- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6841

Is Yokogawa Electric’s Upward Earnings Revision Altering the Investment Case for Yokogawa Electric (TSE:6841)?

Reviewed by Sasha Jovanovic

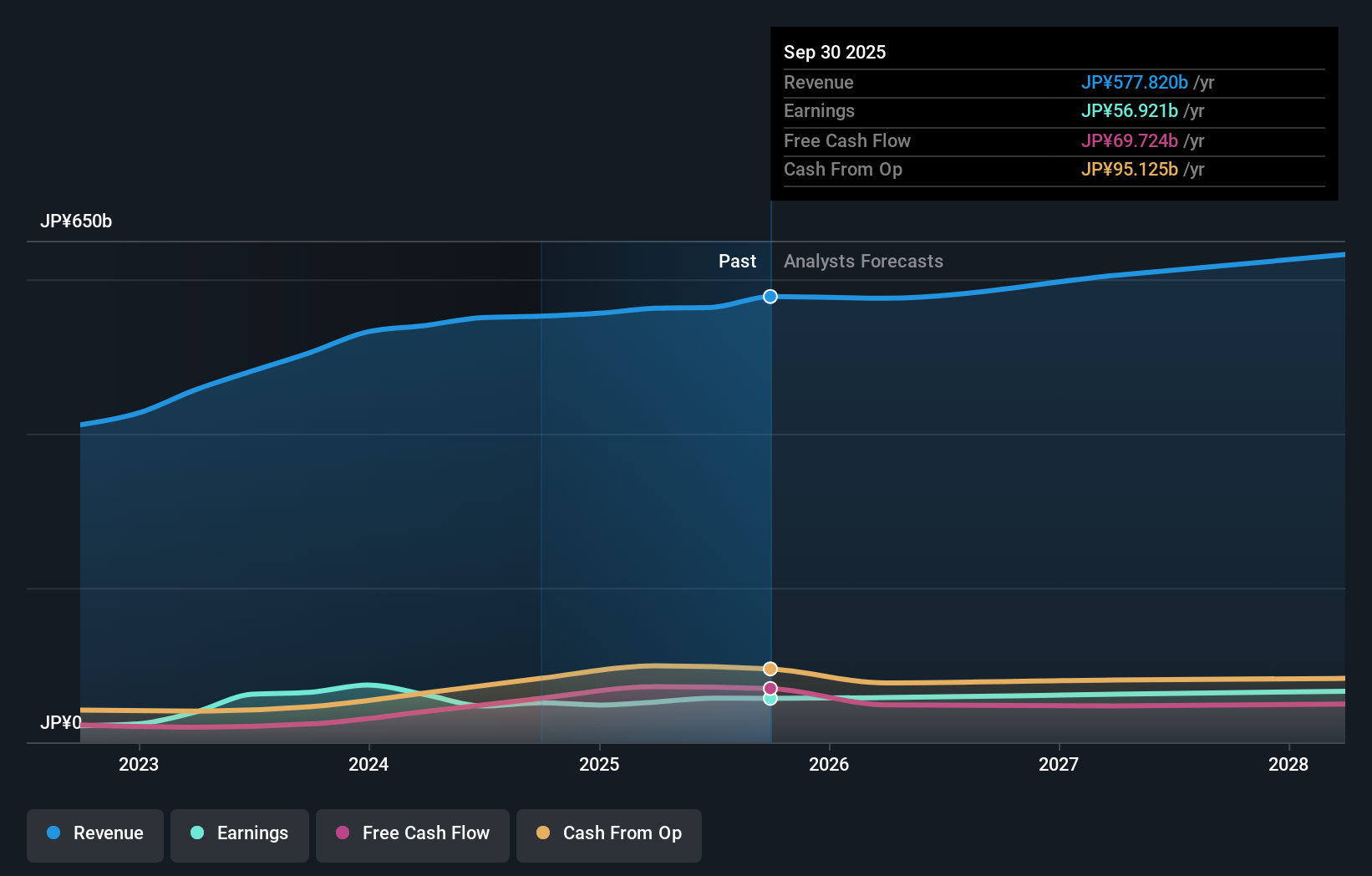

- Yokogawa Electric Corporation recently raised its consolidated earnings guidance for the fiscal year ending March 31, 2026, now projecting net sales of ¥577 billion and operating profit of ¥83 billion, compared to previous forecasts of ¥560 billion and ¥80 billion respectively.

- This upward revision points to growing management confidence and possible improvements in business operations and profitability expectations for the coming year.

- We’ll explore how these strengthened earnings projections could influence Yokogawa Electric’s investment narrative and highlight implications for business momentum.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Yokogawa Electric's Investment Narrative?

For those considering Yokogawa Electric, the core investment case typically revolves around confidence in the company's ability to drive steady growth through its industrial automation innovations, global client relationships, and a disciplined approach to capital returns, including share buybacks and rising dividends. The recent upward earnings revision for 2026 signals management’s increased optimism and may help ease near-term anxiety around softness in revenue growth and profit margin sustainability, two of the key short-term catalysts previously flagged. However, it’s worth noting that while the improvement in expectations is positive, the guidance lift is modest, and the company’s valuation still looks expensive relative to sector averages. Persistent concerns around board and management inexperience and slower forecast growth versus peers could temper enthusiasm, but the stronger outlook does reduce some immediate risk related to downside financial surprises.

But, the relatively brief tenure of board members still presents an issue that shouldn’t be ignored. Yokogawa Electric's shares are on the way up, but they could be overextended by 18%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Yokogawa Electric - why the stock might be worth as much as ¥4722!

Build Your Own Yokogawa Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yokogawa Electric research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Yokogawa Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yokogawa Electric's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6841

Yokogawa Electric

Provides industrial automation, and test and measurement solutions in Japan, Southeast Asia, the Far East, China, India, Europe, CIS countries, North America, the Middle East, Africa, and Central and South America.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives