- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6981

How Murata’s EDA Integration with Cadence May Influence the Outlook for Murata Manufacturing (TSE:6981) Investors

Reviewed by Sasha Jovanovic

- Murata Manufacturing recently announced a collaboration with Cadence Design Systems to integrate Murata’s inductor and capacitor libraries directly into Cadence’s main Electronic Design Automation (EDA) tools, streamlining the design and simulation process for engineers.

- This move removes barriers for designers and makes Murata’s components immediately accessible within critical design workflows, potentially enhancing the appeal of Murata products in high-frequency and advanced PCB applications.

- We'll explore how this expanded integration with Cadence can strengthen Murata's investment narrative by boosting its prominence in electronic circuit design.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Murata Manufacturing's Investment Narrative?

For investors considering Murata Manufacturing, the big picture centers on its position at the heart of electronics innovation, supplying vital passive components to burgeoning sectors such as mobile devices, automotive electronics, and industrial IoT. The recent collaboration with Cadence Design Systems stands out as a potentially meaningful short-term catalyst, making Murata’s products easier to integrate for design engineers and possibly boosting customer stickiness. This move addresses a practical barrier in the electronics design chain, which could modestly accelerate adoption in technical fields demanding robust simulation processes. However, it's worth weighing this against wider sector risks, particularly around tight margins and competition, as well as Murata’s historically unremarkable growth compared to industry benchmarks. While the news event doesn’t radically shift the overall risk profile, any uptick in customer demand or margin expansion now requires close monitoring.

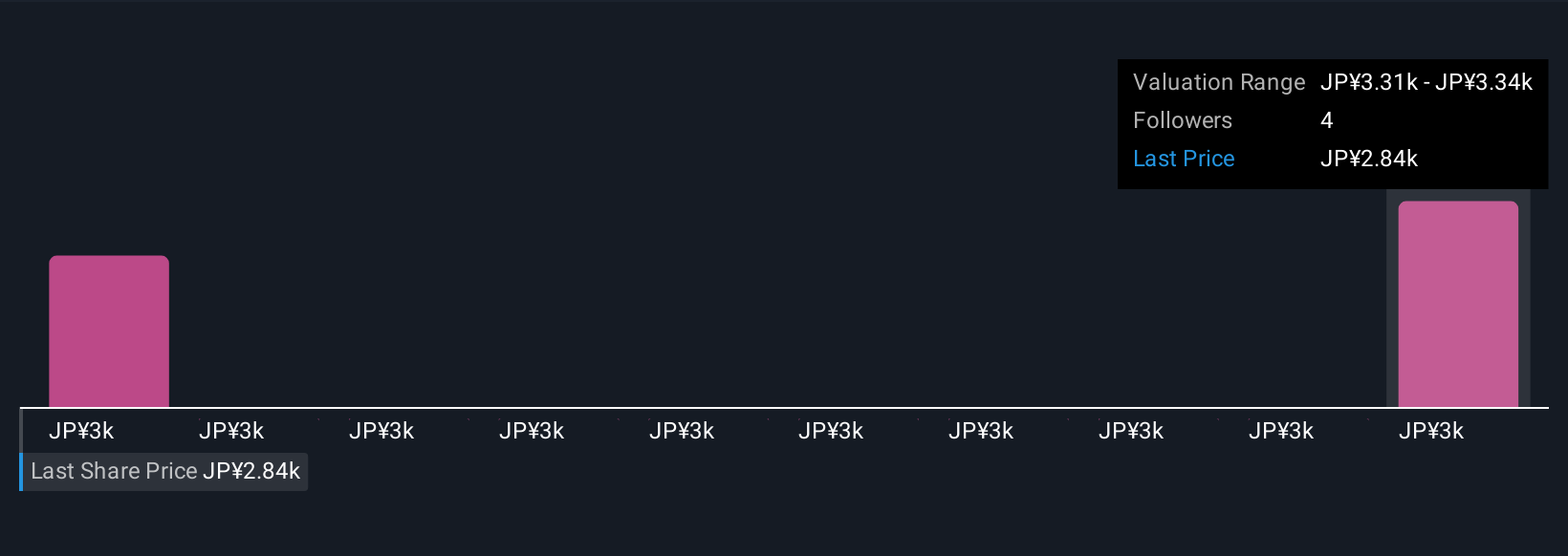

But there are competitive pressures that could affect Murata’s future pricing power, a key point investors should keep in mind. Murata Manufacturing's shares have been on the rise but are still potentially undervalued by 8%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Murata Manufacturing - why the stock might be worth as much as 8% more than the current price!

Build Your Own Murata Manufacturing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Murata Manufacturing research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Murata Manufacturing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Murata Manufacturing's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6981

Murata Manufacturing

Develops, manufactures, and sells ceramic-based passive electronic components and solutions in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives