- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6976

Some Shareholders Feeling Restless Over Taiyo Yuden Co., Ltd.'s (TSE:6976) P/S Ratio

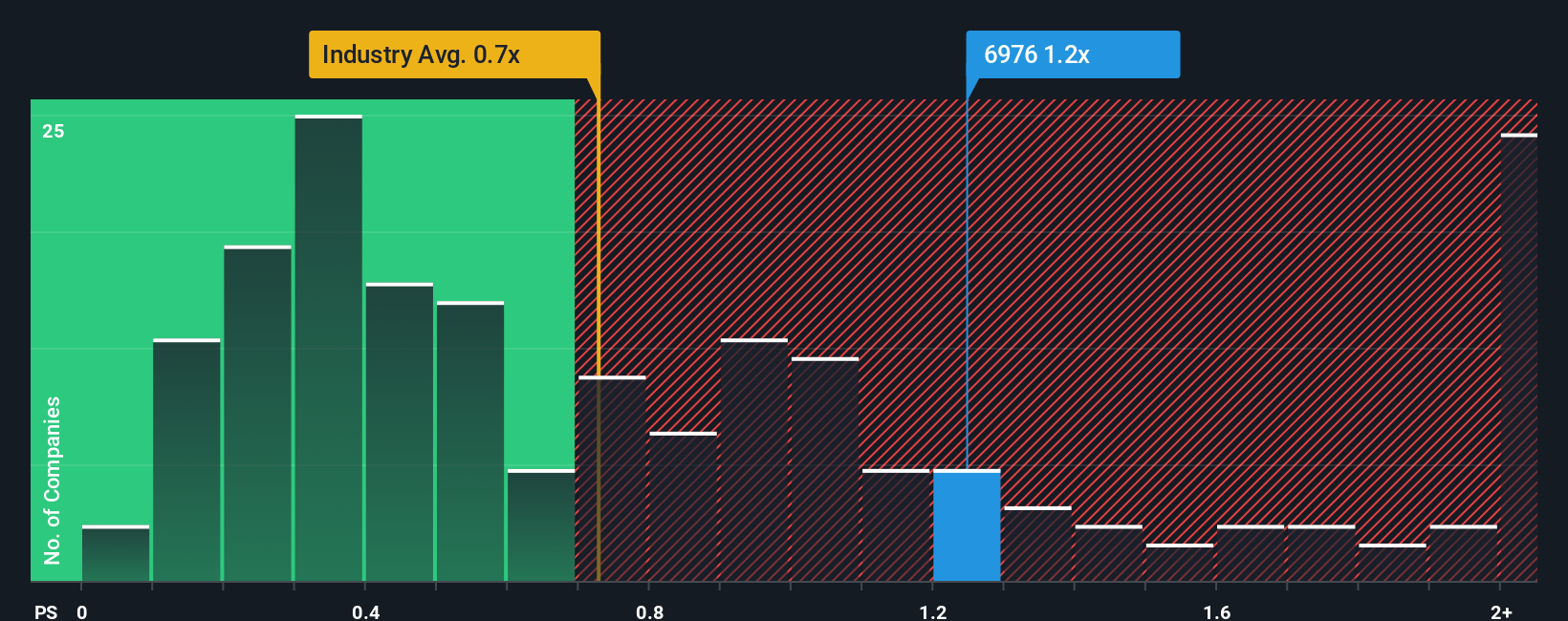

When you see that almost half of the companies in the Electronic industry in Japan have price-to-sales ratios (or "P/S") below 0.7x, Taiyo Yuden Co., Ltd. (TSE:6976) looks to be giving off some sell signals with its 1.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Taiyo Yuden

How Has Taiyo Yuden Performed Recently?

There hasn't been much to differentiate Taiyo Yuden's and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Taiyo Yuden.How Is Taiyo Yuden's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Taiyo Yuden's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.2%. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 4.9% per year over the next three years. That's shaping up to be similar to the 6.6% each year growth forecast for the broader industry.

In light of this, it's curious that Taiyo Yuden's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Taiyo Yuden's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Taiyo Yuden (1 can't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Taiyo Yuden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6976

Taiyo Yuden

Develops, manufactures, and sells electronic components in Japan, North America, China, Europe, Hong Kong, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives