The board of SMK Corporation (TSE:6798) has announced that it will pay a dividend on the 28th of June, with investors receiving ¥50.00 per share. The dividend yield of 3.8% is still a nice boost to shareholder returns, despite the cut.

View our latest analysis for SMK

SMK Might Find It Hard To Continue The Dividend

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Even though SMK isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Assuming the trend of the last few years continues, EPS will grow by 40.0% over the next 12 months. It's nice to see things moving in the right direction, but this probably won't be enough for the company to turn a profit. The healthy cash flows are definitely as good sign, though so we wouldn't panic just yet, especially with the earnings growing.

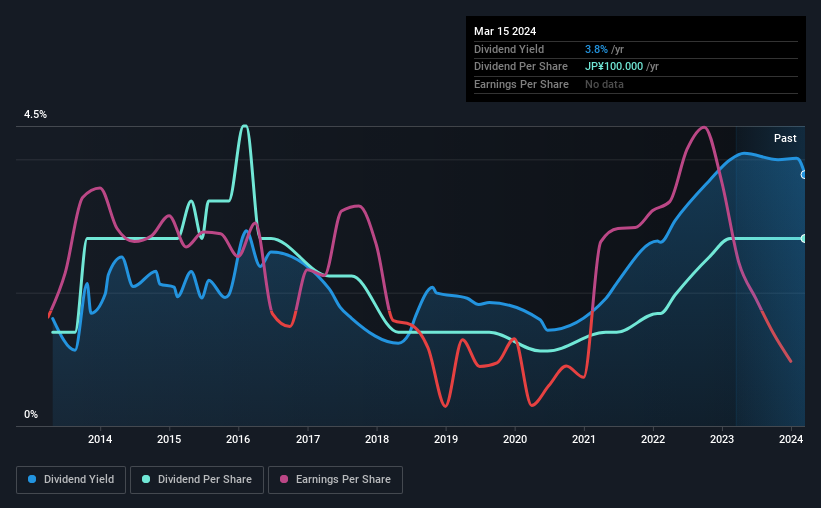

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of ¥50.00 in 2014 to the most recent total annual payment of ¥100.00. This means that it has been growing its distributions at 7.2% per annum over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. SMK might have put its house in order since then, but we remain cautious.

The Company Could Face Some Challenges Growing The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's encouraging to see that SMK has been growing its earnings per share at 40% a year over the past five years. Even though the company is not profitable, it is growing at a solid clip. If this trajectory continues and the company can turn a profit soon, it could bode well for the dividend going forward.

In Summary

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for SMK that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6798

SMK

Engages in the manufacture and sale of various parts for electro-communication device and electronic equipment in Japan, rest of Asia, North America, and Europe.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion