Discover These 3 Undiscovered Gems in Japan with Strong Potential

Reviewed by Simply Wall St

Japan's stock markets have recently experienced a downturn, with the Nikkei 225 Index down 5.8% and the broader TOPIX Index registering a 4.2% loss, driven by a U.S.-led sell-off in semiconductor stocks and yen strength impacting export-oriented companies. Despite these challenges, Japan continues to offer intriguing opportunities for discerning investors seeking undervalued gems. In such volatile market conditions, identifying stocks with strong fundamentals and growth potential becomes crucial. These undiscovered gems often possess unique attributes that can weather economic shifts and provide substantial long-term value.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Poppins | 39.80% | 8.36% | -7.40% | ★★★★★★ |

| Nice | 71.69% | -1.98% | 36.48% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| Denyo | 3.49% | 4.30% | 3.66% | ★★★★★☆ |

| GENOVA | 0.93% | 33.82% | 30.22% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Access (TSE:4813)

Simply Wall St Value Rating: ★★★★★★

Overview: Access Co., Ltd. is a company that provides mobile and network software technologies to various industries worldwide, including telecom carriers, consumer electronics manufacturers, broadcasting and publishing companies, the automotive industry, and energy infrastructure providers; it has a market cap of ¥65.59 billion.

Operations: Access Co., Ltd. generates revenue primarily from its Network Business (¥10.37 billion), IoT Business (¥5.54 billion), and Web Platform Business (¥2.07 billion).

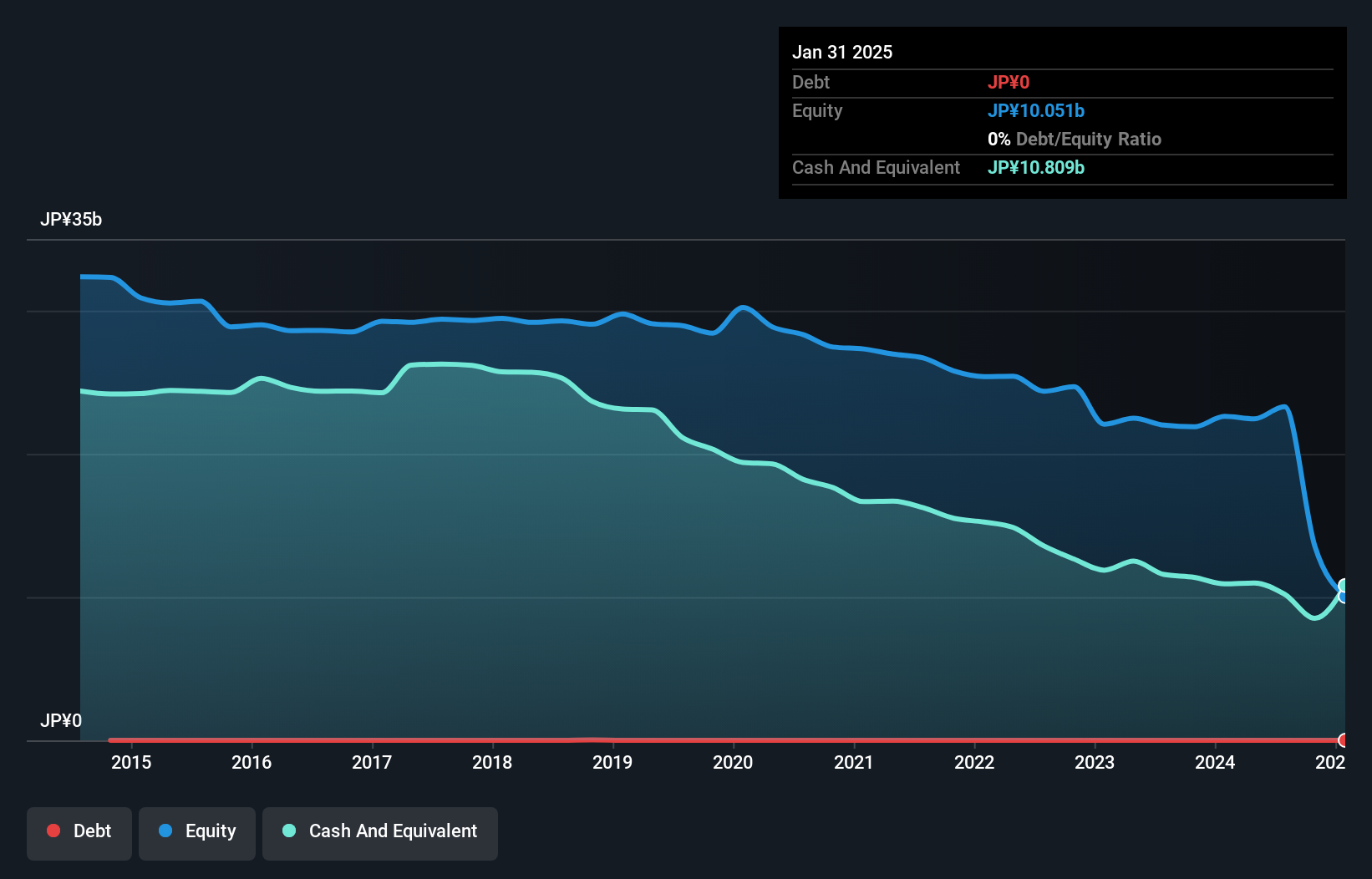

Access Co., Ltd. has shown promising developments, becoming profitable this year and showcasing high-quality earnings. The company is debt-free, which simplifies financial stability concerns. Despite a volatile share price over the past three months, Access's recent performance indicates potential for growth. With no debt five years ago and a positive change in net working capital of ¥2.19 billion as of July 2024, it seems well-positioned for future gains in the software industry.

Nohmi Bosai (TSE:6744)

Simply Wall St Value Rating: ★★★★★★

Overview: Nohmi Bosai Ltd. develops, markets, installs, and maintains fire protection systems across Japan, China, the rest of Asia, and the United States with a market cap of ¥152.75 billion.

Operations: Nohmi Bosai Ltd. generates revenue primarily from Fire Alarm Systems (¥44.38 billion), Fire Extinguishing Systems (¥39.33 billion), and Maintenance and Services (¥32.44 billion).

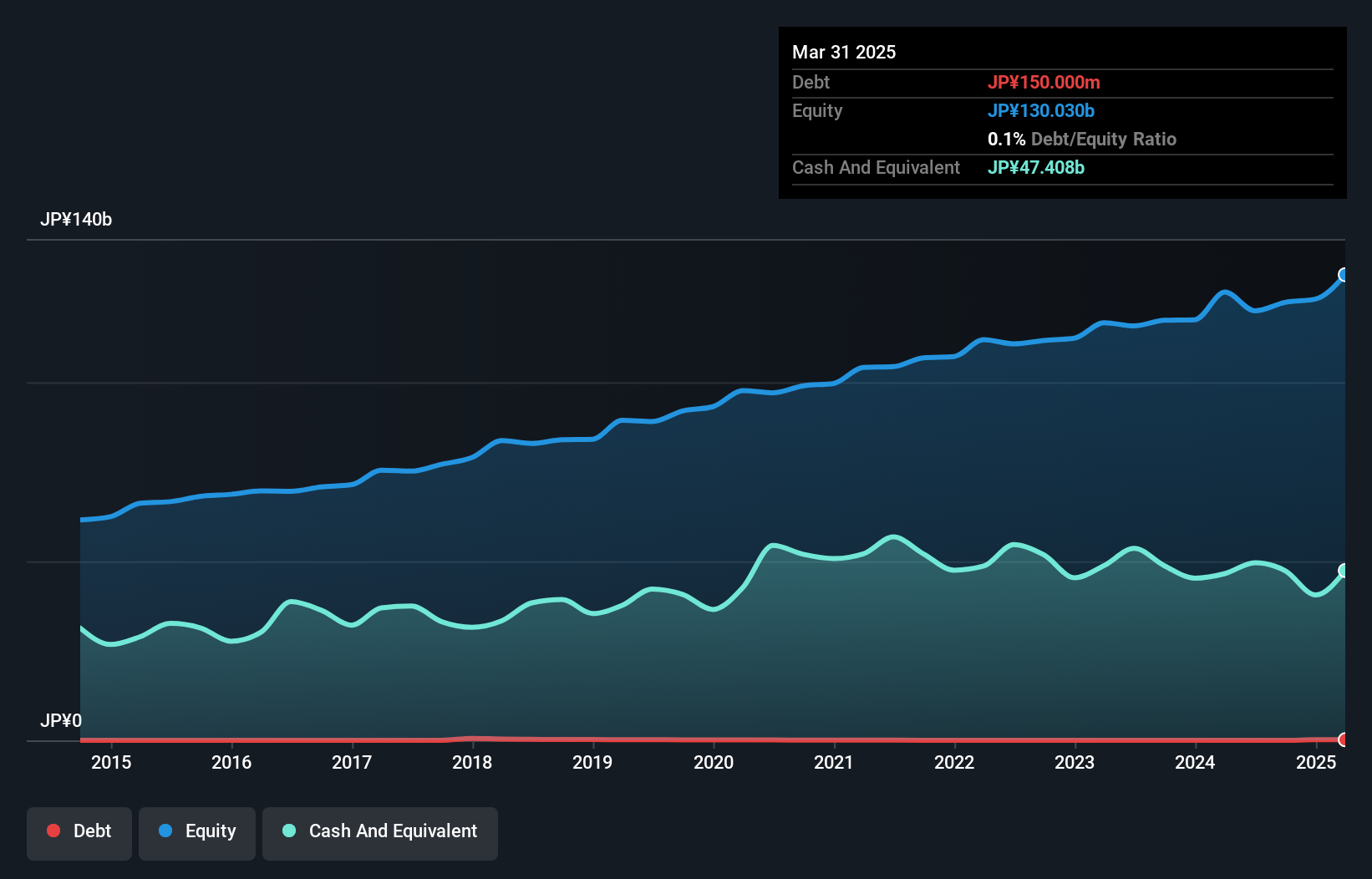

Nohmi Bosai stands out with impressive earnings growth of 21.9% over the past year, far exceeding the Electronic industry’s 8.3%. The company has no debt now, compared to a debt-to-equity ratio of 0.2 five years ago, indicating strong financial health. With high-quality earnings and free cash flow positivity, Nohmi Bosai is well-positioned for steady growth, projected at 2.69% annually. This robust performance highlights its potential as an investment gem in Japan's market.

- Get an in-depth perspective on Nohmi Bosai's performance by reading our health report here.

Assess Nohmi Bosai's past performance with our detailed historical performance reports.

Nanto Bank (TSE:8367)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Nanto Bank, Ltd., with a market cap of ¥93.62 billion, operates in Japan through its banking, securities, leasing, and credit guarantee businesses.

Operations: Nanto Bank generates revenue primarily through its banking, securities, leasing, and credit guarantee operations. The net profit margin for the company is 9.75%.

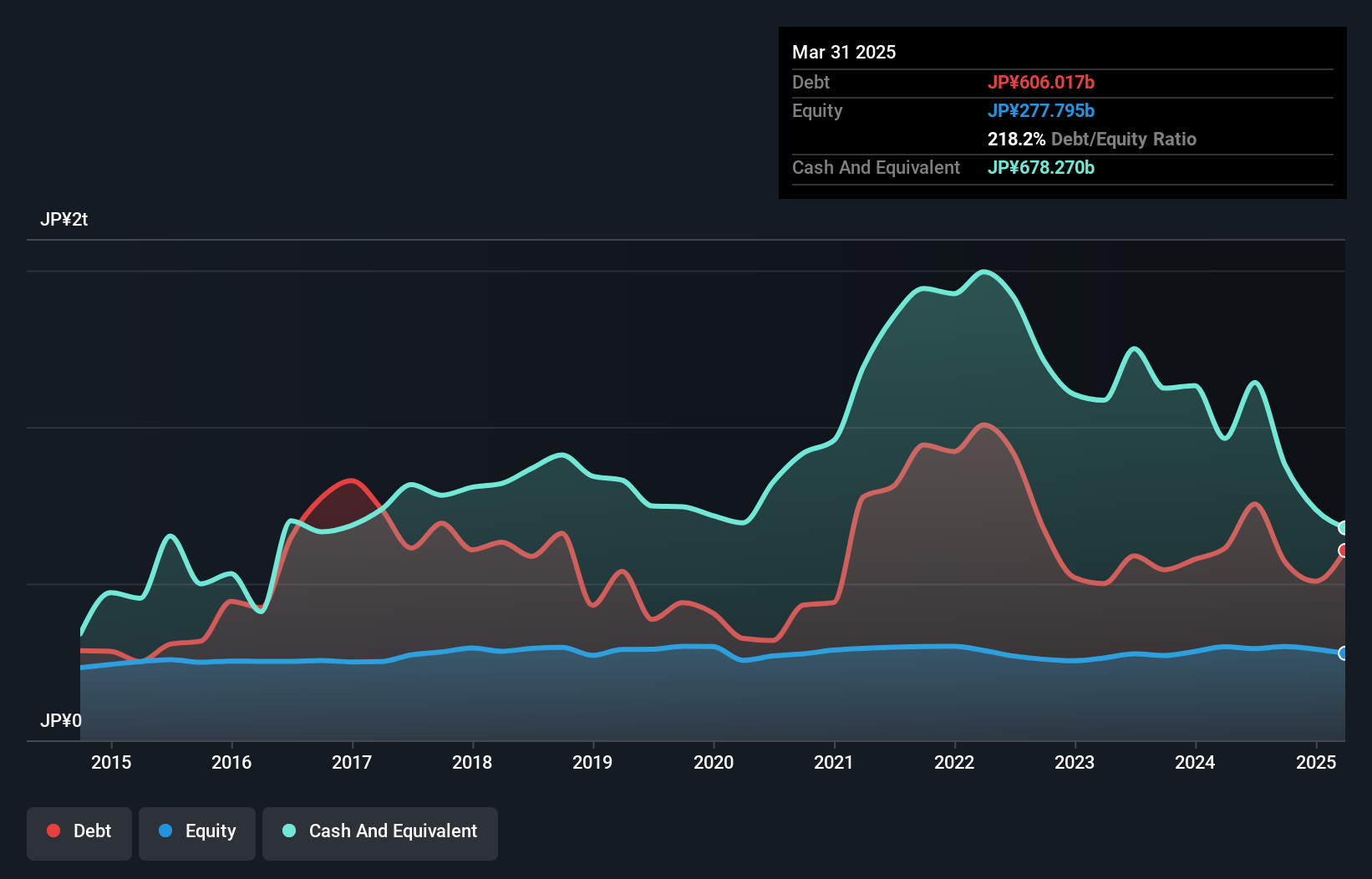

Nanto Bank, with total assets of ¥7,095.3B and equity of ¥292.5B, has seen earnings grow by 161% over the past year, outpacing the industry average of 19.1%. Customer deposits totaling ¥5,974.5B primarily fund its operations, reducing risk compared to external borrowing. Despite a net interest margin of 0.7%, the bank's allowance for bad loans remains insufficient at 1.4% of total loans; however, it recently repurchased shares worth ¥999.77M in July 2024.

- Delve into the full analysis health report here for a deeper understanding of Nanto Bank.

Review our historical performance report to gain insights into Nanto Bank's's past performance.

Seize The Opportunity

- Unlock our comprehensive list of 753 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanto Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8367

Nanto Bank

Provides banking, securities, leasing, and credit guarantee services in Japan.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success