- Japan

- /

- Tech Hardware

- /

- TSE:4902

Konica Minolta, Inc.'s (TSE:4902) 43% Share Price Surge Not Quite Adding Up

Konica Minolta, Inc. (TSE:4902) shares have continued their recent momentum with a 43% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

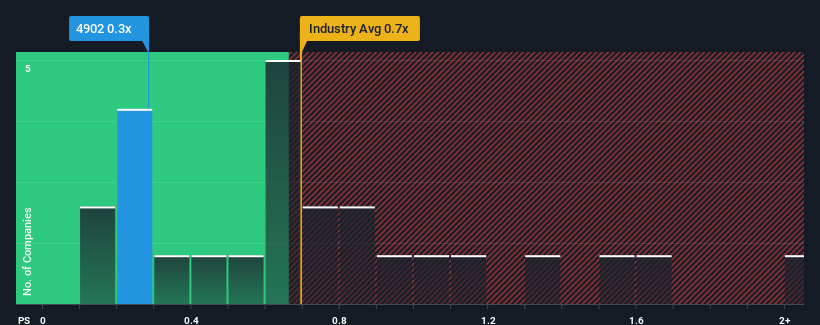

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Konica Minolta's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Tech industry in Japan is also close to 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Konica Minolta

How Has Konica Minolta Performed Recently?

Konica Minolta's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think Konica Minolta's future stacks up against the industry? In that case, our free report is a great place to start.How Is Konica Minolta's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Konica Minolta's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.3%. The latest three year period has also seen a 29% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue growth is heading into negative territory, declining 1.6% per year over the next three years. That's not great when the rest of the industry is expected to grow by 2.8% per year.

With this information, we find it concerning that Konica Minolta is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Konica Minolta's P/S Mean For Investors?

Its shares have lifted substantially and now Konica Minolta's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of Konica Minolta's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Konica Minolta (1 is concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Konica Minolta, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Konica Minolta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4902

Konica Minolta

Engages in digital workplace, professional print, healthcare, and industry business in Japan, China, other Asian countries, the United States, Europe, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026