- Japan

- /

- Tech Hardware

- /

- TSE:6734

Newtech Co.,Ltd.'s (TSE:6734) 28% Price Boost Is Out Of Tune With Earnings

Newtech Co.,Ltd. (TSE:6734) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 33%.

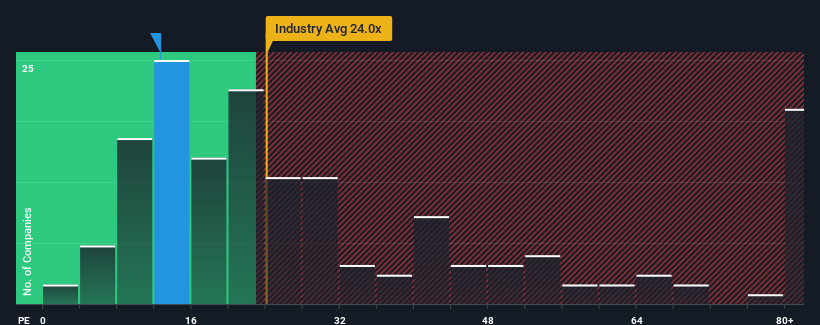

Although its price has surged higher, it's still not a stretch to say that NewtechLtd's price-to-earnings (or "P/E") ratio of 12.6x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We'd have to say that with no tangible growth over the last year, NewtechLtd's earnings have been unimpressive. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Check out our latest analysis for NewtechLtd

Is There Some Growth For NewtechLtd?

There's an inherent assumption that a company should be matching the market for P/E ratios like NewtechLtd's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Comparing that to the market, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's curious that NewtechLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Its shares have lifted substantially and now NewtechLtd's P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that NewtechLtd currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with NewtechLtd.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if NewtechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6734

NewtechLtd

Engages in the development, manufacture, sale, and support of external storage device units and peripherals connected to servers.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026