- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6743

Daido Signal Co., Ltd. (TSE:6743) Soars 32% But It's A Story Of Risk Vs Reward

The Daido Signal Co., Ltd. (TSE:6743) share price has done very well over the last month, posting an excellent gain of 32%. Looking back a bit further, it's encouraging to see the stock is up 69% in the last year.

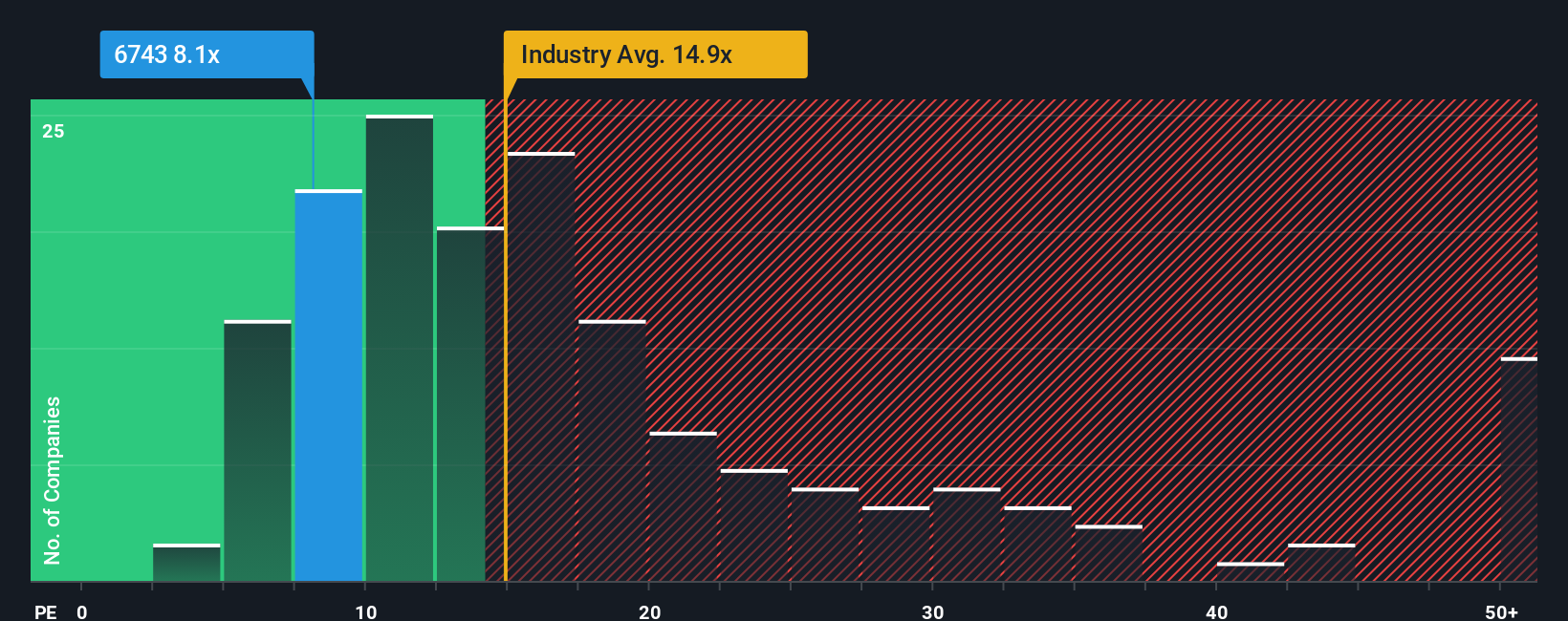

Although its price has surged higher, Daido Signal's price-to-earnings (or "P/E") ratio of 8.1x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 15x and even P/E's above 23x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

As an illustration, earnings have deteriorated at Daido Signal over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Daido Signal

How Is Daido Signal's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Daido Signal's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 5.7% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 230% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Daido Signal's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Daido Signal's P/E?

Despite Daido Signal's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Daido Signal currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Having said that, be aware Daido Signal is showing 3 warning signs in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6743

Daido Signal

Manufactures, sells, installs, and repairs railway signal safety devices, electrical equipment, and other mechanical devices in Japan.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives