- Japan

- /

- Tech Hardware

- /

- TSE:4902

Is Konica Minolta Poised for Growth After Strong Five Year Share Price Rally?

Reviewed by Bailey Pemberton

Trying to decide what to do with Konica Minolta? You are definitely not alone. With the stock closing at 527.6, it has been a fascinating year for shareholders and new investors alike. After years of rebuilding its core business, Konica Minolta is once again on investors’ radars, and for good reason.

Despite some recent turbulence as the stock dipped -2.7% over the last week, those who have looked further back will notice some remarkable momentum. Year to date, the price has fallen -18.1%, which might have some worried, but the longer-term story is far more compelling: up 18.9% over the past year and a significant 106.6% over five years. That kind of turnaround is difficult to ignore and suggests a shifting perception of risk and opportunity among investors. Some of these moves align with broader market developments and optimism about digital transformation across industries that Konica Minolta serves.

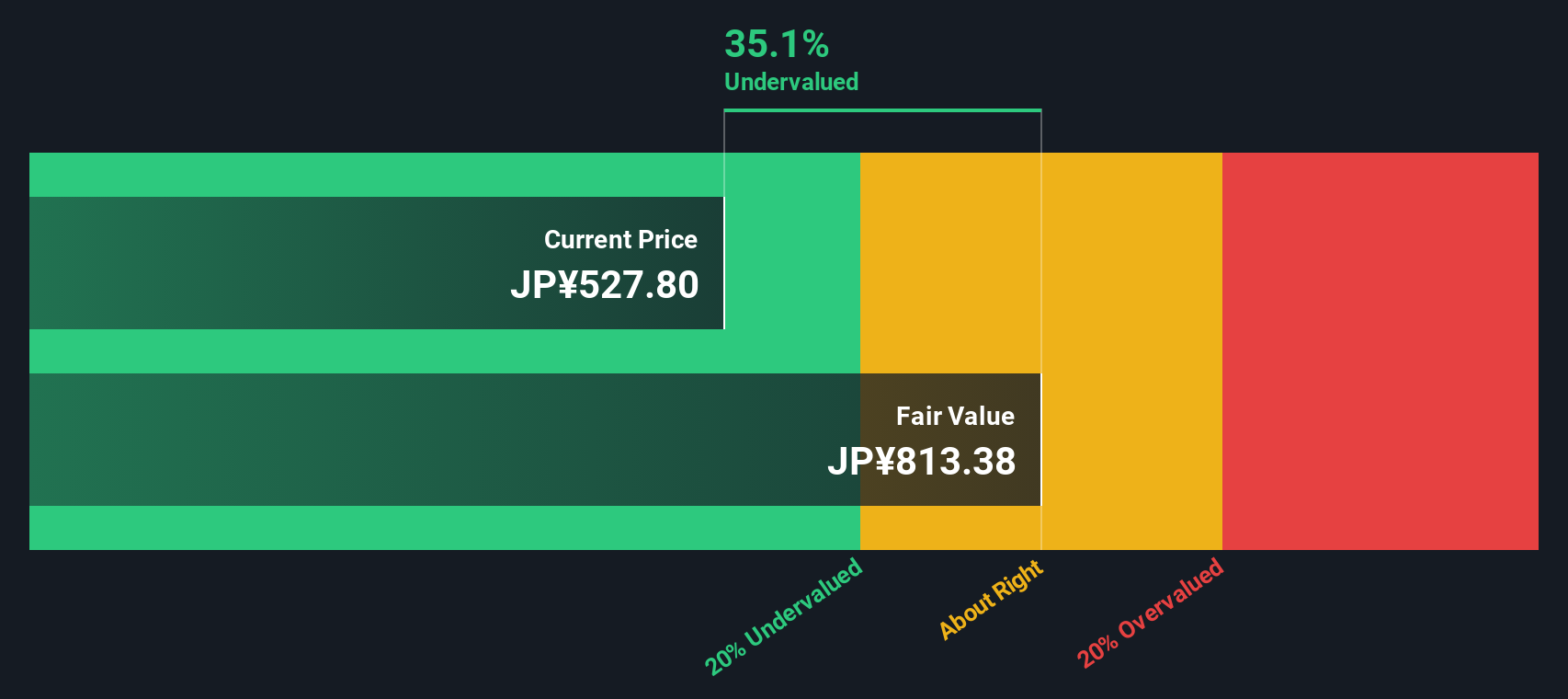

So, is Konica Minolta undervalued, fairly priced, or getting ahead of itself? On many traditional metrics, it scores highly for value. In fact, it meets 5 out of 6 major valuation checks, indicating that there may still be some upside overlooked by the market.

Let’s dig deeper into each of those valuation approaches and see whether the numbers truly back up Konica Minolta’s story. And, if you stick with me to the end, I’ll share a perspective on valuation that even seasoned investors should find illuminating.

Approach 1: Konica Minolta Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by projecting a company's expected future cash flows and discounting them back to their value today. This method provides investors with a way to estimate what a stock should be worth. In Konica Minolta's case, the DCF model uses a "2 Stage Free Cash Flow to Equity" approach to forecast the company’s long-term financial health.

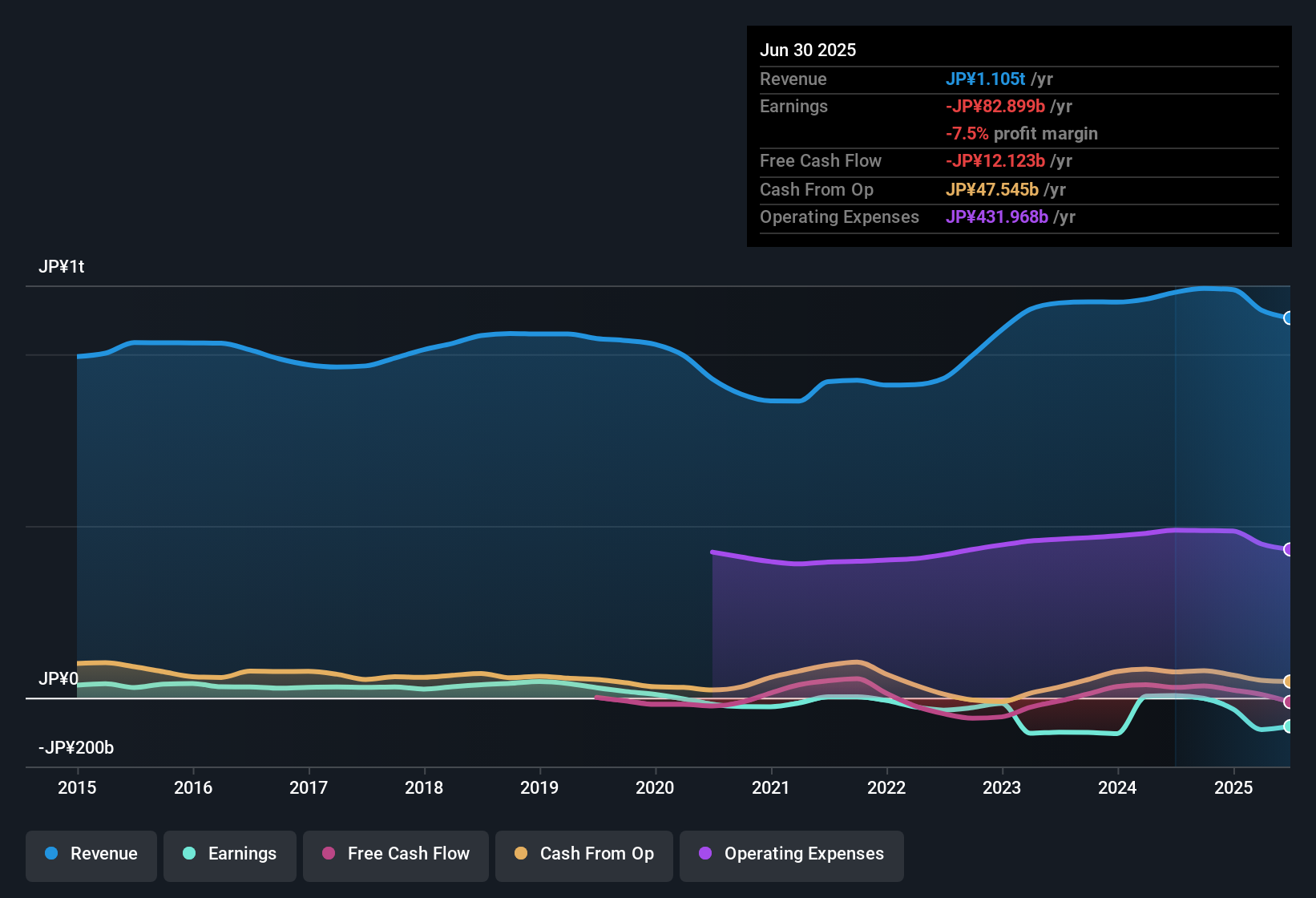

Currently, Konica Minolta generates free cash flow (FCF) of ¥721.8 Million. Analyst estimates suggest significant growth in the coming years. Looking ahead, projections show FCF reaching ¥40.4 Billion by the year ending March 2030. It is important to note that estimates for the next five years are provided by analysts, while longer-term projections have been extrapolated for context.

When these projected cash flows are discounted back to today's value, the model arrives at an estimated intrinsic value of ¥797.66 per share. With the current share price at ¥527.6, the analysis suggests the stock is trading at a 33.9% discount to its intrinsic value. This may indicate that investors are overlooking considerable upside potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Konica Minolta is undervalued by 33.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Konica Minolta Price vs Sales

