- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6976

Asian Value Stocks Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, Asian equities have not been immune to the prevailing cautious sentiment. However, within this challenging environment lie opportunities for discerning investors to identify stocks trading below their estimated fair value. In such conditions, a good stock is often characterized by strong fundamentals and resilience in its business model, offering potential for long-term value despite short-term market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥156.19 | CN¥304.29 | 48.7% |

| Q & M Dental Group (Singapore) (SGX:QC7) | SGD0.49 | SGD0.95 | 48.5% |

| Nippon Thompson (TSE:6480) | ¥716.00 | ¥1409.41 | 49.2% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.18 | CN¥26.14 | 49.6% |

| NEXON Games (KOSDAQ:A225570) | ₩12350.00 | ₩24179.77 | 48.9% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.195 | NZ$0.39 | 49.5% |

| Foxconn Industrial Internet (SHSE:601138) | CN¥56.61 | CN¥111.22 | 49.1% |

| China Ruyi Holdings (SEHK:136) | HK$2.43 | HK$4.80 | 49.4% |

| Beijing Roborock Technology (SHSE:688169) | CN¥156.22 | CN¥302.76 | 48.4% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.57 | CN¥56.17 | 49.1% |

We'll examine a selection from our screener results.

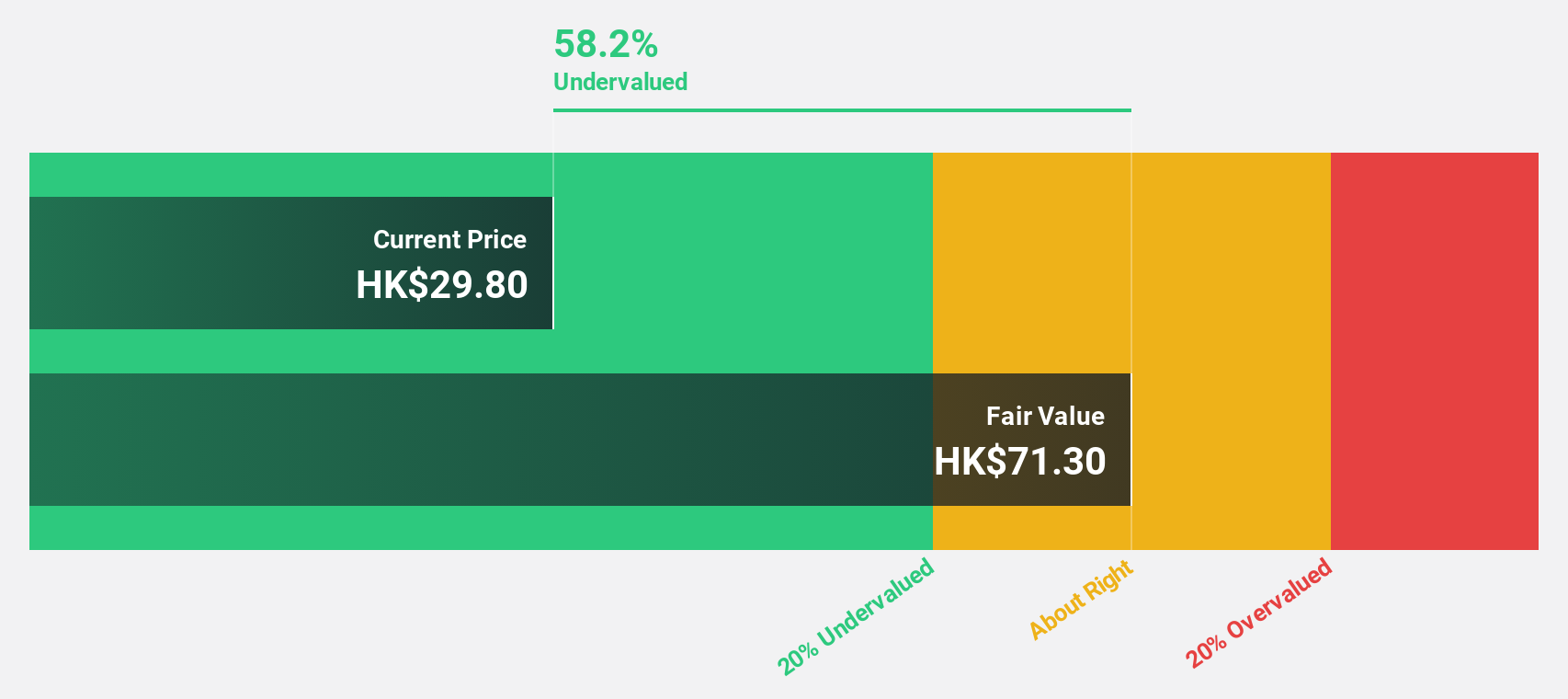

Cowell e Holdings (SEHK:1415)

Overview: Cowell e Holdings Inc. is an investment holding company involved in designing, developing, manufacturing and selling modules and system integration products for smartphones, multimedia tablets and other mobile devices, with a market cap of approximately HK$24.72 billion.

Operations: The company's revenue is primarily derived from its Photographic Equipment & Supplies segment, which generated approximately $3.27 billion.

Estimated Discount To Fair Value: 45.1%

Cowell e Holdings is trading at HK$28.48, significantly below its estimated fair value of HK$51.88, indicating a potential undervaluation based on cash flows. Despite recent revenue growth of 18.3% per year being slower than 20%, earnings are forecast to grow significantly at 21.53% annually over the next three years, outpacing the Hong Kong market's average growth rate of 11.6%. Analysts expect a stock price increase of 37.6%.

- Our earnings growth report unveils the potential for significant increases in Cowell e Holdings' future results.

- Click to explore a detailed breakdown of our findings in Cowell e Holdings' balance sheet health report.

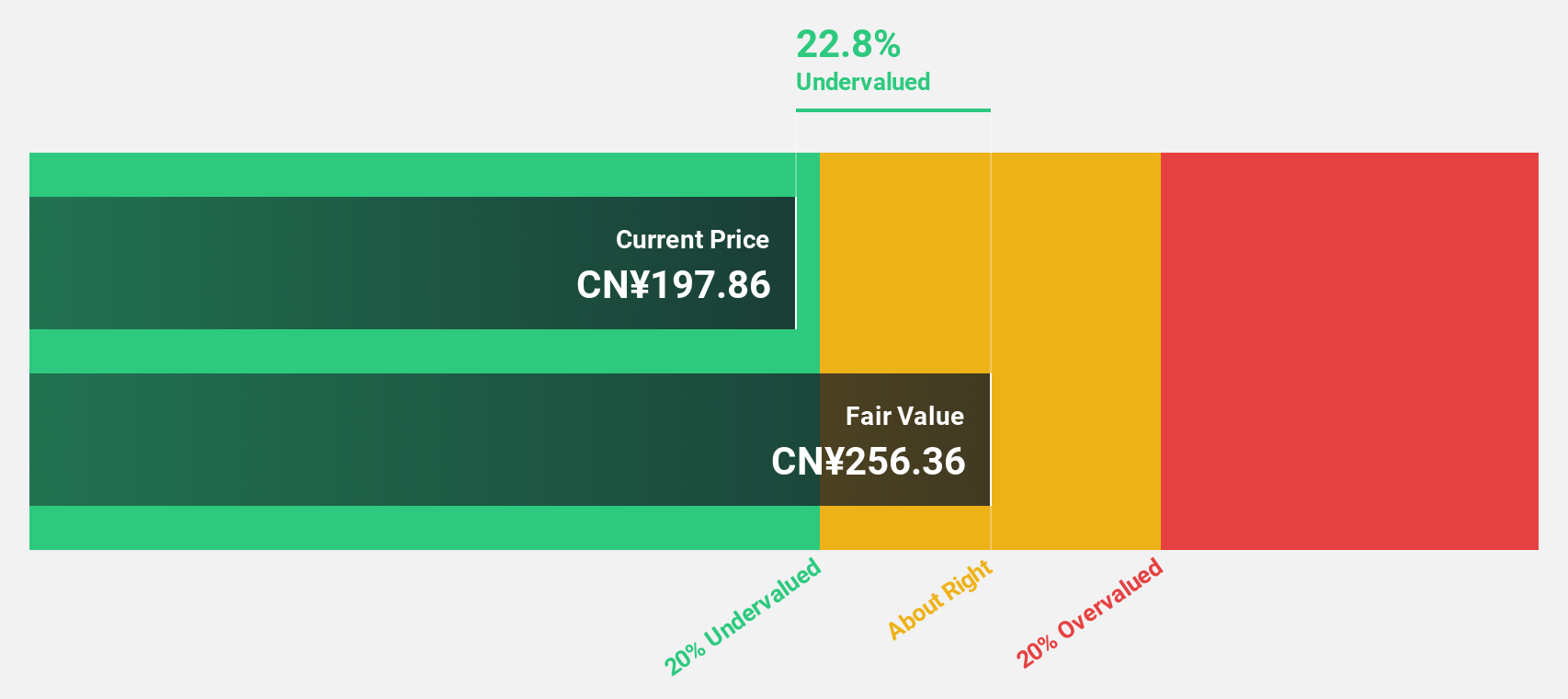

Shennan Circuit (SZSE:002916)

Overview: Shennan Circuit Company Limited designs, manufactures, and sells printed circuit boards, packaging substrates, and electronic assemblies both in China and internationally, with a market cap of CN¥133.93 billion.

Operations: The company's revenue segments include printed circuit boards, packaging substrates, and electronic assemblies.

Estimated Discount To Fair Value: 21.8%

Shennan Circuit's shares, trading at CN¥200.88, are valued 21.8% below the estimated fair value of CN¥256.76, highlighting potential undervaluation based on cash flows. The company reported strong financial performance with nine-month revenue reaching CN¥16.75 billion, up from CN¥13.05 billion year-over-year, and net income increasing to CN¥2.33 billion from CN¥1.49 billion previously. Despite high share price volatility recently, earnings growth is expected to remain robust at 26% annually over the next three years.

- Insights from our recent growth report point to a promising forecast for Shennan Circuit's business outlook.

- Click here to discover the nuances of Shennan Circuit with our detailed financial health report.

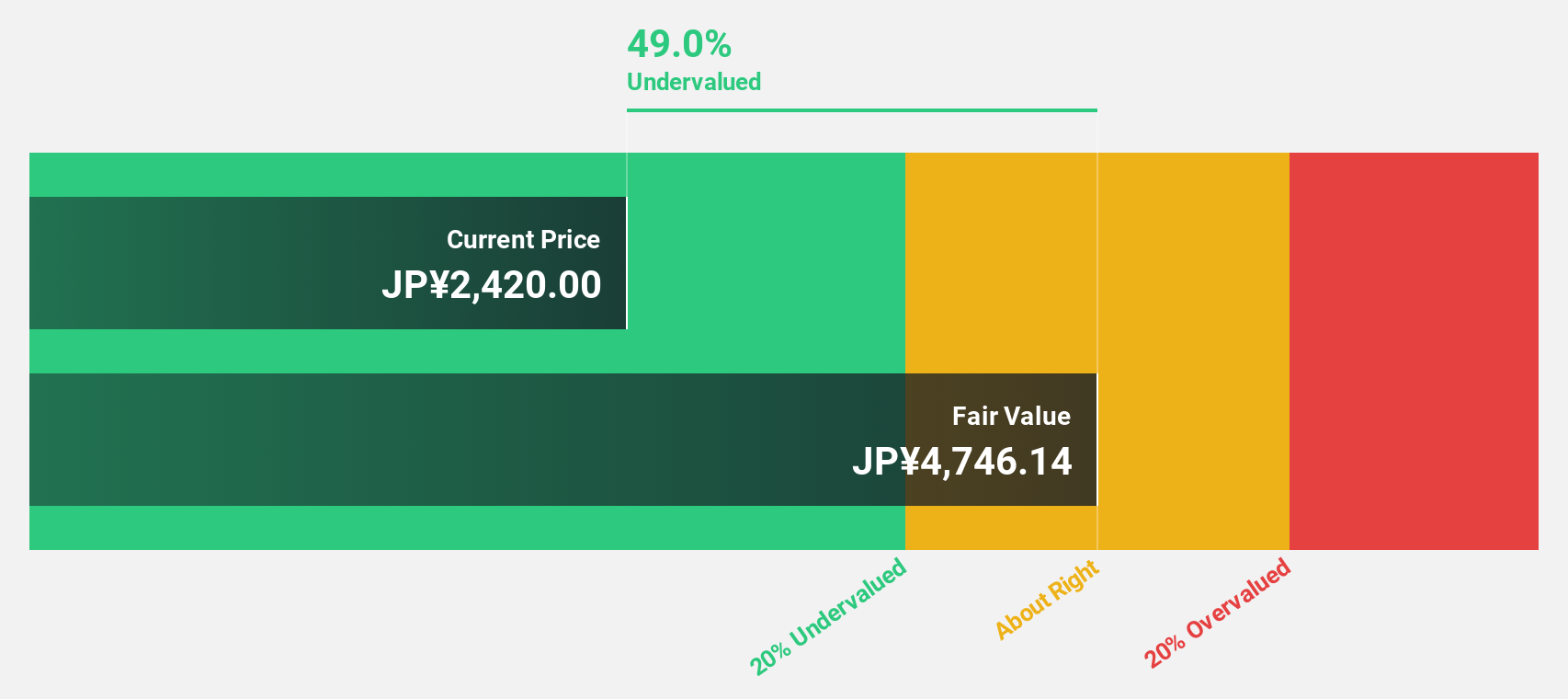

Taiyo Yuden (TSE:6976)

Overview: Taiyo Yuden Co., Ltd. is engaged in the development, manufacturing, and sale of electronic components across Japan, North America, China, Europe, Hong Kong, and other international markets with a market cap of ¥400.79 billion.

Operations: The company's revenue is primarily derived from its Electronic Components Business, which generated ¥351.21 billion.

Estimated Discount To Fair Value: 28.3%

Taiyo Yuden is trading at ¥3,205, significantly below its estimated fair value of ¥4,468.38, indicating potential undervaluation based on cash flows. The company revised its earnings guidance upwards for the fiscal year ending March 2026, with expected net sales of ¥347.5 billion and operating profit of ¥18 billion. Despite a volatile share price and lower profit margins compared to last year, earnings are forecasted to grow substantially at 38% annually over the next three years.

- The analysis detailed in our Taiyo Yuden growth report hints at robust future financial performance.

- Take a closer look at Taiyo Yuden's balance sheet health here in our report.

Next Steps

- Discover the full array of 273 Undervalued Asian Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiyo Yuden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6976

Taiyo Yuden

Develops, manufactures, and sells electronic components in Japan, North America, China, Europe, Hong Kong, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success