- Japan

- /

- Tech Hardware

- /

- TSE:6736

What Does Sun's (TSE:6736) Interim Dividend Pause Reveal About Its Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- On November 14, 2025, Sun Corporation's board convened and resolved to refrain from paying interim dividends for the period with a record date of September 30, 2025.

- This move highlights how changes in dividend policy can directly affect shareholder expectations and influence overall confidence in the company.

- We'll explore how Sun Corporation's decision to refrain from interim dividends may impact its investment appeal and long-term capital allocation story.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Sun's Investment Narrative?

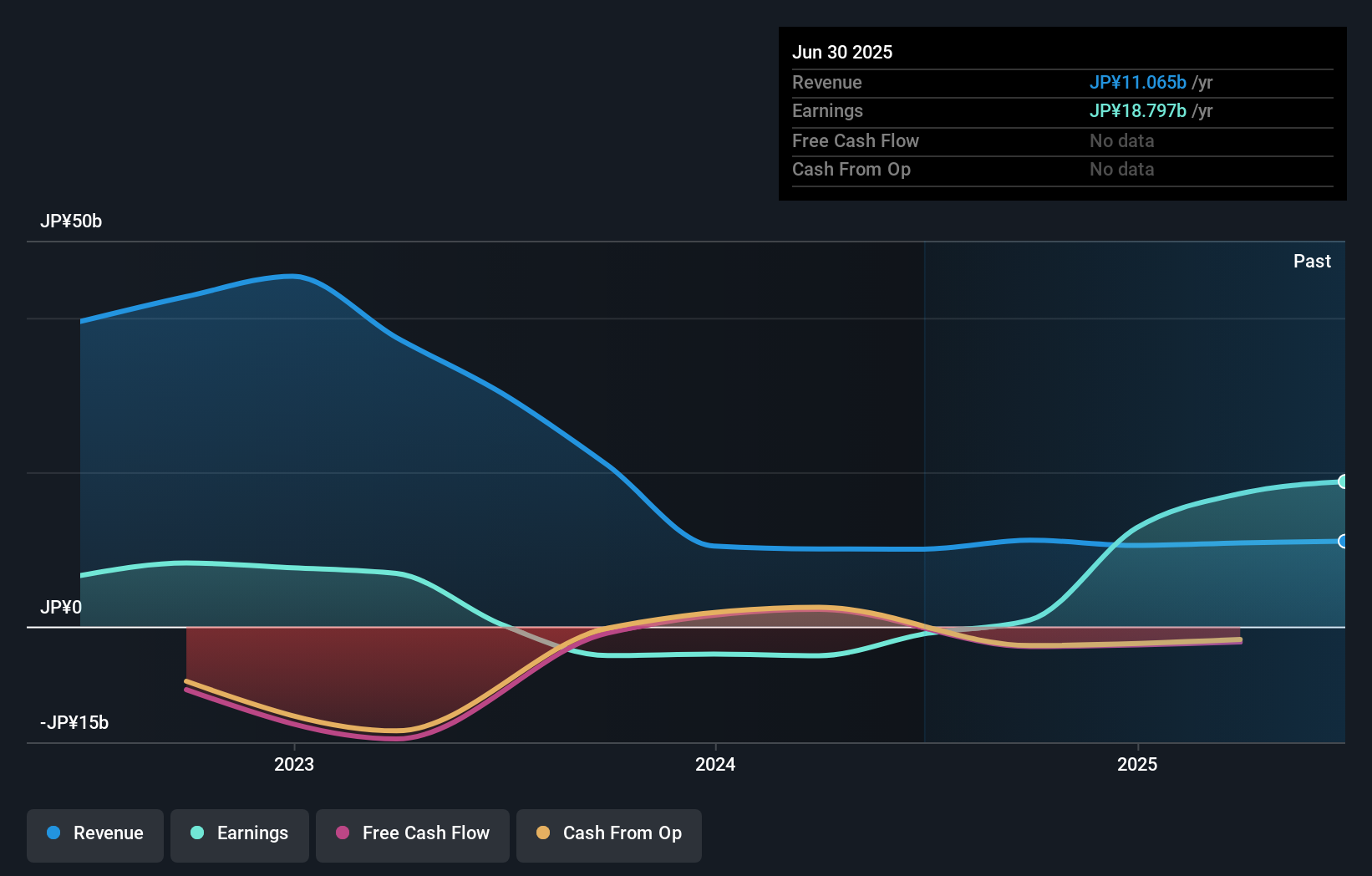

For anyone considering Sun Corporation as a long-term holding, the core belief tends to center on its transition to consistent profitability, high return on equity, and management's active steps to address shareholder value, evident from recent share buybacks and a board experienced in weathering volatility. The decision on November 14 to forgo an interim dividend right after a period of robust total returns and a series of share repurchases changes the near-term script, though. It signals a potential shift towards reinvesting in the business or maintaining liquidity at the expense of immediate yield, which might dampen short-term sentiment but doesn't appear to undermine the major catalysts: ongoing buybacks, recently improved profits, and strategic partnerships such as with TRM Labs. That said, with large one-off items distorting past earnings and a very volatile share price, risk levels have not diminished, and the dividend move is a reminder to stay alert to further capital allocation changes. On the flip side, the potential impact of more one-off gains or losses should not be overlooked.

Sun's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Sun - why the stock might be worth as much as ¥1681!

Build Your Own Sun Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6736

Sun

Engages in the global data intelligence, entertainment, information technology, and other businesses in Japan.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives