- Japan

- /

- Tech Hardware

- /

- TSE:6638

Mimaki Engineering Co., Ltd.'s (TSE:6638) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Mimaki Engineering Co., Ltd. (TSE:6638) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 7.2% isn't as impressive.

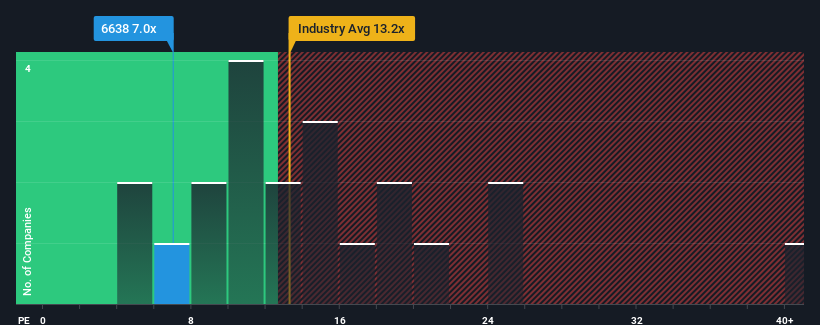

Although its price has surged higher, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Mimaki Engineering as an attractive investment with its 7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Our free stock report includes 2 warning signs investors should be aware of before investing in Mimaki Engineering. Read for free now.With earnings growth that's superior to most other companies of late, Mimaki Engineering has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Mimaki Engineering

Is There Any Growth For Mimaki Engineering?

There's an inherent assumption that a company should underperform the market for P/E ratios like Mimaki Engineering's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 89% last year. The latest three year period has also seen an excellent 156% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 1.6% as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 9.7% growth forecast for the broader market.

With this information, we can see why Mimaki Engineering is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Mimaki Engineering's P/E?

Mimaki Engineering's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Mimaki Engineering maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Mimaki Engineering you should be aware of, and 1 of them is concerning.

If you're unsure about the strength of Mimaki Engineering's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6638

Mimaki Engineering

Develops, manufactures, and sells computer devices and software in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026