- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6946

Market Cool On Nippon Avionics Co., Ltd.'s (TSE:6946) Earnings

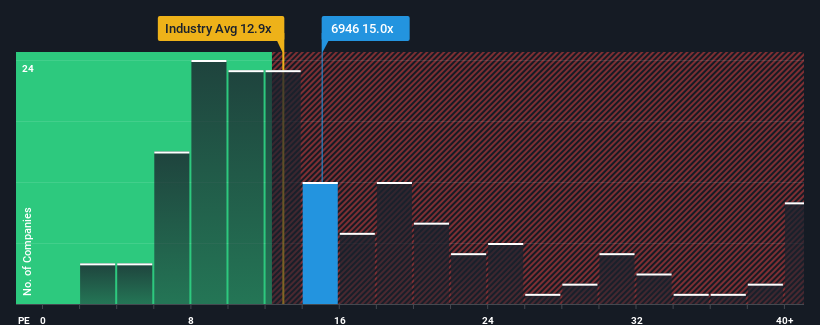

With a median price-to-earnings (or "P/E") ratio of close to 14x in Japan, you could be forgiven for feeling indifferent about Nippon Avionics Co., Ltd.'s (TSE:6946) P/E ratio of 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Earnings have risen at a steady rate over the last year for Nippon Avionics, which is generally not a bad outcome. One possibility is that the P/E is moderate because investors think this good earnings growth might only be parallel to the broader market in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for Nippon Avionics

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Nippon Avionics' to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 2.9% last year. This was backed up an excellent period prior to see EPS up by 76% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that Nippon Avionics is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Nippon Avionics' P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Nippon Avionics currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You need to take note of risks, for example - Nippon Avionics has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If these risks are making you reconsider your opinion on Nippon Avionics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Avionics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6946

Nippon Avionics

Designs, develops, manufactures and sells data processing systems and related electric equipment in Japan.

Proven track record with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026