- Japan

- /

- Tech Hardware

- /

- TSE:6724

Epson (TSE:6724) Margin Miss Challenges Bullish Narratives on Earnings Quality and Growth Outlook

Reviewed by Simply Wall St

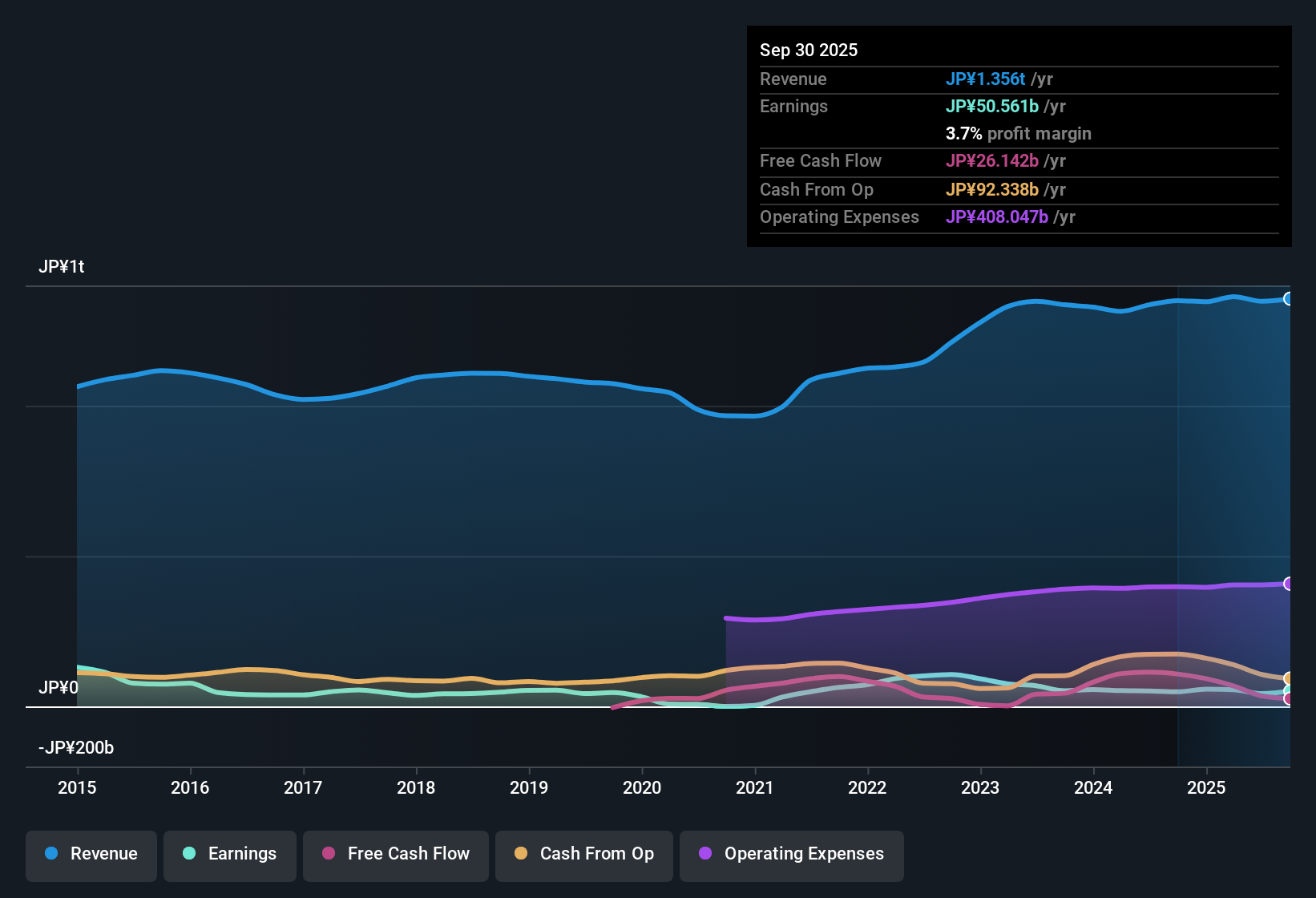

Seiko Epson (TSE:6724) posted 5.9% average annual earnings growth over the past five years. However, the latest results reflect a year-over-year drop in earnings and a tighter net profit margin at 3.2%, down from 3.9% last year. Looking ahead, longer-term earnings are forecast to accelerate at 9.5% per year, which is higher than Japan’s broader market outlook of 7.9% annual growth, although revenue is expected to trail the market. With shares currently trading below the estimated fair value, investors are watching to see whether improving earnings quality and growth prospects can spark a turnaround in margins.

See our full analysis for Seiko Epson.Now, let’s see how the latest results compare to the most widely discussed narratives. Do the numbers back up market expectations, or challenge them?

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Retreats to 3.2%

- Net profit margin has narrowed to 3.2%, down from 3.9% the previous year. This highlights a notable squeeze on profitability even as earnings are expected to rebound in coming years.

- Despite tighter margins, anticipated annual earnings growth of 9.5% stands out and points to improving operational efficiency in response to sector challenges.

- This projected growth pace exceeds the Japanese market average of 7.9%, suggesting an ability to outperform in a competitive environment.

- The trend could support future margin recovery if revenue growth accelerates alongside profits.

Sales Growth Lags Market Trend

- Revenue is forecast to rise at just 1.8% per year, noticeably lower than the 4.4% average annual growth for Japan’s wider market. This highlights limited top-line momentum compared to peers.

- Recent performance underscores the challenge of balancing slower revenue expansion with ambitions for higher profit growth.

- While market narratives favor companies with strong revenue stories, Seiko Epson’s outlook depends on squeezing more efficiency and profit from gradual sales gains.

- This contrast raises the bar for management to deliver on margin improvement strategies and stand out in a sector driven by innovation and scale.

Valuation Sits Below DCF Fair Value

- Shares trade at ¥1,865 each, notably under the DCF fair value estimate of ¥2,764.04. The shares command a higher price-to-earnings multiple (14x) than sector peers (12.7x) but are slightly below the broader Japanese tech industry (14.4x).

- This discount to fair value suggests room for upside if execution improves, especially as the market assigns little material risk to fundamentals at present.

- An appealing mix of attractive valuation on some measures, positive profit growth projections, and a steady dividend profile creates a supportive backdrop for investors looking for recovery potential.

- With forecast profit growth outpacing the wider market, closing the gap to fair value may hinge on margin stabilization and delivery of projected earnings momentum.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Seiko Epson's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Seiko Epson’s slow revenue growth and tightening profit margins highlight the risks of relying on efficiency gains instead of stable top-line expansion.

For peace of mind during uncertain cycles, use our stable growth stocks screener (2074 results) to uncover companies with proven records of consistent revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6724

Seiko Epson

Develops, manufactures, sells, and provides services for products in the printing solutions, visual communications, manufacturing-related and wearables, and other businesses.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives