- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6834

SEIKOH GIKEN (TSE:6834) Has Announced That It Will Be Increasing Its Dividend To ¥55.00

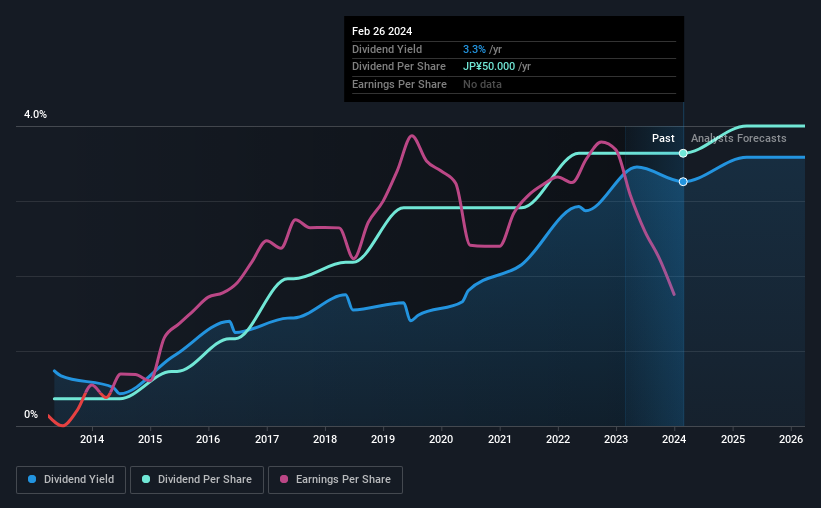

SEIKOH GIKEN Co., Ltd. (TSE:6834) has announced that it will be increasing its periodic dividend on the 24th of June to ¥55.00, which will be 10% higher than last year's comparable payment amount of ¥50.00. This will take the annual payment to 3.3% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for SEIKOH GIKEN

SEIKOH GIKEN's Earnings Easily Cover The Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, SEIKOH GIKEN was easily earning enough to cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

EPS is set to grow by 31.8% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 78%, which is on the higher side, but certainly still feasible.

SEIKOH GIKEN Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The annual payment during the last 10 years was ¥5.00 in 2014, and the most recent fiscal year payment was ¥50.00. This means that it has been growing its distributions at 26% per annum over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. Earnings per share has been sinking by 12% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

In Summary

Overall, this is a reasonable dividend, and it being raised is an added bonus. The earnings coverage is acceptable for now, but with earnings on the decline we would definitely keep an eye on the payout ratio. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 3 warning signs for SEIKOH GIKEN that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6834

SEIKOH GIKEN

Engages in design, manufacture, and sale of optical components and lens, and radio over fiber products in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026