- Japan

- /

- Electronic Equipment and Components

- /

- TSE:4980

A Look at Dexerials (TSE:4980) Valuation After Upgraded Guidance and Strong Product Expansion

Reviewed by Simply Wall St

Dexerials (TSE:4980) caught attention after it raised its full-year earnings guidance, citing stronger sales of high value-added products and support from a weaker yen. Investors are now watching closely for next steps.

See our latest analysis for Dexerials.

Dexerials has seen its momentum accelerate, with a 1-day share price return of nearly 3% and a remarkable 34% jump over the past month alone. Recent news, including renewed earnings guidance, a strategic tech alliance, and a dividend update, have supported strong sentiment and driven the year-to-date share price return to 23%. With a total shareholder return of 22% over the last 12 months and an impressive 191% return over three years, performance points to robust growth and increasing investor confidence.

If this surge has you rethinking where opportunities lie, why not broaden your horizons and discover fast growing stocks with high insider ownership

But after such an impressive run and upgraded guidance, is Dexerials still undervalued, or have investors already priced in much of the upside, leaving little room for a buying opportunity?

Price-to-Earnings of 19.7x: Is it justified?

Dexerials trades at a price-to-earnings ratio of 19.7x, higher than the JP Electronic industry average of 14.9x. This signals a premium relative to peers at its last close of ¥2,942.5.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each yen of company earnings, reflecting growth expectations and profitability. For a company like Dexerials, a higher-than-average P/E may suggest the market is pricing in above-average growth or superior business quality.

However, paying a premium does not automatically mean it is justified. While Dexerials stands out for its strong historical earnings growth, investors are expecting this trend to continue, or even accelerate, for the valuation gap to be warranted. Compared to the industry average of 14.9x, the market is clearly attributing higher value to Dexerials' future earnings stream. Yet, when compared to its estimated fair P/E ratio of 22.3x, the current multiple actually appears reasonable and could even signal room for future expansion if the company delivers on growth expectations.

Explore the SWS fair ratio for Dexerials

Result: Price-to-Earnings of 19.7x (ABOUT RIGHT)

However, risks remain, including Dexerials’ current premium valuation and a share price now above analyst targets. This could temper future gains if expectations falter.

Find out about the key risks to this Dexerials narrative.

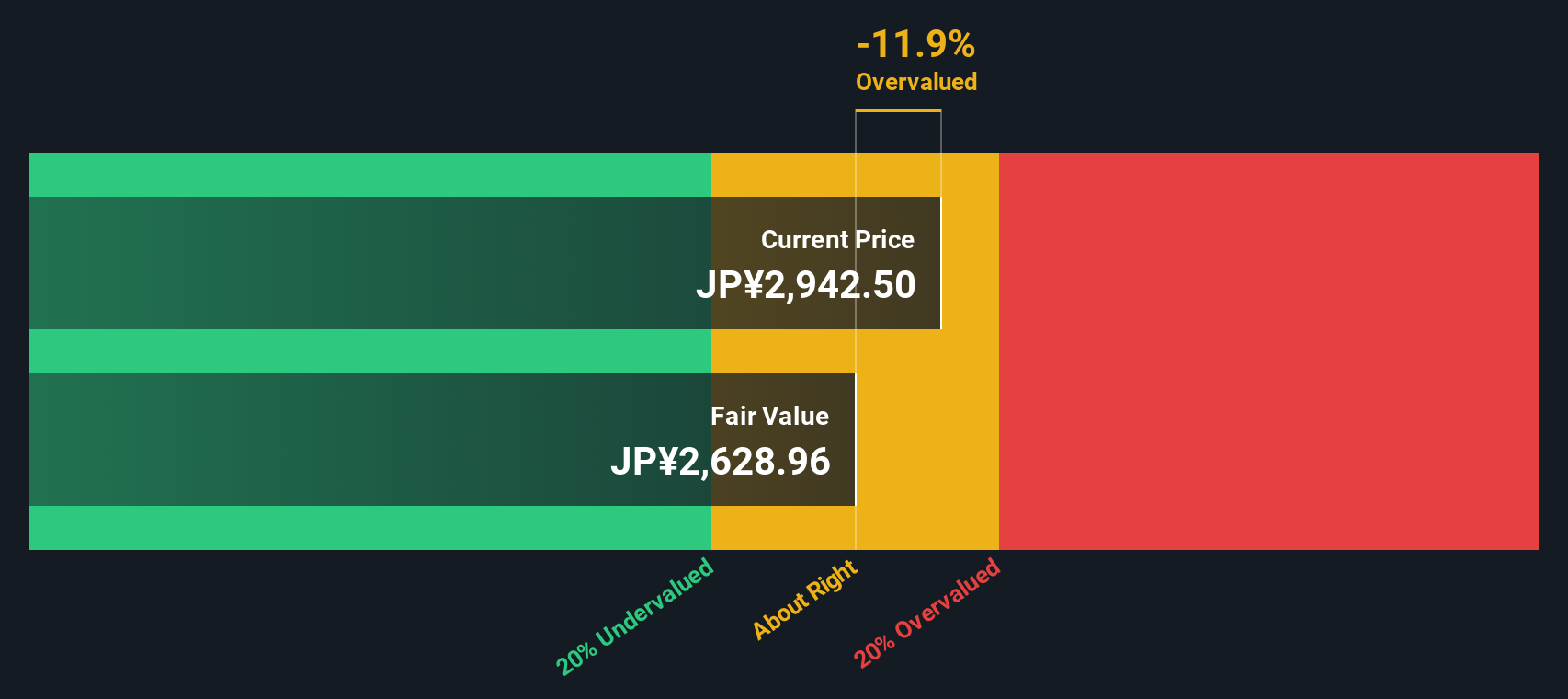

Another View: Discounted Cash Flow Perspective

Looking at Dexerials through the lens of our SWS DCF model offers a different perspective. Despite strong market sentiment, the DCF method estimates the fair value at ¥2,630.53, which is below the current share price. This suggests shares may be overvalued, at least by this approach. Are investors too optimistic, or is there more upside that the model does not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dexerials for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dexerials Narrative

If you want to dig deeper or believe your perspective adds something new, it takes just a few minutes to build your own view of Dexerials. Do it your way

A great starting point for your Dexerials research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means staying a step ahead. If you want a stronger edge, use these powerful tools to pinpoint opportunities others might overlook and make your next winning move.

- Uncover potential in up-and-coming companies by checking out these 3592 penny stocks with strong financials, which stand out for robust financials in a volatile market.

- Boost your passive income by scanning these 16 dividend stocks with yields > 3% to spot high-yielding stocks paying more than 3%.

- Catch the latest wave in cutting-edge medicine with these 31 healthcare AI stocks, connecting you to innovators transforming healthcare through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4980

Dexerials

Manufactures and sells electronic components, bonding materials, optics materials, and other products in Japan.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives