As global markets experience a mix of economic signals, with U.S. small-cap stocks showing notable gains and tensions between the U.S. and China impacting trade sentiment, investors are closely monitoring the Asian tech sector for opportunities. In this dynamic environment, identifying high-growth tech stocks involves looking at companies that can leverage technological advancements like AI to drive innovation and capture market share amidst evolving geopolitical landscapes.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.40% | 25.85% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the research and development, production, sale, and technical services of laser, intelligent equipment, and optical devices with a market cap of CN¥5.53 billion.

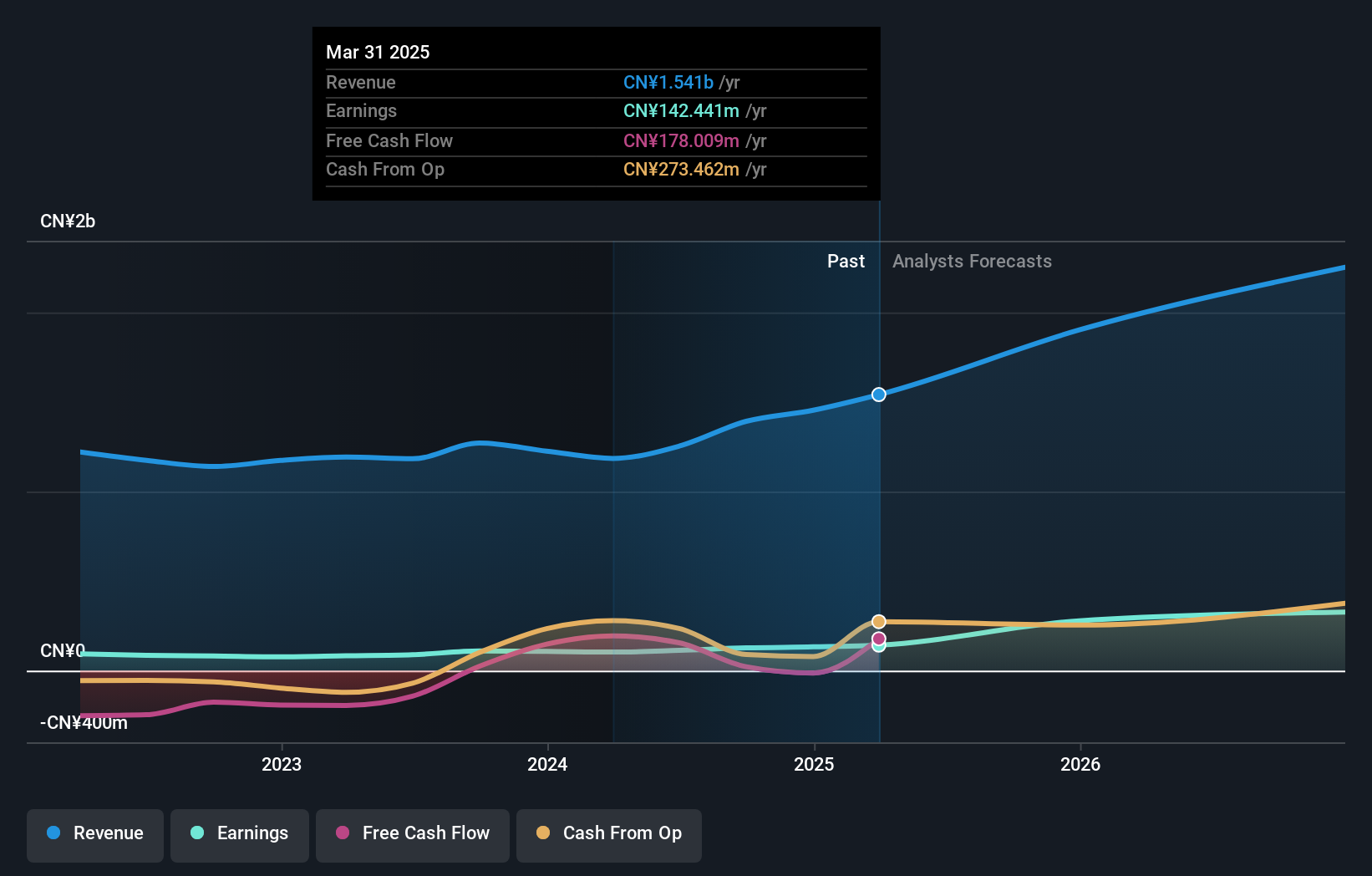

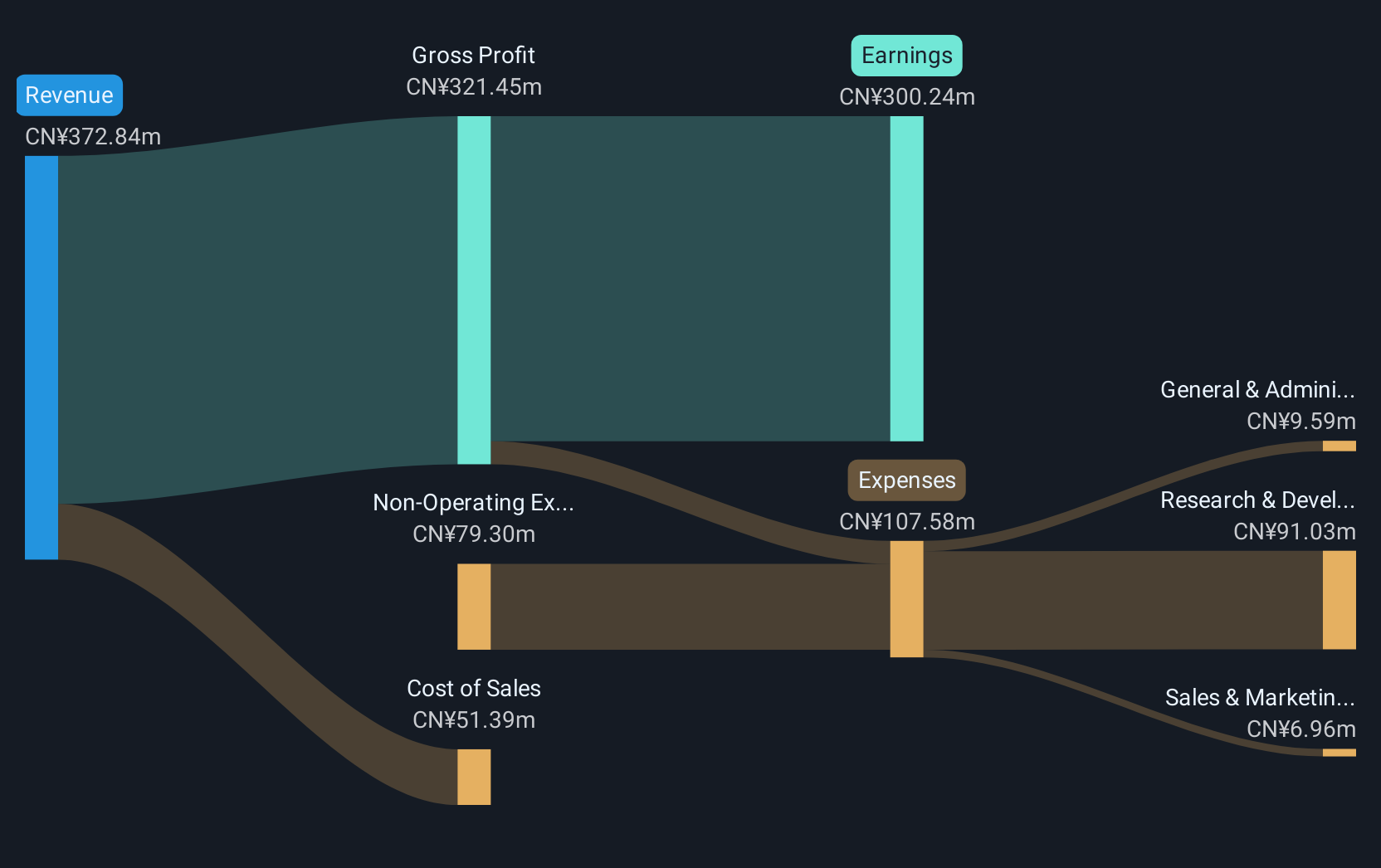

Operations: JPT Opto-Electronics generates revenue primarily from the computer communications and electronic equipment segment, amounting to CN¥1.54 billion.

Shenzhen JPT Opto-Electronics has demonstrated robust growth, with a 21.2% increase in annual revenue and an impressive 41.6% projected annual earnings growth, outpacing the broader Chinese market's expectations. Recent financial results for Q1 2025 show a substantial rise in sales to CNY 342.86 million from CNY 255.73 million the previous year, alongside net income climbing to CNY 36.05 million from CNY 26.29 million, reflecting a solid operational performance and market positioning within the high-tech sector in Asia. This performance is supported by significant R&D investment aimed at sustaining innovation and competitive edge in opto-electronic solutions, crucial for maintaining its trajectory in a rapidly evolving industry landscape.

Shenzhen Fortune Trend Technology (SHSE:688318)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Fortune Trend Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥25.97 billion.

Operations: Fortune Trend Technology focuses on the technology sector, generating revenue through software development and IT services. The company has experienced fluctuations in its net profit margin, which stood at 18.5% in the most recent period.

Shenzhen Fortune Trend Technology, despite a recent 1.4:1 stock split signaling potential confidence, faces challenges with a notable decline in quarterly revenue from CNY 71.05 million to CNY 54.9 million and a dip in net income to CNY 46.49 million from CNY 50.19 million year-over-year. Nonetheless, the company's commitment to innovation is evident with R&D investments aimed at refining its tech offerings in a competitive market. With an annual earnings growth forecast at an impressive 28.1% and revenue expected to rise by 28.9%, the firm appears poised for recovery and growth amidst Asia’s expanding tech landscape, potentially buoyed by strategic moves like recent dividends and shareholder engagements indicated by their AGM scheduling.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market capitalization of ¥761.78 billion.

Operations: OMRON Corporation's primary revenue driver is its Industrial Automation Business, generating ¥365.52 billion, followed by the Social Systems, Solutions and Service Business at ¥158.03 billion. The Devices & Module Solutions Business and Healthcare Business contribute ¥142.74 billion and ¥146.20 billion respectively, while the Data Solution Business adds ¥43.18 billion to the overall revenue mix.

OMRON's strategic initiatives, including the adoption of virtual-only shareholder meetings and a revised incentive plan, underscore its commitment to modern governance and employee motivation. With a robust earnings projection for FY 2026, anticipating net sales between JPY 820 billion and JPY 835 billion and operating income ranging from JPY 56 billion to JPY 65 billion, OMRON is aligning with digital transformation trends. This forward-looking approach is supported by a significant earnings growth over the past year at 101%, surpassing the electronic industry's growth of 7.4%. Additionally, the company’s R&D focus remains sharp as evidenced by recent technological showcases at industry events like Automate 2025, ensuring OMRON stays at the forefront of innovation in automation technology.

- Get an in-depth perspective on OMRON's performance by reading our health report here.

Assess OMRON's past performance with our detailed historical performance reports.

Taking Advantage

- Reveal the 490 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688318

Shenzhen Fortune Trend Technology

Shenzhen Fortune Trend Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives