- China

- /

- Electronic Equipment and Components

- /

- SZSE:000970

3 Asian Stocks That Could Be Trading At A Discount Of Up To 42.3%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by trade tensions and economic indicators, Asian stocks present intriguing opportunities for investors seeking value. In this environment, identifying undervalued stocks can be particularly rewarding, as these equities may offer potential for appreciation when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥22.30 | CN¥43.65 | 48.9% |

| PixArt Imaging (TPEX:3227) | NT$220.00 | NT$436.06 | 49.5% |

| Livero (TSE:9245) | ¥1716.00 | ¥3347.40 | 48.7% |

| Kanto Denka Kogyo (TSE:4047) | ¥862.00 | ¥1687.52 | 48.9% |

| J&T Global Express (SEHK:1519) | HK$6.79 | HK$13.27 | 48.8% |

| Good Will Instrument (TWSE:2423) | NT$44.50 | NT$87.18 | 49% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.82 | CN¥52.35 | 48.8% |

| Everest Medicines (SEHK:1952) | HK$54.70 | HK$106.95 | 48.9% |

| Brangista (TSE:6176) | ¥604.00 | ¥1178.82 | 48.8% |

| APAC Realty (SGX:CLN) | SGD0.46 | SGD0.90 | 49.1% |

Here we highlight a subset of our preferred stocks from the screener.

China Southern Power Grid TechnologyLtd (SHSE:688248)

Overview: China Southern Power Grid Technology Co., Ltd. (SHSE:688248) operates in the energy sector, focusing on power grid technology solutions and has a market cap of approximately CN¥17.69 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for China Southern Power Grid Technology Co., Ltd.

Estimated Discount To Fair Value: 21.2%

China Southern Power Grid Technology Ltd. is trading at CN¥31.33, below its estimated fair value of CN¥39.74, indicating it may be undervalued based on cash flows. Despite a low dividend coverage by free cash flows and high non-cash earnings, the company shows strong growth potential with revenue and earnings forecasted to grow significantly above market averages over the next three years. Recent Q1 2025 results show increased net income to CN¥56.93 million from CN¥41.97 million year-on-year, supporting its growth trajectory.

- According our earnings growth report, there's an indication that China Southern Power Grid TechnologyLtd might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of China Southern Power Grid TechnologyLtd.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. operates in the high-tech industry with a focus on manufacturing and distributing advanced materials, and it has a market cap of CN¥14.83 billion.

Operations: Beijing Zhong Ke San Huan High-Tech Co., Ltd. generates revenue through its operations in the high-tech sector, concentrating on the production and distribution of advanced materials.

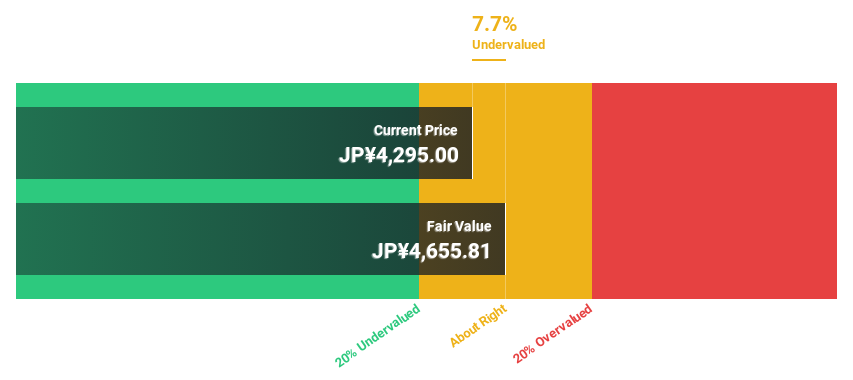

Estimated Discount To Fair Value: 40.5%

Beijing Zhong Ke San Huan High-Tech is trading at CN¥12.32, significantly below its fair value estimate of CN¥20.7, highlighting potential undervaluation based on cash flows. Despite recent dividend reductions, the company has demonstrated robust earnings growth of 64.7% over the past year and forecasts suggest a continued strong trajectory with expected annual earnings growth of 43.9%, outpacing the broader Chinese market's growth expectations. However, future return on equity is projected to remain low at 5.5%.

- Our comprehensive growth report raises the possibility that Beijing Zhong Ke San Huan High-Tech is poised for substantial financial growth.

- Take a closer look at Beijing Zhong Ke San Huan High-Tech's balance sheet health here in our report.

OMRON (TSE:6645)

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market cap of approximately ¥761.78 billion.

Operations: OMRON's revenue segments include the Industrial Automation Business at ¥365.52 billion, Social Systems, Solutions and Service Business at ¥158.03 billion, Healthcare Business at ¥146.20 billion, Devices & Module Solutions Business at ¥142.74 billion, and Data Solution Business at ¥43.18 billion.

Estimated Discount To Fair Value: 42.3%

OMRON is trading at ¥3,869, significantly below its fair value estimate of ¥6,704.09, indicating potential undervaluation based on cash flows. Earnings are expected to grow significantly at 25% annually, outpacing the Japanese market's growth rate. However, the dividend yield of 2.69% is not well covered by earnings or free cash flows. The company's recent amendments to allow virtual-only shareholder meetings reflect a forward-thinking approach in line with digitalization trends and regulatory changes.

- The analysis detailed in our OMRON growth report hints at robust future financial performance.

- Dive into the specifics of OMRON here with our thorough financial health report.

Where To Now?

- Access the full spectrum of 290 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Zhong Ke San Huan High-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000970

Beijing Zhong Ke San Huan High-Tech

Beijing Zhong Ke San Huan High-Tech Co., Ltd.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives