Unveiling 3 Undiscovered Gems In Japan With Strong Potential

Reviewed by Simply Wall St

As Japan's stock markets recover from recent volatility, the Nikkei 225 and TOPIX indices have shown resilience, regaining much of the ground lost earlier in the month. This backdrop creates a fertile environment for identifying promising small-cap stocks that may be overlooked by mainstream investors. In such a dynamic market, good stocks often exhibit strong fundamentals, innovative business models, and robust growth potential despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 0.86% | 4.40% | ★★★★★★ |

| Togami Electric Mfg | 1.55% | 3.53% | 7.20% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| Kondotec | 11.75% | 6.85% | 2.62% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| Toho Bank | 98.27% | 0.43% | 22.80% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Furuno Electric (TSE:6814)

Simply Wall St Value Rating: ★★★★★☆

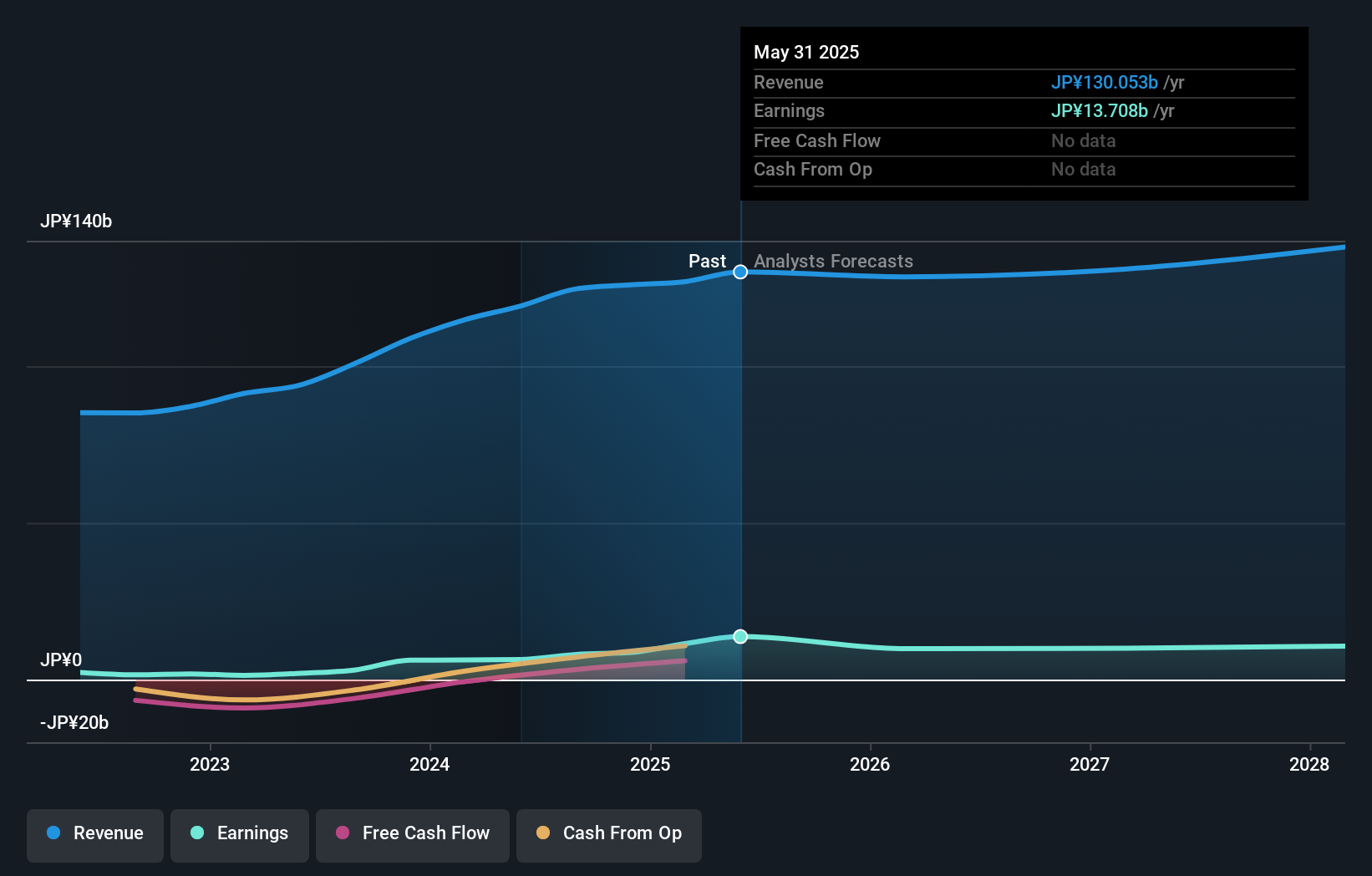

Overview: Furuno Electric Co., Ltd. manufactures and sells marine and industrial electronics equipment, wireless LAN systems, and handy terminals in Japan and internationally, with a market cap of ¥56.61 billion.