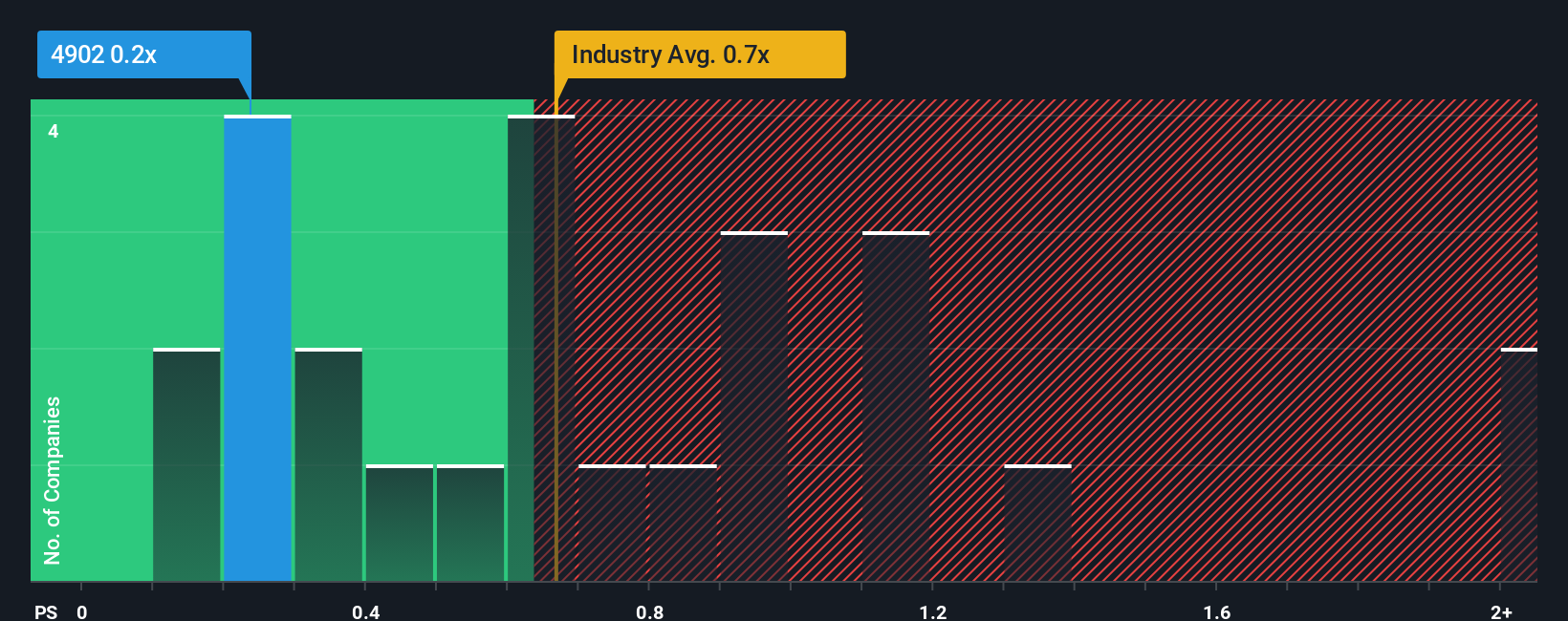

The Price-to-Sales (P/S) ratio is a widely used valuation metric, especially for companies where current profits may be low or volatile, but revenues are more stable. For Konica Minolta, using the P/S ratio is appropriate because it provides a clear view of how the market values its sales, regardless of recent swings in profitability. Investors often rely on this multiple to identify companies with potential sales-driven recovery or growth.

Growth prospects and risk profile are important in determining what constitutes a "normal" or "fair" P/S ratio. For instance, companies with higher growth and lower risk warrant a higher ratio, while slower growth or higher risk means a lower valuation is justified. In Konica Minolta’s case, the current P/S ratio is 0.24x, which is noticeably lower than both the tech industry average of 0.71x and the average for its peers at 0.64x.

Simply Wall St introduces the “Fair Ratio”, a proprietary metric that calculates what an equitable P/S ratio should be by taking into account the company’s revenue growth outlook, risks, profitability margins, industry context, and market capitalization. Unlike a simple industry or peer comparison, the Fair Ratio is more comprehensive and nuanced, ensuring the valuation assessment is tailored to Konica Minolta's unique profile. Here, the Fair Ratio for the company stands at 1.23x, significantly higher than both the current P/S and its external benchmarks. This suggests that Konica Minolta is trading well below what would be considered a fair price on a sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Konica Minolta Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you create and share the story you believe about a company, connecting your view of its future prospects and risks with the numbers, such as fair value, forecasted revenue, and profit margins.

Rather than relying only on static ratios or analyst estimates, Narratives let you anchor your investment decisions in your own research and perspective. This story-driven approach is at the core of Simply Wall St’s Community page, which is used by millions of investors, where you can quickly craft, compare, and adjust Narratives for Konica Minolta and other companies.

Narratives make it easy to decide when to buy or sell by linking your assumptions to a dynamic fair value and instantly comparing it to the company’s current price. As new news or earnings emerge, your Narrative updates automatically, helping you stay ahead of the market.

For example, on Konica Minolta, some investors’ Narratives see significant upside while others are more cautious, reflecting a wide range from ¥500 to over ¥800 in estimated fair value.

Do you think there's more to the story for Konica Minolta? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Konica Minolta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4902

Konica Minolta

Engages in digital workplace, professional print, healthcare, and industry business in Japan, China, other Asian countries, the United States, Europe, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success