- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6858

Ono Sokki Co., Ltd.'s (TSE:6858) Popularity With Investors Under Threat As Stock Sinks 31%

Ono Sokki Co., Ltd. (TSE:6858) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. Indeed, the recent drop has reduced its annual gain to a relatively sedate 8.0% over the last twelve months.

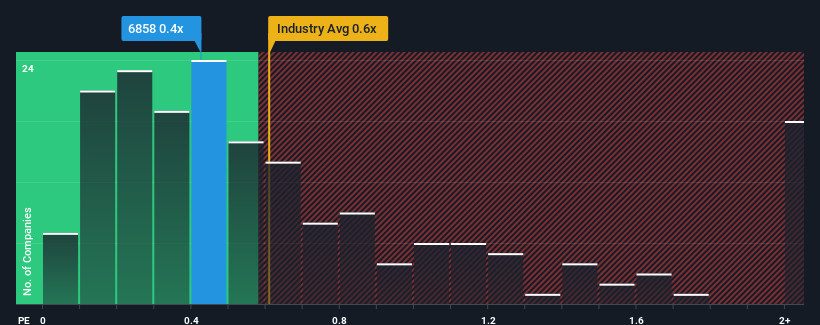

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Ono Sokki's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in Japan is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Ono Sokki

What Does Ono Sokki's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Ono Sokki, which is generally not a bad outcome. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on Ono Sokki will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ono Sokki's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Ono Sokki?

Ono Sokki's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.1%. Revenue has also lifted 17% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 8.1% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Ono Sokki's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does Ono Sokki's P/S Mean For Investors?

Following Ono Sokki's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ono Sokki's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Ono Sokki that you need to be mindful of.

If these risks are making you reconsider your opinion on Ono Sokki, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6858

Ono Sokki

Manufactures and sells measuring instruments in Japan and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives