- Japan

- /

- Tech Hardware

- /

- TSE:6737

Earnings Update: Here's Why Analysts Just Lifted Their EIZO Corporation (TSE:6737) Price Target To JP¥5,000

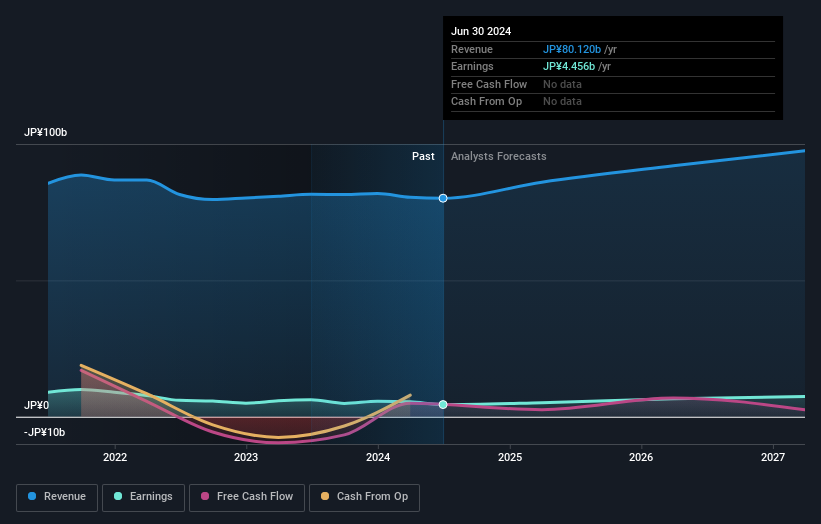

EIZO Corporation (TSE:6737) shareholders are probably feeling a little disappointed, since its shares fell 9.1% to JP¥4,350 in the week after its latest first-quarter results. Results were roughly in line with estimates, with revenues of JP¥18b and statutory earnings per share of JP¥265. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for EIZO

Taking into account the latest results, the most recent consensus for EIZO from two analysts is for revenues of JP¥86.0b in 2025. If met, it would imply a modest 7.3% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to climb 16% to JP¥250. Before this earnings report, the analysts had been forecasting revenues of JP¥87.0b and earnings per share (EPS) of JP¥267 in 2025. The analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share numbers for next year.

Despite cutting their earnings forecasts,the analysts have lifted their price target 6.4% to JP¥5,000, suggesting that these impacts are not expected to weigh on the stock's value in the long term.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting EIZO's growth to accelerate, with the forecast 9.9% annualised growth to the end of 2025 ranking favourably alongside historical growth of 2.3% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 2.7% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that EIZO is expected to grow much faster than its industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for EIZO. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on EIZO. Long-term earnings power is much more important than next year's profits. At least one analyst has provided forecasts out to 2027, which can be seen for free on our platform here.

Even so, be aware that EIZO is showing 2 warning signs in our investment analysis , you should know about...

Valuation is complex, but we're here to simplify it.

Discover if EIZO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6737

EIZO

Designs, develops, manufactures, and sells visual display systems, amusement monitors, and imaging system software in Japan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success