- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6787

Market Participants Recognise Meiko Electronics Co., Ltd.'s (TSE:6787) Earnings Pushing Shares 31% Higher

Despite an already strong run, Meiko Electronics Co., Ltd. (TSE:6787) shares have been powering on, with a gain of 31% in the last thirty days. The last 30 days bring the annual gain to a very sharp 75%.

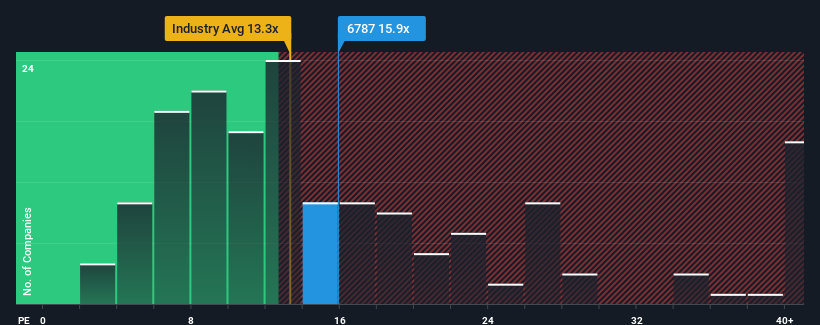

After such a large jump in price, given around half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may consider Meiko Electronics as a stock to potentially avoid with its 15.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been advantageous for Meiko Electronics as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Meiko Electronics

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Meiko Electronics' is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 67% last year. Pleasingly, EPS has also lifted 44% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 15% each year as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 9.9% per year, which is noticeably less attractive.

In light of this, it's understandable that Meiko Electronics' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Meiko Electronics shares have received a push in the right direction, but its P/E is elevated too. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Meiko Electronics' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Meiko Electronics (1 doesn't sit too well with us!) that we have uncovered.

If you're unsure about the strength of Meiko Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6787

Meiko Electronics

Engages in the design, manufacture, and sale of printed circuit boards (PCBs) and auxiliary electronics in Japan, China, Vietnam, the rest of Asia, North America, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026