- Turkey

- /

- Transportation

- /

- IBSE:TUREX

Spotlighting Undiscovered Gems with Strong Potential This November 2024

Reviewed by Simply Wall St

In the wake of recent market fluctuations, including the partial rollback of gains from the "Trump Trade" and shifts in sector performances, investors are navigating a landscape marked by policy uncertainties and economic indicators like inflation rates. Amidst these dynamics, identifying promising small-cap stocks with strong potential can be particularly rewarding as they often offer unique growth opportunities that might not yet be reflected in broader market indices.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| SG Mart | 3.62% | 96.95% | 95.31% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Tureks Turizm Tasimacilik Anonim Sirketi (IBSE:TUREX)

Simply Wall St Value Rating: ★★★★★☆

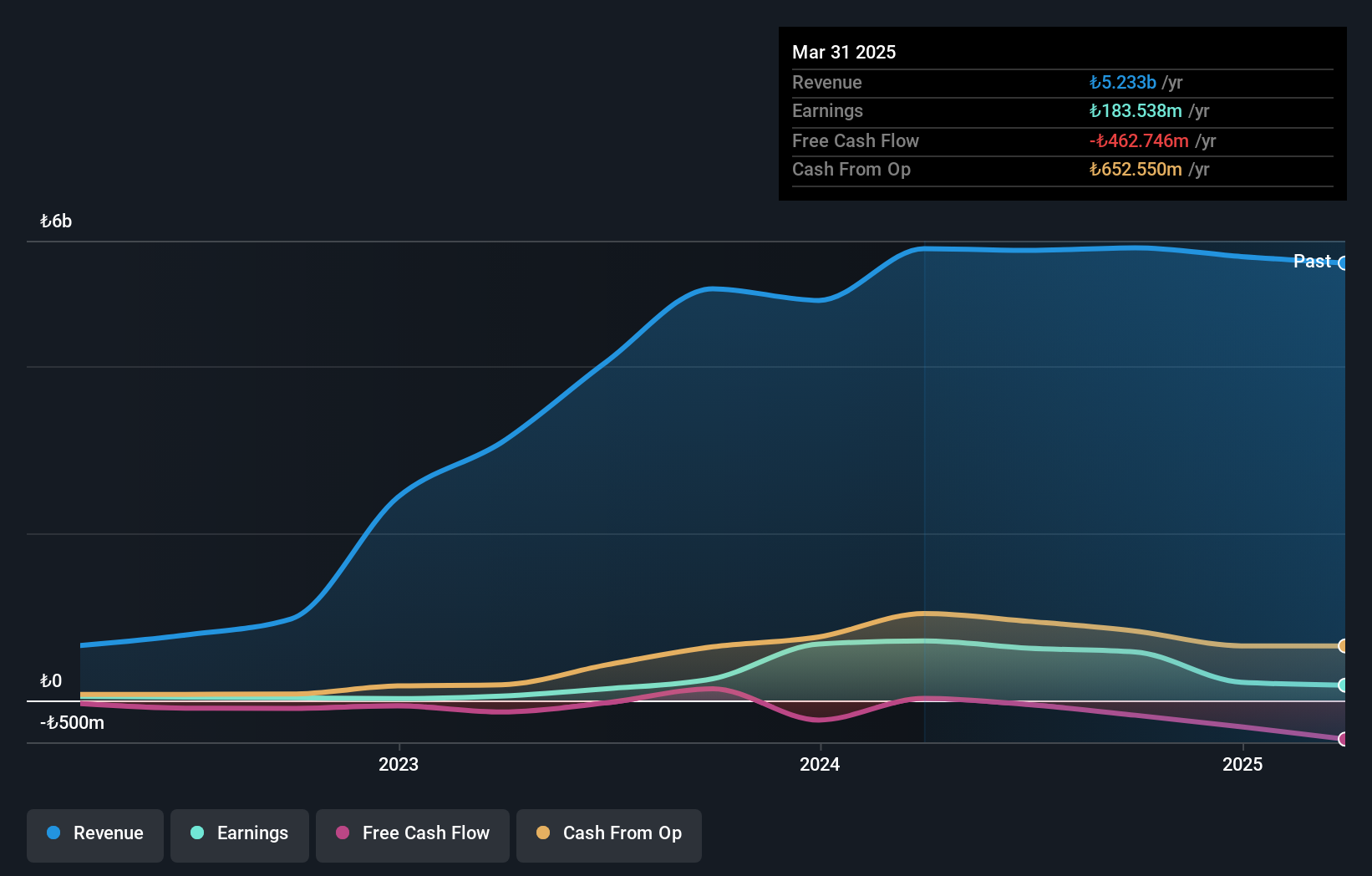

Overview: Tureks Turizm Tasimacilik Anonim Sirketi offers transportation services to public and private institutions in Turkey, with a market cap of TRY10.95 billion.

Operations: Tureks generates revenue primarily through transportation services for public and private institutions in Turkey. The company's net profit margin has shown variability, indicating fluctuations in profitability over different periods.

Tureks Turizm Tasimacilik Anonim Sirketi, a modest player in the transportation sector, has shown impressive earnings growth of 215.6% over the past year, outpacing the industry average of 91.3%. Despite this surge, recent financials reveal a mixed picture; third-quarter sales rose to TRY 1.24 billion from TRY 1.21 billion last year, yet net income dropped to TRY 80.26 million from TRY 125.31 million previously. The company's debt situation is favorable with a net debt to equity ratio at a satisfactory level of 0.9%, and its interest payments are well covered by EBIT at 5.5 times coverage.

Computer Direct Group (TASE:CMDR)

Simply Wall St Value Rating: ★★★★★★

Overview: Computer Direct Group Ltd. operates in the computing and software sector both in Israel and internationally, with a market capitalization of ₪1.14 billion.

Operations: Computer Direct Group generates revenue primarily from three segments: Infrastructure and Computing (₪1.23 billion), Outsourcing of Business Processes and Technology Support Centers (₪321.95 million), and Software Solutions & Services Management Consulting & Value-Added Services (₪2.32 billion).