Operations: Furuno Electric generates revenue primarily from the sale of marine and industrial electronics equipment, wireless LAN systems, and handy terminals across various regions including Japan, the Americas, Europe, and Asia. The company's net profit margin is notably recorded at 6.5%.

Furuno Electric, a noteworthy Japanese small-cap, has shown impressive performance with earnings growth of 218.4% over the past year, outpacing the electronics industry’s 7.8%. The company's debt to equity ratio improved from 27.6% to 24.5% in five years and its P/E ratio of 8.9x is attractive compared to Japan's market average of 13.6x. Despite high volatility in share price recently, Furuno maintains satisfactory interest coverage and offers high-quality earnings with a recent ¥15 dividend payout per share on August-29-2024.

TOKYO KEIKI (TSE:7721)

Simply Wall St Value Rating: ★★★★★☆

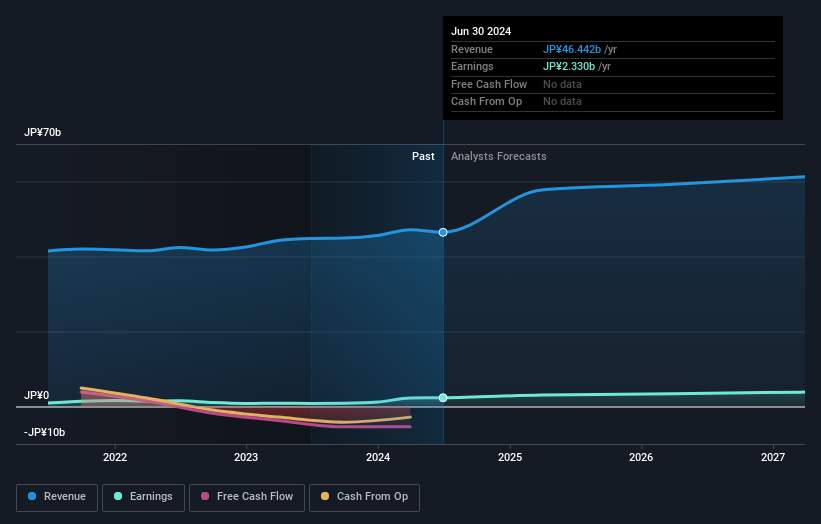

Overview: TOKYO KEIKI INC., with a market cap of ¥50.92 billion, manufactures and sells measuring instruments both in Japan and internationally through its subsidiaries.

Operations: TOKYO KEIKI generates revenue primarily from the sale of measuring instruments. The company's market cap stands at ¥50.92 billion.

Tokyo Keiki, a small-cap machinery firm, has shown impressive earnings growth of 189.8% over the past year, significantly outpacing the industry's 13.1%. The company's debt to equity ratio has improved from 53.7% to 50.4% in five years, with a satisfactory net debt to equity ratio of 24.5%. Despite high share price volatility recently, Tokyo Keiki's earnings are considered high quality and it earns more interest than it pays, ensuring solid coverage of interest payments.

- Get an in-depth perspective on TOKYO KEIKI's performance by reading our health report here.

Assess TOKYO KEIKI's past performance with our detailed historical performance reports.

Seiko Group (TSE:8050)

Simply Wall St Value Rating: ★★★★★☆

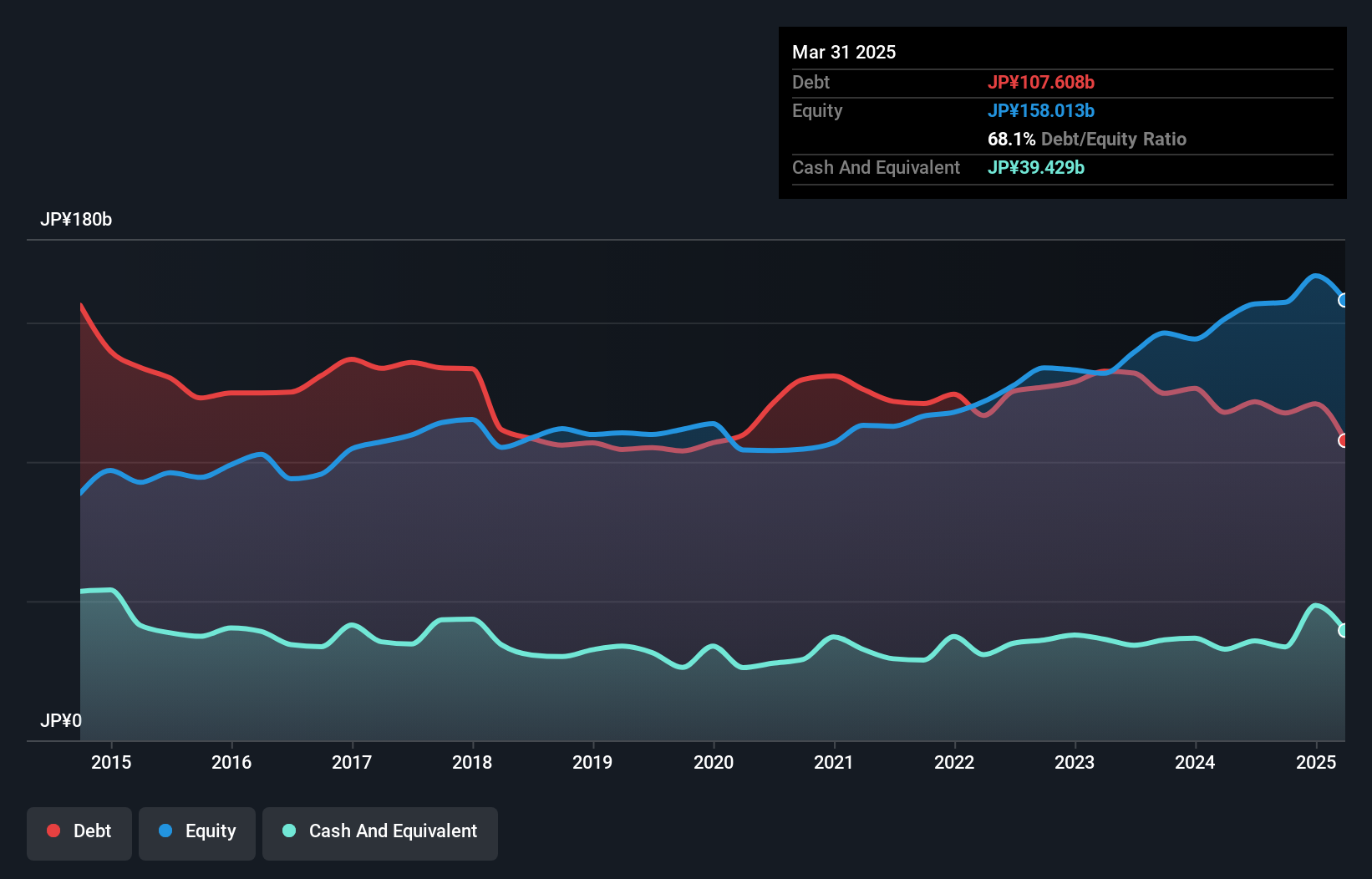

Overview: Seiko Group Corporation operates in watches, devices solutions, systems solutions, apparels, clocks, fashion accessories, and other businesses both in Japan and internationally with a market cap of ¥164.53 billion.

Operations: Revenue streams for Seiko Group Corporation include Emotional Value Solutions (¥196.02 billion), Devices Solutions (¥59.52 billion), and System Solution Business (¥42.59 billion).

Seiko Group, a notable player in the luxury sector, has seen its debt to equity ratio improve from 95.7% to 77.6% over the past five years. Despite having a high net debt to equity ratio of 54.8%, interest payments are well covered by EBIT at 340x coverage. The company is trading at 21% below its estimated fair value and reported earnings growth of 94% last year, outperforming the industry’s growth rate of 14%.

- Unlock comprehensive insights into our analysis of Seiko Group stock in this health report.

Examine Seiko Group's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Embark on your investment journey to our 753 Japanese Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOKYO KEIKI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7721

TOKYO KEIKI

Manufactures and sells measuring instruments in Japan and internationally.

Excellent balance sheet with proven track record.