- Taiwan

- /

- Semiconductors

- /

- TWSE:6937

Changzheng Engineering TechnologyLtd And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week marked by heightened tariff uncertainties and mixed economic signals, global markets have experienced notable fluctuations, with key indices like the S&P 500 and Russell 2000 showing slight declines. Amidst these market dynamics, investors are increasingly seeking opportunities in small-cap stocks that can offer potential growth despite broader economic challenges. In this context, identifying undiscovered gems such as Changzheng Engineering Technology Ltd can provide valuable diversification to a portfolio. These companies often possess unique attributes or operate in niche sectors that allow them to thrive even when larger market forces are at play.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Changzheng Engineering TechnologyLtd (SHSE:603698)

Simply Wall St Value Rating: ★★★★☆☆

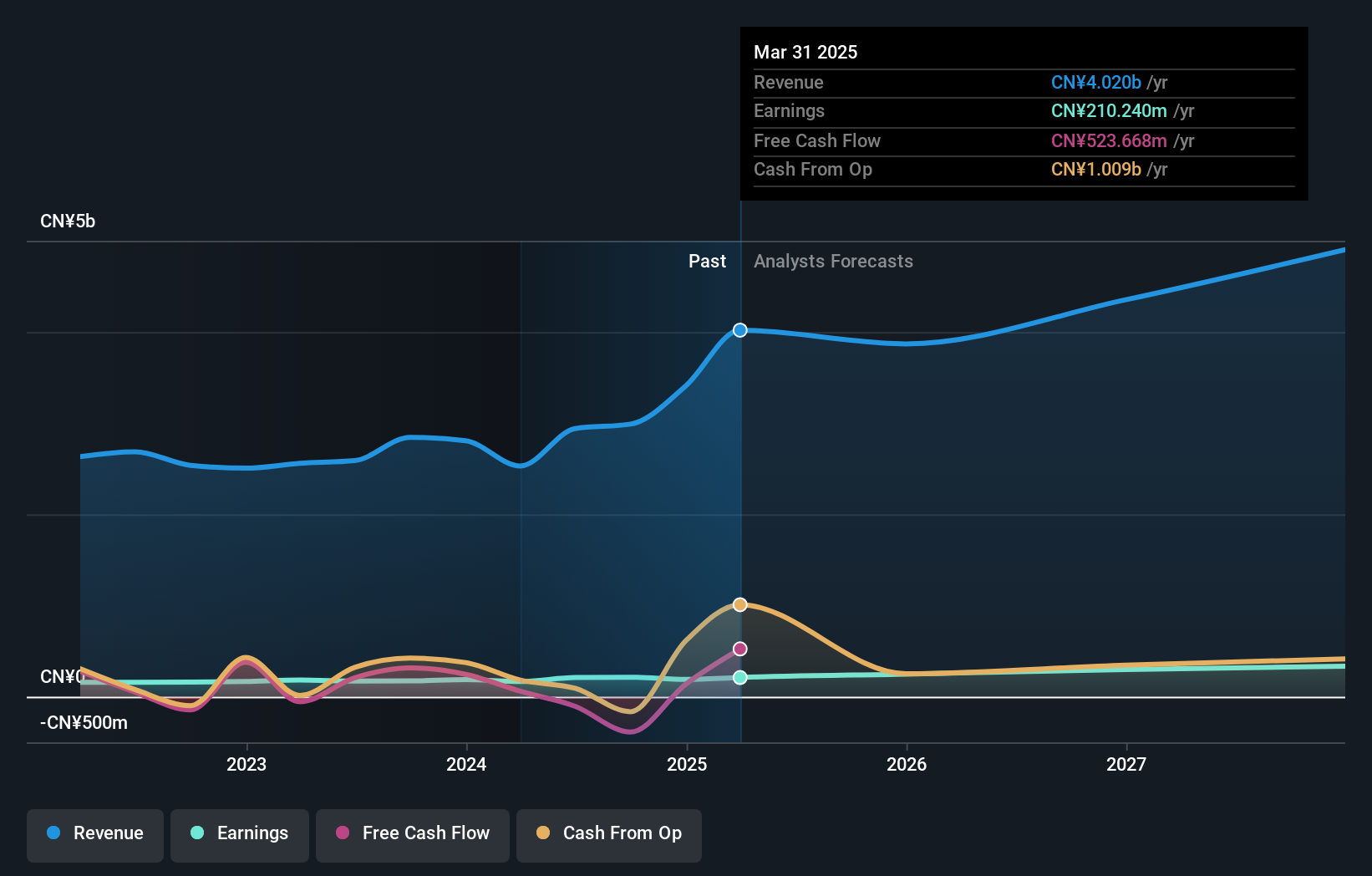

Overview: Changzheng Engineering Technology Co., Ltd specializes in R&D, engineering design, technical services, equipment supply, and EPC contracting for aerospace pulverized coal pressurized gasification technology and equipment in China, with a market cap of CN¥8.99 billion.

Operations: The company generates revenue primarily through its services in research and development, engineering design, technical services, equipment supply, and EPC contracting. It has a market capitalization of CN¥8.99 billion. The financial performance shows a notable trend in the net profit margin over recent periods.

Changzheng Engineering Technology, a nimble player in the engineering sector, has shown notable financial resilience with earnings growth of 23% over the past year, surpassing its industry peers who grew at 8%. Its debt-to-equity ratio increased to 21% over five years, indicating a strategic use of leverage. Despite not being free cash flow positive recently, it enjoys high-quality earnings and more cash than total debt. An extraordinary shareholders meeting was held in December 2024 in Beijing, suggesting active engagement with stakeholders as it navigates future growth opportunities projected at nearly 25% annually.

Nippon Ceramic (TSE:6929)

Simply Wall St Value Rating: ★★★★★★

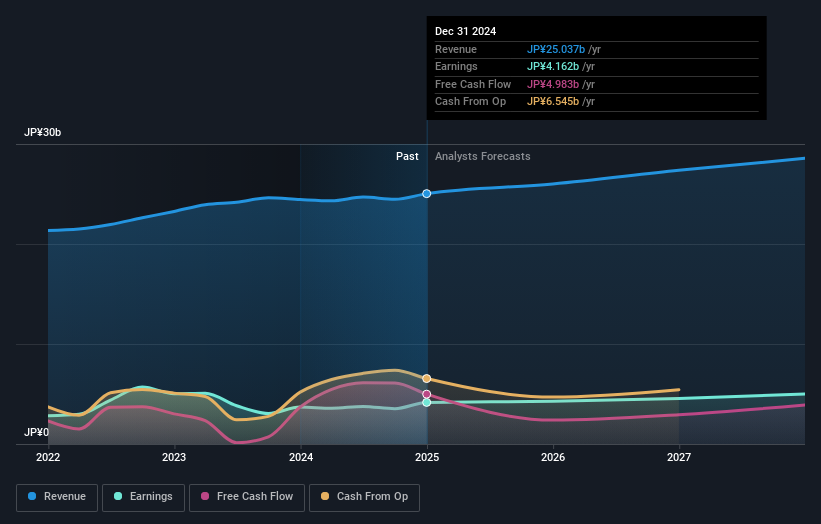

Overview: Nippon Ceramic Co., Ltd. develops, manufactures, and sells ceramic sensors and modules both in Japan and internationally, with a market cap of ¥60.67 billion.

Operations: Nippon Ceramic generates revenue primarily from the sale of ceramic sensors and modules. The company's financial performance is influenced by its cost structure, which includes manufacturing and operational expenses.

Nippon Ceramic, a small player in the electronics industry, is trading at 37.7% below its estimated fair value, suggesting potential undervaluation. With earnings growth of 12.7% over the past year and a forecasted annual increase of 5.4%, it outpaces the industry average of 5.1%. The company boasts high-quality earnings and has successfully reduced its debt-to-equity ratio from 0.2% to 0.1% over five years, demonstrating prudent financial management. Recently announced share buyback plans aim to improve capital efficiency by repurchasing up to ¥1,500 million worth of shares, further enhancing shareholder returns and flexibility in capital policies amidst changing business environments.

- Delve into the full analysis health report here for a deeper understanding of Nippon Ceramic.

Explore historical data to track Nippon Ceramic's performance over time in our Past section.

Skytech (TWSE:6937)

Simply Wall St Value Rating: ★★★★★☆

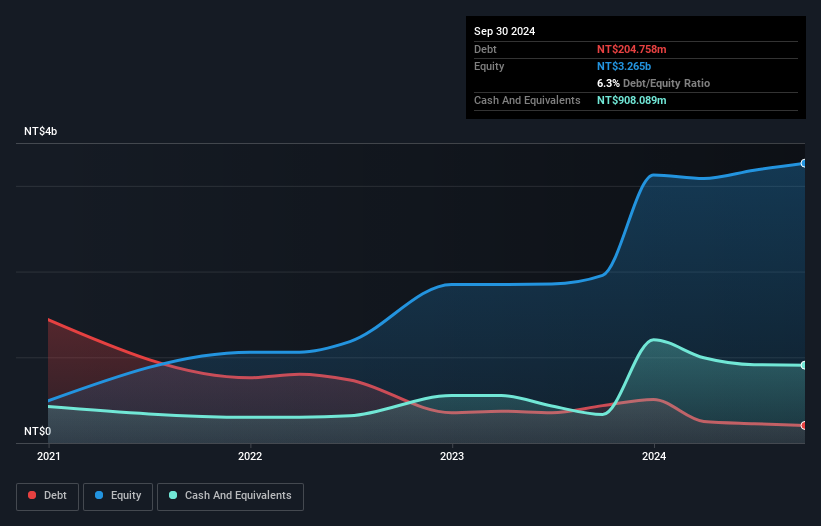

Overview: Skytech Inc. operates within the semiconductor and related technology industries with a market capitalization of NT$21.83 billion.

Operations: Skytech generates revenue primarily from its Machinery & Industrial Equipment segment, which amounts to NT$2.22 billion.

Skytech is making waves with its recent decision to establish a subsidiary in Taiwan, investing up to TWD 99 million. The company reported third-quarter sales of TWD 563.63 million, slightly higher than last year's TWD 537.75 million, though net income dipped from TWD 89.41 million to TWD 82.89 million. Over nine months, however, net income rose significantly from TWD 159.15 million to TWD 261.16 million, showcasing strong earnings growth of 47% over the past year—outpacing the semiconductor industry's average of nearly 6%. Despite a volatile share price recently and negative free cash flow figures like -US$77.72M in late September, Skytech's financial health remains robust with more cash than debt and high-quality non-cash earnings contributing positively.

- Get an in-depth perspective on Skytech's performance by reading our health report here.

Evaluate Skytech's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Reveal the 4706 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6937

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives