- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6971

Does Kyocera’s CES 2026 Tech Showcase Signal a Shift in Strategic Focus for TSE:6971?

Reviewed by Sasha Jovanovic

- Kyocera announced it will showcase its latest technology breakthroughs, including an advanced Underwater Wireless Optical Communication system and a triple lens AI-based high-resolution depth sensor, at CES 2026 in Las Vegas, with exhibits highlighting innovations in mobility, marine ICT, and industrial automation.

- These product innovations suggest Kyocera is targeting emerging markets in robotics, marine research, and next-generation manufacturing, expanding its reach beyond traditional electronics.

- We'll examine how the debut of Kyocera's high-speed underwater optical communication technology influences its broader investment narrative and future market focus.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Kyocera's Investment Narrative?

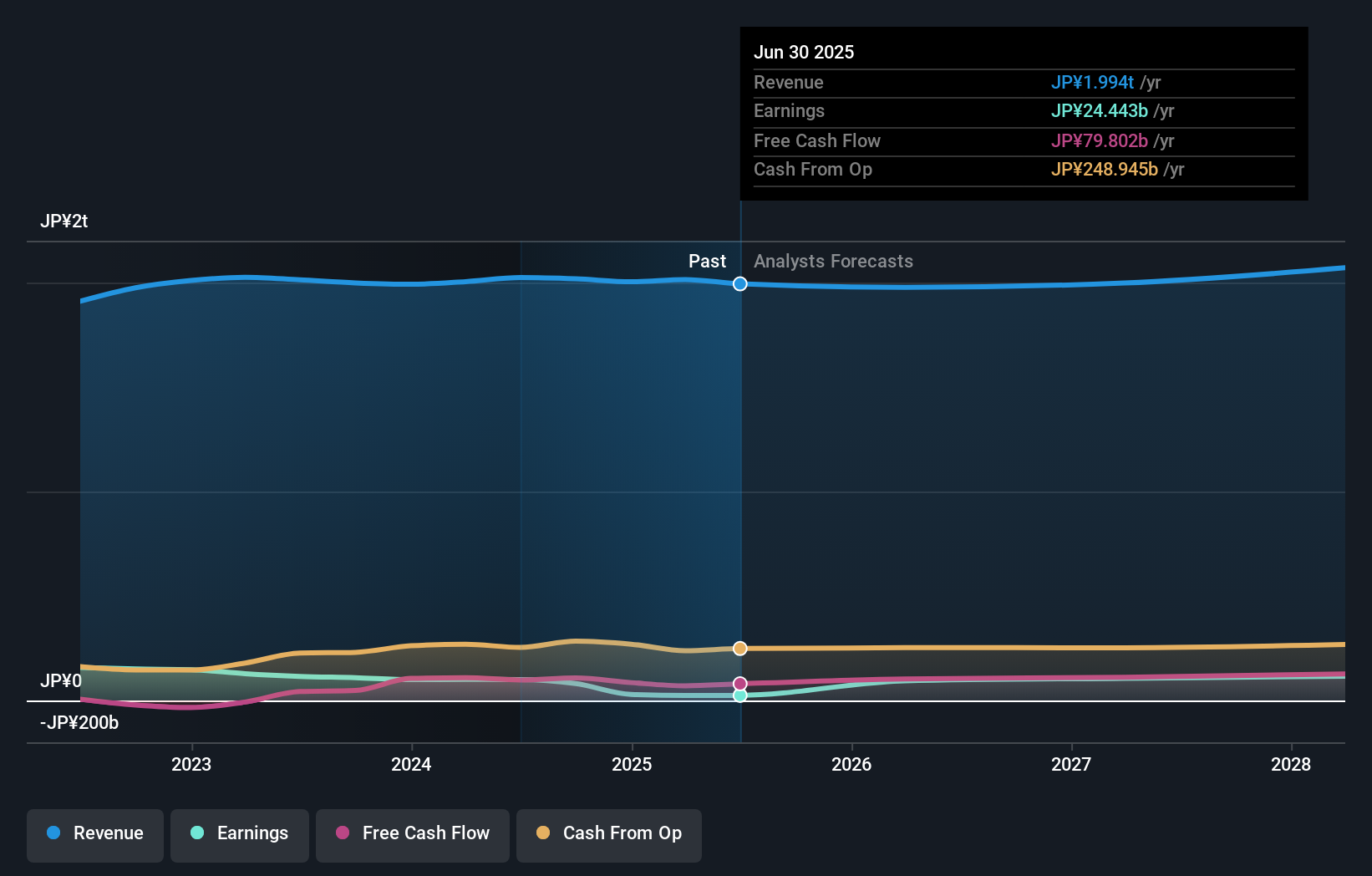

As a Kyocera shareholder, the big picture often comes down to whether the company’s ongoing push into advanced sensor and communications technology can meaningfully accelerate growth beyond its traditional business model. The company’s demonstration of cutting-edge solutions like ultra high-speed Underwater Wireless Optical Communication and a triple-lens AI-based depth sensor at CES 2026 signals renewed ambition in marine robotics, industrial automation, and smart manufacturing. These product launches have the potential to strengthen near-term catalysts by attracting new partners or boosting its industry reputation, although the financial impact may take time to materialize. Short-term risks still revolve around expensive valuation, low profit margins, and earnings that have struggled to outpace broader industry peers. If Kyocera's latest innovations are commercially validated, there could be some positive momentum, but execution and adoption remain key hurdles, especially with rising R&D costs and pressure on margins.

On the other hand, the high price-to-earnings ratio and lagging margins are worth paying close attention to.

Exploring Other Perspectives

Explore another fair value estimate on Kyocera - why the stock might be worth just ¥2444!

Build Your Own Kyocera Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kyocera research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kyocera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kyocera's overall financial health at a glance.

No Opportunity In Kyocera?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyocera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6971

Kyocera

Develops and sells products based on fine ceramic technologies in Japan, China, rest of Asia, Europe, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives