- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6997

Optimistic Investors Push Nippon Chemi-Con Corporation (TSE:6997) Shares Up 35% But Growth Is Lacking

Nippon Chemi-Con Corporation (TSE:6997) shareholders are no doubt pleased to see that the share price has bounced 35% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

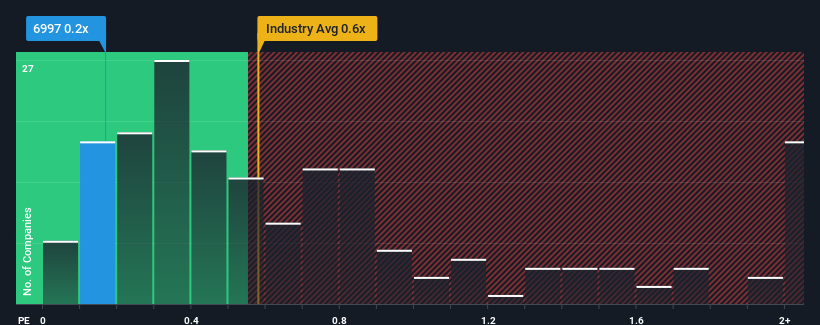

Even after such a large jump in price, there still wouldn't be many who think Nippon Chemi-Con's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Japan's Electronic industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Nippon Chemi-Con

What Does Nippon Chemi-Con's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Nippon Chemi-Con's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Nippon Chemi-Con will help you uncover what's on the horizon.How Is Nippon Chemi-Con's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nippon Chemi-Con's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. As a result, revenue from three years ago have also fallen 5.9% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 2.9% over the next year. That's shaping up to be materially lower than the 5.3% growth forecast for the broader industry.

With this in mind, we find it intriguing that Nippon Chemi-Con's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Nippon Chemi-Con's P/S

Nippon Chemi-Con appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Nippon Chemi-Con's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It is also worth noting that we have found 3 warning signs for Nippon Chemi-Con (2 don't sit too well with us!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nippon Chemi-Con might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6997

Nippon Chemi-Con

Manufactures and sells aluminum and other capacitors, precision mechanical components, and electronics equipment in Japan, China, the Americas, Europe, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026