- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6861

Keyence (TSE:6861) Revenue Growth Forecast Tops Market, Reinforcing Bullish Investor Narratives

Reviewed by Simply Wall St

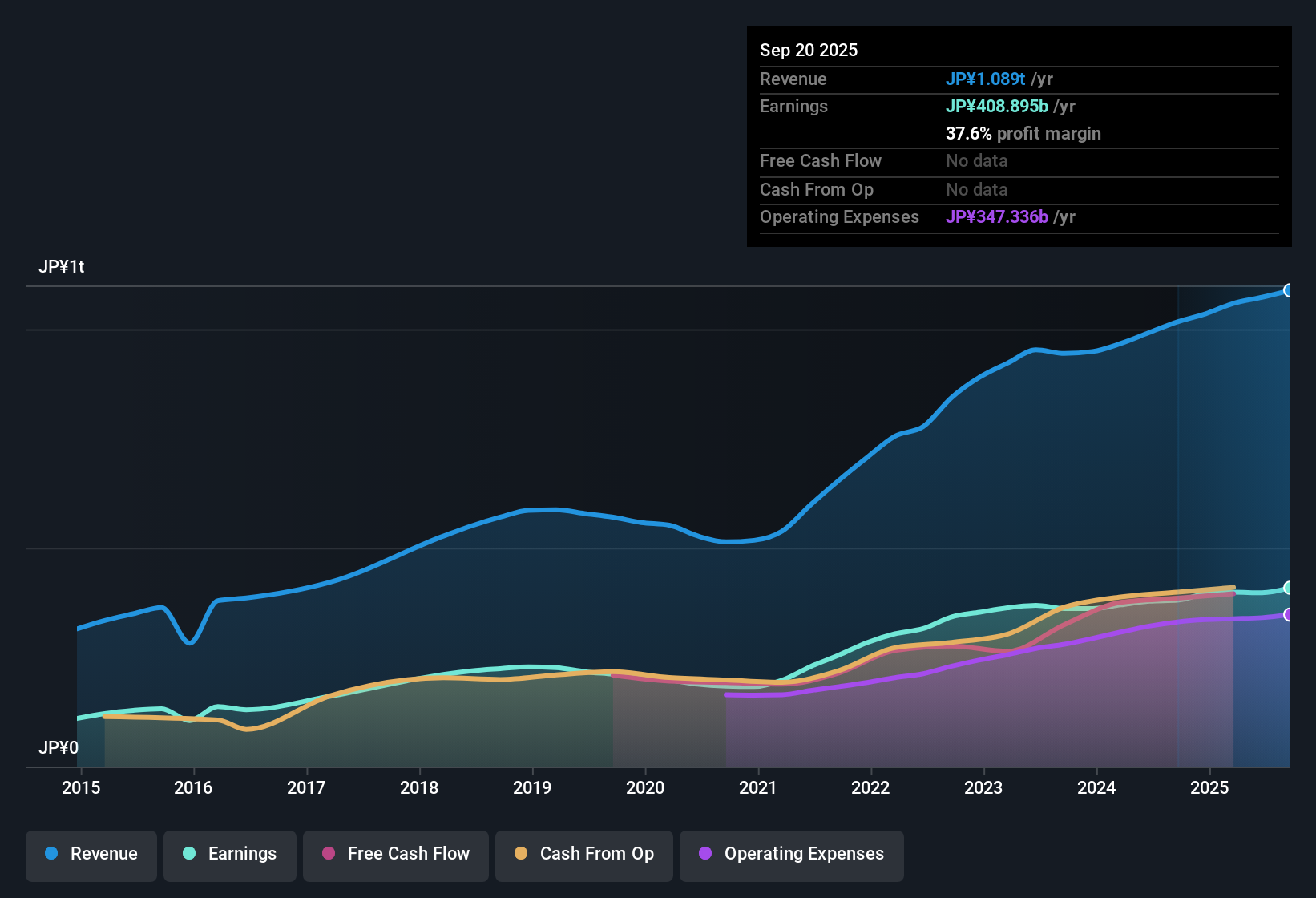

Keyence (TSE:6861) delivered another standout performance, with revenue forecast to grow at 9.9% per year and earnings expected to expand 10.3% per year. Both of these figures outpace the broader Japanese market’s projections. Over the past five years, the company’s earnings have increased by 13.8% annually, and net profit margins have inched up to 37.6% from last year’s 37.4%. With high earnings quality and notable profit and revenue growth, investors continue to see compelling rewards based on current trends.

See our full analysis for Keyence.Next, we will see how these latest numbers compare with the key narratives shaping market expectations for Keyence. Some views will find support, and others may be challenged by what the data reveals.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Edge Up to 37.6%

- Net profit margin stands at 37.6%, slightly higher than last year’s 37.4%, extending the company’s already strong earnings quality.

- What is surprising is that such high and stable margins support arguments that Keyence’s innovation and sector leadership continue to shield its profitability, even as competitors operate at much lower averages.

- With no major risks flagged and margins ticking upwards, bulls point to sector-wide trends in automation and digital factory solutions as a tailwind supporting further margin durability.

- Still, the consistency at these high levels reinforces Keyence’s reputation for operational excellence while keeping valuation debates active.

Premium Price Tag Versus Peers

- Keyence trades at a 35.6x price-to-earnings ratio, substantially higher than both peer companies (19.3x) and the wider Japanese electronics sector (15x).

- Critics highlight that while Keyence’s above-market growth justifies some premium, the current share price of ¥60,010 is well above its DCF fair value of ¥34,355. This raises questions about how much future growth is already priced in.

- Bears argue that, despite sector leadership and high growth, further upside may be limited unless earnings accelerate faster than forecast or market appetite for premium multiples remains strong.

- In the absence of major risks, this valuation tension keeps investors sharply divided between paying up for quality and being cautious on further re-rating potential.

No Flagged Risks, All Rewards

- Investor materials and filings show no flagged major or minor risks, while Keyence’s profit has expanded by an average of 13.8% per year over five years and is forecast to maintain double-digit earnings growth.

- The prevailing market view is that this combination, with sector trends in automation and strong financials, positions Keyence as a resilient growth leader rather than just a cyclical play.

- Strong profit and margin trends reinforce the sense of durability, turning attention to whether premium valuation will persist as these trends continue.

- The lack of outlined risks lets investors focus on fundamentals, with growth and quality squarely at the center of the long-term case.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Keyence's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust growth and strong margins, Keyence’s lofty valuation means investors face the risk that much of its future potential is already priced in.

If you want a better value entry, use these 850 undervalued stocks based on cash flows to target stocks with compelling prospects that are not weighed down by premium price tags.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keyence might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6861

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives