- Japan

- /

- Professional Services

- /

- TSE:2146

3 Japanese Exchange Stocks Estimated To Be Up To 31.1% Undervalued

Reviewed by Simply Wall St

Wrapping up a volatile month, Japan’s stock markets rose over the week, with the Nikkei 225 Index gaining 0.7% and the broader TOPIX Index up 1.0%. By the end of August, both indexes had recovered most of the ground lost in the steep sell-off around the start of the month, which followed the Bank of Japan’s late-July interest rate hike and was largely driven by renewed U.S. growth fears. In this context, identifying undervalued stocks can be particularly rewarding as these equities may offer significant upside potential when market conditions stabilize. Here are three Japanese exchange stocks currently estimated to be up to 31.1% undervalued based on various financial metrics and market analyses.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Syuppin (TSE:3179) | ¥1358.00 | ¥2667.54 | 49.1% |

| Densan System Holdings (TSE:4072) | ¥2666.00 | ¥5331.44 | 50% |

| Kotobuki Spirits (TSE:2222) | ¥1778.50 | ¥3434.73 | 48.2% |

| Hottolink (TSE:3680) | ¥350.00 | ¥661.37 | 47.1% |

| Kadokawa (TSE:9468) | ¥2893.50 | ¥5603.86 | 48.4% |

| West Holdings (TSE:1407) | ¥2651.00 | ¥5093.73 | 48% |

| Adventure (TSE:6030) | ¥3780.00 | ¥7445.90 | 49.2% |

| Fudo Tetra (TSE:1813) | ¥2409.00 | ¥4705.50 | 48.8% |

| Visional (TSE:4194) | ¥8950.00 | ¥17023.36 | 47.4% |

| SBI ARUHI (TSE:7198) | ¥863.00 | ¥1692.89 | 49% |

Here we highlight a subset of our preferred stocks from the screener.

UT GroupLtd (TSE:2146)

Overview: UT Group Co., Ltd. (TSE:2146) specializes in the dispatch and outsourcing of permanent employees across various sectors such as manufacturing, design and development, and construction in Japan, with a market cap of ¥113.09 billion.

Operations: The company generates revenue from several segments including Area Business (¥66.39 billion), Vietnam Business (¥11.86 billion), Solution Business (¥18.89 billion), and Manufacturing Business excluding Solution Business (¥64.78 billion).

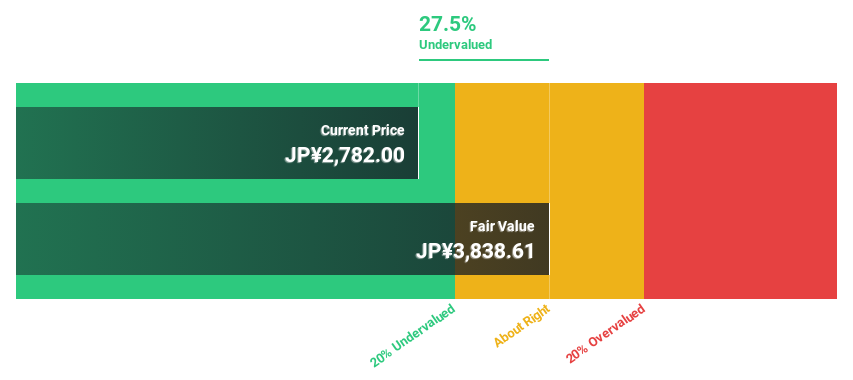

Estimated Discount To Fair Value: 25.4%

UT Group Ltd. appears undervalued based on cash flows, trading at 25.4% below its estimated fair value and more than 20% under its discounted cash flow valuation. Despite large one-off items affecting results, earnings grew by 153.5% last year and are forecast to grow annually by nearly 13%, outpacing the JP market's growth rate of 8.6%. However, the dividend yield of ¥164.81 per share is not well covered by free cash flows, raising sustainability concerns.

- Our growth report here indicates UT GroupLtd may be poised for an improving outlook.

- Take a closer look at UT GroupLtd's balance sheet health here in our report.

Toray Industries (TSE:3402)

Overview: Toray Industries, Inc., with a market cap of ¥1.21 trillion, operates globally in the manufacturing and sale of fibers and textiles, performance chemicals, carbon fiber composite materials, environment and engineering products, and life science products.

Operations: Toray Industries generates revenue through its diverse segments, including fibers and textiles, performance chemicals, carbon fiber composite materials, environment and engineering products, and life science products.

Estimated Discount To Fair Value: 12.4%

Toray Industries is trading at ¥754.4, below its estimated fair value of ¥860.87, representing a 12.4% discount. Earnings are forecast to grow significantly at 23.1% per year, outpacing the JP market's growth rate of 8.6%. Recent guidance for FY2025 projects revenue of ¥2.62 trillion and profit attributable to owners of parent at ¥81 billion, with basic earnings per share expected to be ¥50.56, indicating strong future cash flows despite a low return on equity forecast (6.3%).

- According our earnings growth report, there's an indication that Toray Industries might be ready to expand.

- Click to explore a detailed breakdown of our findings in Toray Industries' balance sheet health report.

Japan Investment Adviser (TSE:7172)

Overview: Japan Investment Adviser Co., Ltd. provides various financial solutions in Japan and has a market cap of ¥75.42 billion.

Operations: Japan Investment Adviser Co., Ltd. generates revenue primarily through its Finance Solution segment, which accounted for ¥27.86 billion.

Estimated Discount To Fair Value: 31.1%

Japan Investment Adviser is trading at ¥1,247, well below its estimated fair value of ¥1,808.69. Despite recent shareholder dilution and a dividend not fully covered by free cash flows, the company shows strong potential with earnings forecast to grow 39.7% annually over the next three years. Recent half-year results reported net income of ¥5.70 billion compared to ¥1.70 billion a year ago, driven by robust performance in its Operating Lease Business and favorable exchange gains from yen depreciation.

- In light of our recent growth report, it seems possible that Japan Investment Adviser's financial performance will exceed current levels.

- Navigate through the intricacies of Japan Investment Adviser with our comprehensive financial health report here.

Summing It All Up

- Get an in-depth perspective on all 78 Undervalued Japanese Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2146

UT GroupLtd

Engages in the dispatch and outsourcing of permanent employees in the manufacturing, design and development, construction, and other sectors in Japan.

Flawless balance sheet, undervalued and pays a dividend.