Computer Direct Group seems to be a promising player in the IT sector, with its earnings growing at 15.9% annually over the past five years. The company reported a net income of ILS 19.45 million for Q2 2024, up from ILS 16.94 million the previous year, alongside sales of ILS 969.24 million compared to last year's ILS 881.79 million. Despite not outpacing industry growth recently, it trades at a significant discount—77% below estimated fair value—and boasts strong financial health with more cash than total debt and an impressive EBIT interest coverage of 20 times.

- Navigate through the intricacies of Computer Direct Group with our comprehensive health report here.

Explore historical data to track Computer Direct Group's performance over time in our Past section.

Furuno Electric (TSE:6814)

Simply Wall St Value Rating: ★★★★★★

Overview: Furuno Electric Co., Ltd. is involved in the manufacture and sale of marine and industrial electronics equipment, wireless LAN systems, and handy terminals across Japan, the Americas, Europe, Asia, and other international markets with a market cap of ¥86.86 billion.

Operations: Furuno Electric generates revenue primarily from the sale of marine and industrial electronics equipment, wireless LAN systems, and handy terminals across various global markets. The company's financial performance is highlighted by a market cap of ¥86.86 billion.

Furuno Electric, a small cap player in the electronics sector, is showcasing impressive financial resilience. With earnings growth of 160% over the past year, it outpaces the industry average significantly. The company trades at 64% below its estimated fair value, suggesting potential undervaluation. Over five years, Furuno's debt to equity ratio has decreased from 26% to 23%, indicating prudent financial management. Despite recent share price volatility, its high-quality earnings and satisfactory net debt to equity ratio of 5% reinforce its solid financial standing. However, projected earnings decline by an average of 14% annually for the next three years may warrant caution.

- Get an in-depth perspective on Furuno Electric's performance by reading our health report here.

Assess Furuno Electric's past performance with our detailed historical performance reports.

Where To Now?

- Discover the full array of 4651 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tureks Turizm Tasimacilik Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TUREX

Tureks Turizm Tasimacilik Anonim Sirketi

Provides transportation services to the public and private institutions in Turkey.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives