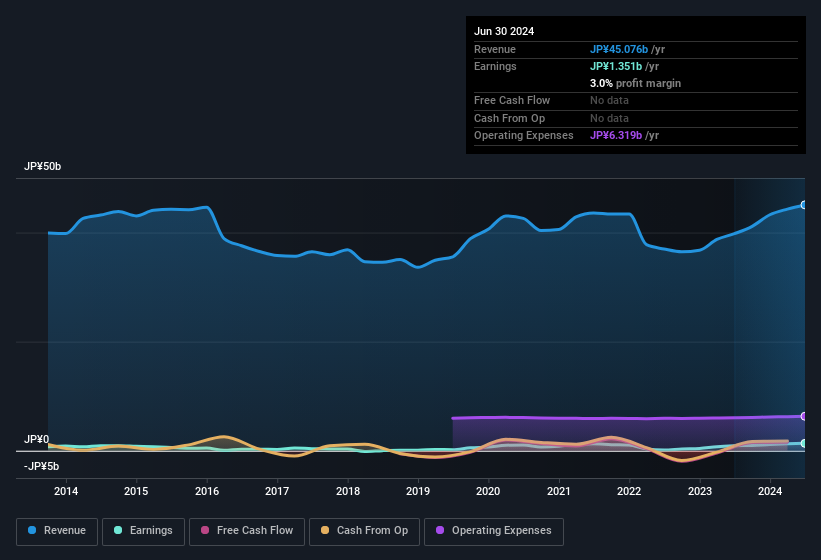

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Fuso Dentsu achieved similar EBIT margins to last year, revenue grew by a solid 13% to JP¥45b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Fuso Dentsu is no giant, with a market capitalisation of JP¥12b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Fuso Dentsu Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Fuso Dentsu shares worth a considerable sum. Indeed, they hold JP¥2.3b worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 19% of the company; visible skin in the game.

Should You Add Fuso Dentsu To Your Watchlist?

For growth investors, Fuso Dentsu's raw rate of earnings growth is a beacon in the night. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. You still need to take note of risks, for example - Fuso Dentsu has 1 warning sign we think you should be aware of.

Although Fuso Dentsu certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Japanese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7505

Fuso Dentsu

Engages in the information and communication technology (ICT) business in Japan.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026