- Japan

- /

- Auto Components

- /

- TSE:7240

Top 3 Dividend Stocks To Watch On The Japanese Exchange

Reviewed by Simply Wall St

As Japan's stock markets wrap up a volatile month, the Nikkei 225 Index and TOPIX Index have shown resilience by recovering most of their early August losses. This recovery comes amid renewed U.S. growth fears and a hawkish outlook from the Bank of Japan, making it an interesting time to explore dividend stocks on the Japanese exchange. In such an environment, identifying strong dividend stocks requires focusing on companies with stable earnings and robust cash flows that can sustain regular payouts even during market fluctuations.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.94% | ★★★★★★ |

| Globeride (TSE:7990) | 4.20% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.80% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.78% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| Innotech (TSE:9880) | 4.49% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.08% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.32% | ★★★★★★ |

Click here to see the full list of 440 stocks from our Top Japanese Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

ID Holdings (TSE:4709)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ID Holdings Corporation provides information technology (IT) services in Japan and has a market cap of ¥23.70 billion.

Operations: The company's revenue primarily comes from its Information Services Business, which generated ¥33.35 billion.

Dividend Yield: 3.5%

ID Holdings, despite its volatile dividend history, offers a reasonable 3.53% yield and maintains a sustainable payout ratio of 48.8% from earnings and 69.2% from cash flows. Recent corporate guidance projects net sales of ¥35 billion and net income of ¥1.75 billion for FY2025, indicating potential stability in earnings. The company also completed a share buyback worth ¥49.88 million, reflecting confidence in its financial position while trading at a significant discount to fair value estimates.

- Get an in-depth perspective on ID Holdings' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of ID Holdings shares in the market.

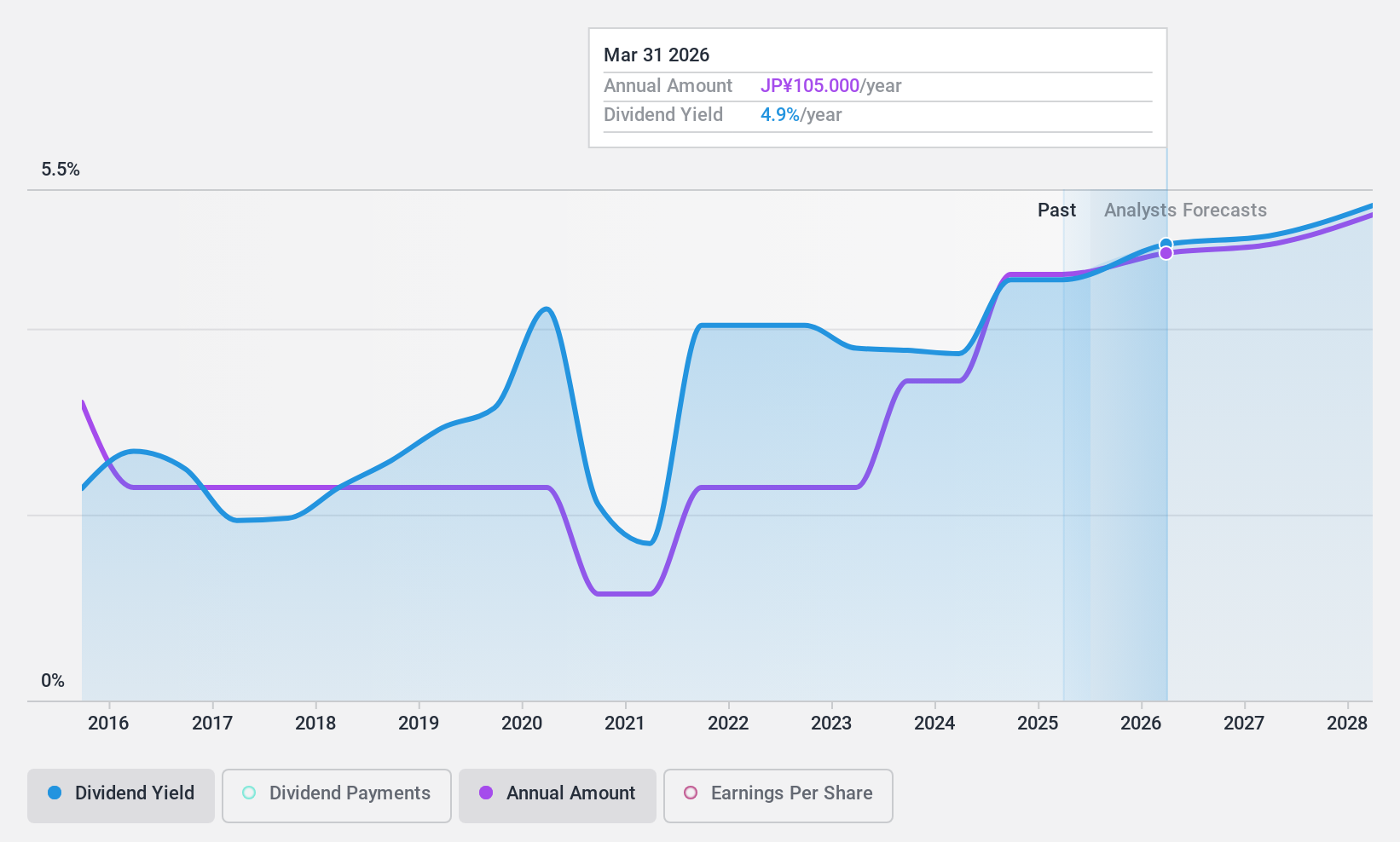

Shibaura ElectronicsLtd (TSE:6957)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shibaura Electronics Co., Ltd. manufactures and sells thermistor elements and related products in Japan, with a market cap of approximately ¥51.44 billion.

Operations: Shibaura Electronics Co., Ltd. generates revenue from various regions, including ¥25.33 billion from Japan, ¥17.86 billion from Asia, ¥1.28 billion from Europe, and ¥0.91 billion from the U.S.A.

Dividend Yield: 4.4%

Shibaura Electronics has shown strong earnings growth of 19.1% per year over the past five years, with a reasonable payout ratio of 58.7%, indicating dividends are well-covered by earnings and cash flows. However, its dividend history has been volatile over the past decade despite recent increases. The company recently completed a share buyback program worth ¥637.05 million, reflecting confidence in its financial stability while trading at a significant discount to fair value estimates.

- Click here to discover the nuances of Shibaura ElectronicsLtd with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Shibaura ElectronicsLtd's current price could be quite moderate.

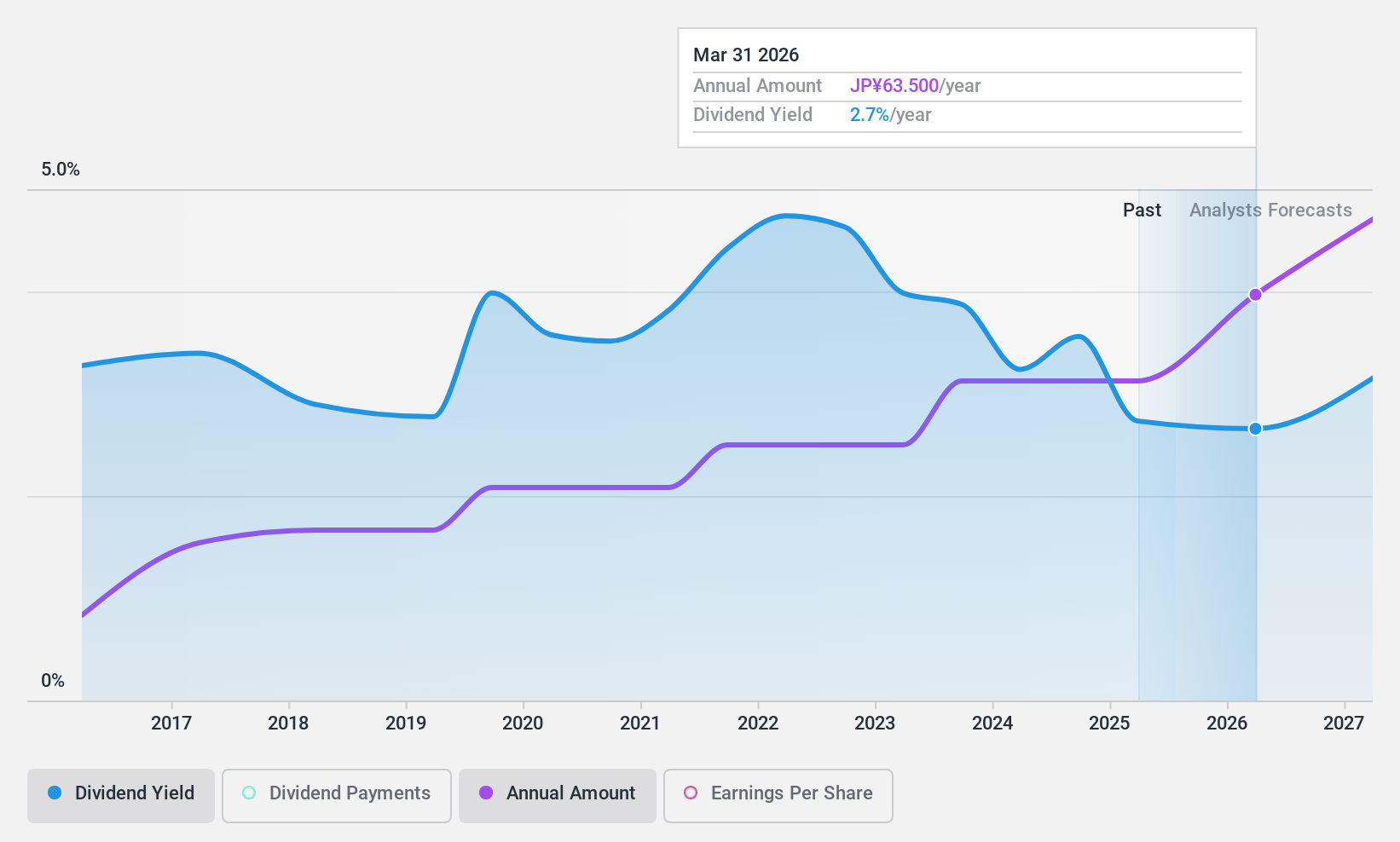

NOK (TSE:7240)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NOK Corporation manufactures, imports, and sells a diverse range of products including seal products, industrial mechanical parts, hydraulic and pneumatic equipment, nuclear power equipment, synthetic chemical products, and electronic items both in Japan and internationally; it has a market cap of ¥402.73 billion.

Operations: NOK Corporation's revenue segments include ¥363.14 billion from the Seal Business and ¥381.78 billion from Electronic Products.

Dividend Yield: 4.1%

NOK Corporation offers a dividend yield of 4.09%, placing it in the top 25% of JP market payers. Despite earnings growing by 167.8% last year, its dividend history has been volatile over the past decade with insufficient data to confirm coverage by cash flows. The payout ratio stands at a reasonable 40.1%, suggesting dividends are covered by earnings, but the unstable track record raises concerns about reliability and sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of NOK.

- Our valuation report unveils the possibility NOK's shares may be trading at a discount.

Taking Advantage

- Discover the full array of 440 Top Japanese Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7240

NOK

Manufactures, imports, and sells seal products, industrial mechanical parts, hydraulic and pneumatic equipment, nuclear power equipment, synthetic chemical products, and electronic and various other products in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.