- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6971

Does Kyocera (TSE:6971) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Kyocera Corporation (TSE:6971) makes use of debt. But should shareholders be worried about its use of debt?

Our free stock report includes 2 warning signs investors should be aware of before investing in Kyocera. Read for free now.When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Kyocera's Debt?

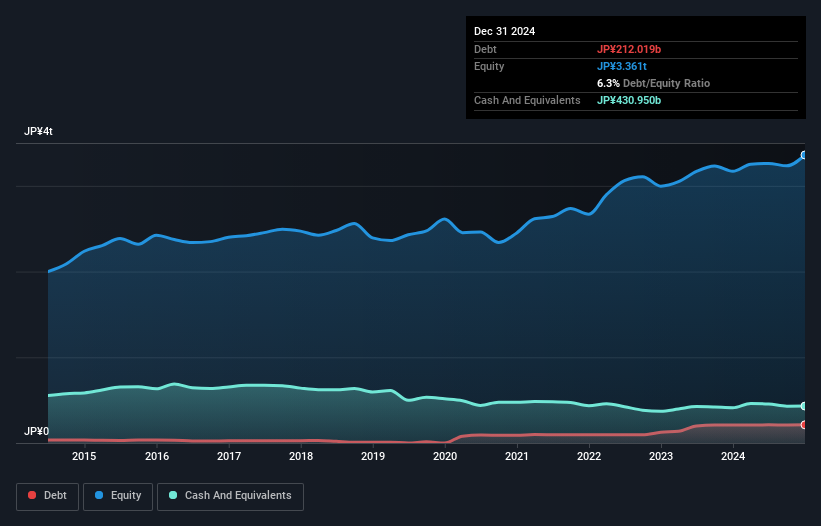

As you can see below, Kyocera had JP¥212.0b of debt, at December 2024, which is about the same as the year before. You can click the chart for greater detail. But it also has JP¥431.0b in cash to offset that, meaning it has JP¥218.9b net cash.

A Look At Kyocera's Liabilities

The latest balance sheet data shows that Kyocera had liabilities of JP¥440.0b due within a year, and liabilities of JP¥791.1b falling due after that. On the other hand, it had cash of JP¥431.0b and JP¥364.2b worth of receivables due within a year. So its liabilities total JP¥436.0b more than the combination of its cash and short-term receivables.

Of course, Kyocera has a titanic market capitalization of JP¥2.37t, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Kyocera boasts net cash, so it's fair to say it does not have a heavy debt load!

See our latest analysis for Kyocera

The modesty of its debt load may become crucial for Kyocera if management cannot prevent a repeat of the 78% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Kyocera's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Kyocera may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Kyocera produced sturdy free cash flow equating to 55% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

Although Kyocera's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of JP¥218.9b. So we are not troubled with Kyocera's debt use. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Kyocera that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Kyocera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6971

Kyocera

Develops and sells products based on fine ceramic technologies in Japan, China, rest of Asia, Europe, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026