Undiscovered Gems with Promising Potential This December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating interest rates and mixed economic signals, the technology-heavy Nasdaq Composite has reached new heights, while small-cap stocks underperformed their larger counterparts. Amid these dynamics, discerning investors often seek out lesser-known opportunities that may offer promising potential for growth. In this environment, identifying stocks with strong fundamentals and unique market positions can be crucial for those looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

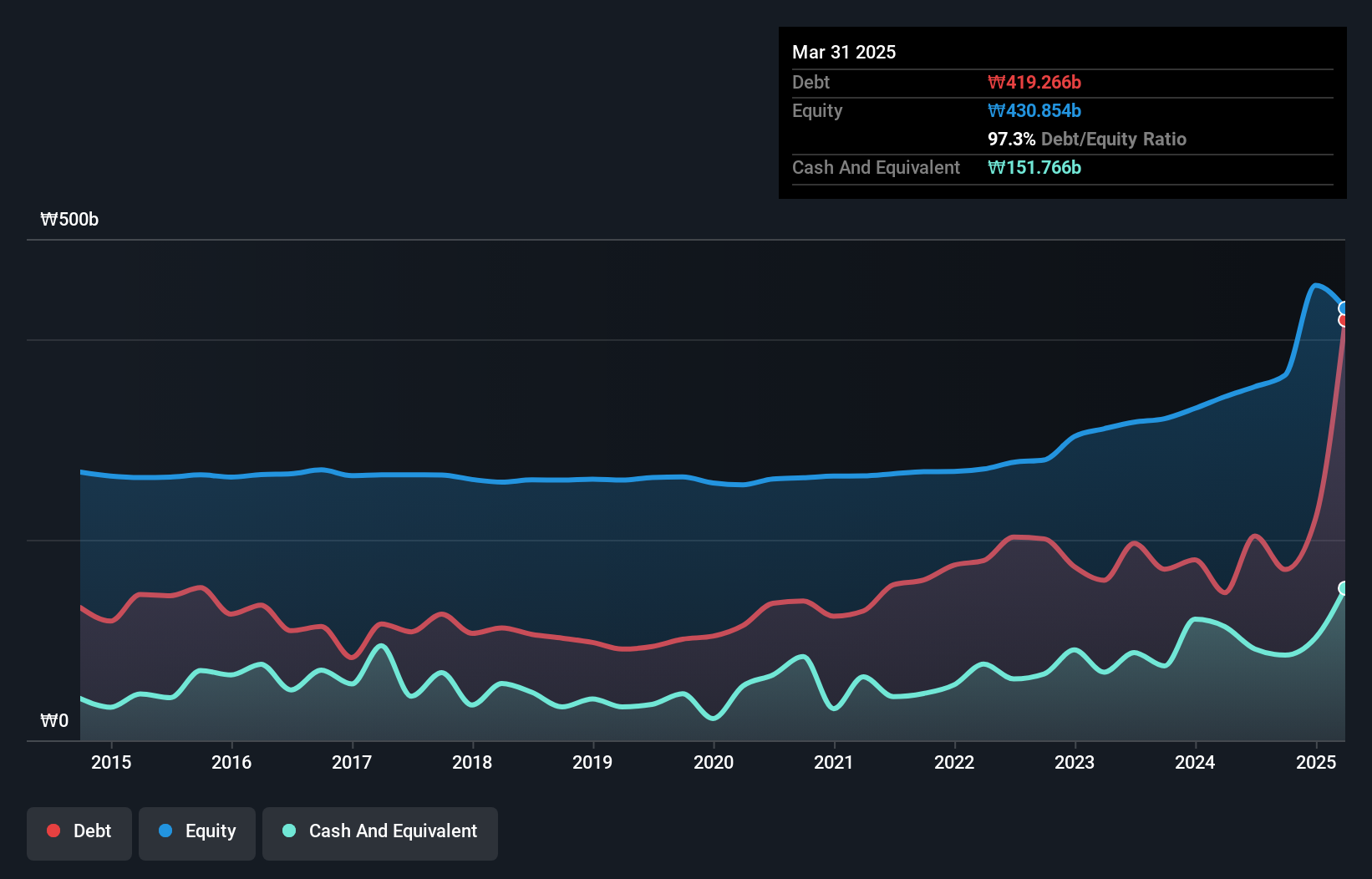

GAON CABLE (KOSE:A000500)

Simply Wall St Value Rating: ★★★★★☆

Overview: GAON CABLE Co., Ltd. is a South Korean company specializing in the production of industrial power cables, with a market cap of ₩475.68 billion.

Operations: GAON CABLE generates revenue primarily from its Power Line Division, contributing ₩1.60 trillion, and the Telecommunications Line Division, which adds ₩195.31 billion.

GAON CABLE, a smaller player in the electrical industry, has shown notable financial resilience. The company's earnings grew by 6.9% over the past year, outpacing the industry's 1.2% growth rate. Its net debt to equity ratio stands at a satisfactory 23.4%, and interest payments are well covered with EBIT at 6.3 times interest repayments. Despite recent shareholder dilution through private placements totaling KRW 204 billion, GAON CABLE's shares trade at a significant discount of 36% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in this sector.

- Get an in-depth perspective on GAON CABLE's performance by reading our health report here.

Assess GAON CABLE's past performance with our detailed historical performance reports.

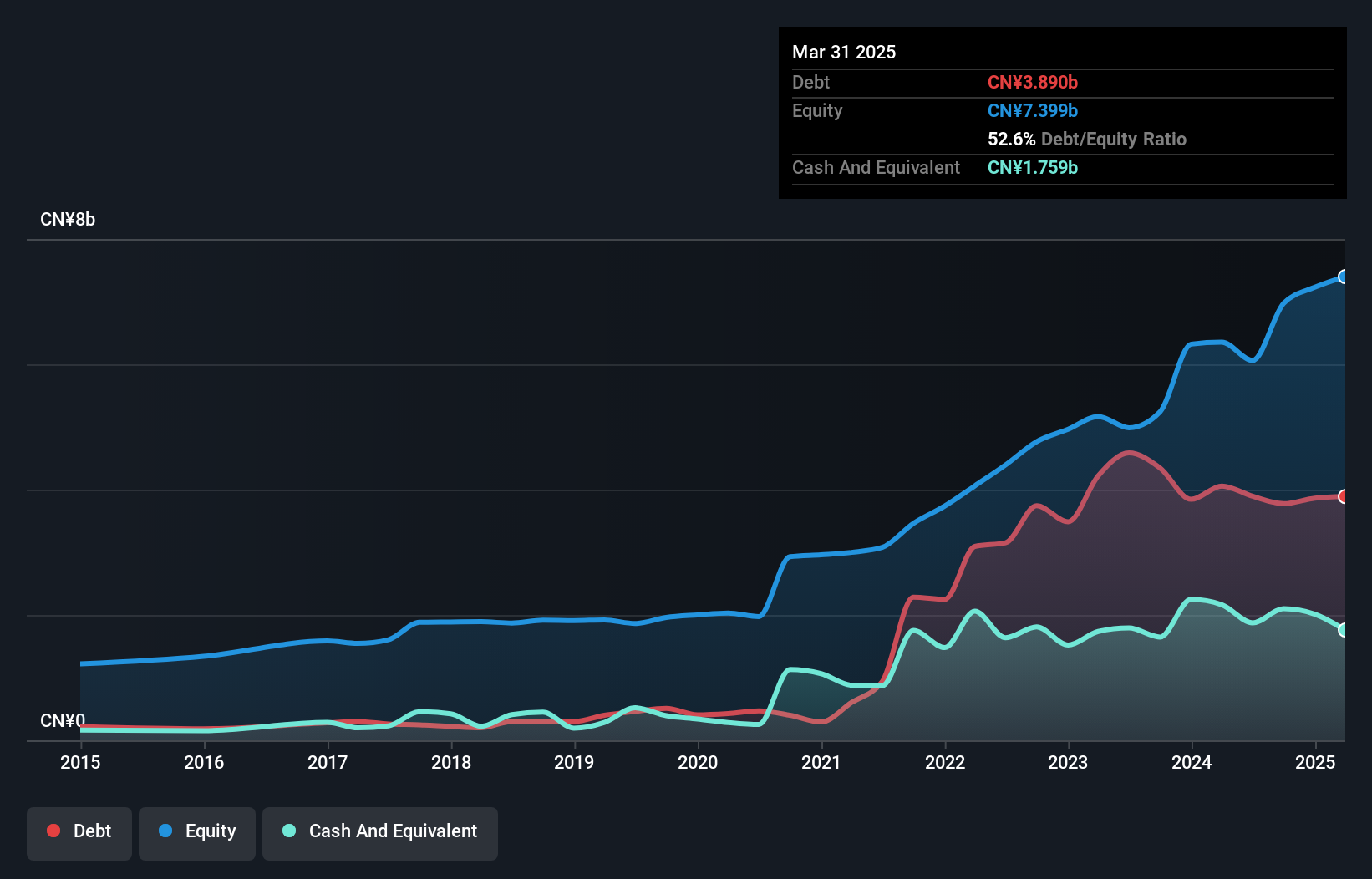

Guizhou Chanhen Chemical (SZSE:002895)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guizhou Chanhen Chemical Corporation is involved in the mining, beneficiation of phosphate, and processing of phosphorus in China, with a market cap of CN¥12.06 billion.

Operations: Guizhou Chanhen Chemical's revenue is primarily derived from its phosphate mining and phosphorus processing activities. The company's financial performance includes a focus on managing cost structures related to these operations.

Guizhou Chanhen Chemical, a promising player in the chemicals sector, has shown impressive growth with earnings surging 43% over the past year, outpacing the industry's -4.7%. Trading at a favorable price-to-earnings ratio of 13x compared to the broader CN market's 37x, it offers good relative value. Despite an increase in its debt-to-equity ratio from 26% to 54% over five years, its net debt level remains satisfactory at 24%. With earnings forecasted to grow by another 26% annually and interest payments well covered by EBIT at an impressive 11.3x, this company exhibits robust financial health and potential for continued success.

- Dive into the specifics of Guizhou Chanhen Chemical here with our thorough health report.

Gain insights into Guizhou Chanhen Chemical's past trends and performance with our Past report.

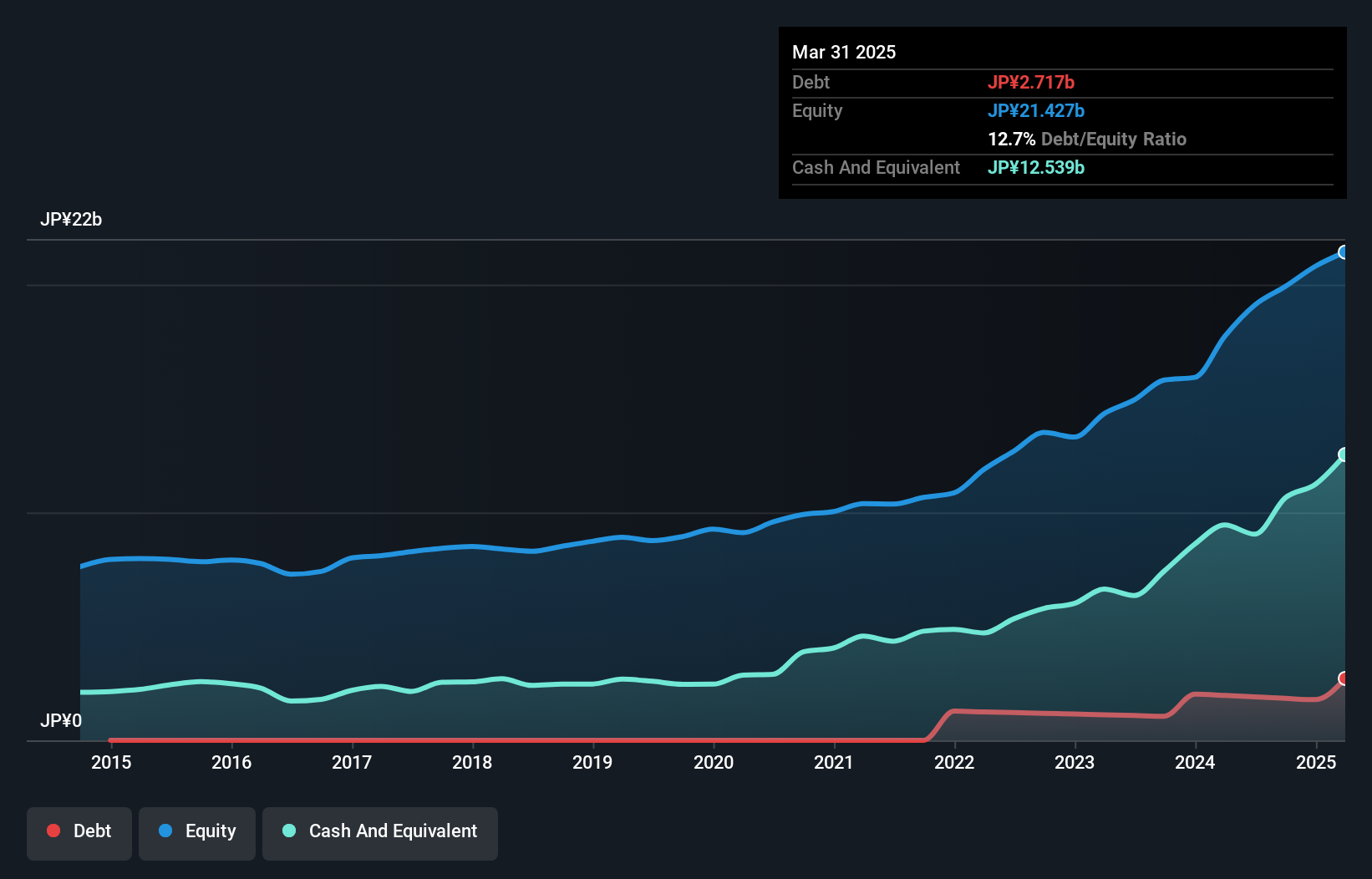

santec Holdings (TSE:6777)

Simply Wall St Value Rating: ★★★★★☆

Overview: Santec Holdings Corporation develops, manufactures, and sells components for fiber optic telecommunication systems with a market cap of ¥76.33 billion.

Operations: Santec Holdings generates revenue primarily from its Optical Measuring Instrument Related Business, contributing ¥17.74 billion, and its Optical Components Related Business, adding ¥3.93 billion.

With a notable 59% earnings growth over the past year, santec Holdings is making waves in the electronics sector. The company, which trades at a significant 61% below its estimated fair value, showcases high-quality earnings and positive free cash flow. Despite an increase in debt to equity from 0% to 9% over five years, it maintains more cash than total debt, ensuring financial stability. However, its share price has been highly volatile recently. As part of the S&P Global BMI Index now, santec seems poised for further attention with forecasts suggesting an annual growth rate of around 8%.

- Navigate through the intricacies of santec Holdings with our comprehensive health report here.

Examine santec Holdings' past performance report to understand how it has performed in the past.

Seize The Opportunity

- Access the full spectrum of 4502 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002895

Guizhou Chanhen Chemical

Engages in the mining and beneficiation of phosphate and processing of phosphorus in China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives