- Japan

- /

- Electronic Equipment and Components

- /

- TSE:4062

Does Ibiden (TSE:4062)'s Progressive Dividend Policy Reveal a New Capital Allocation Play?

Reviewed by Sasha Jovanovic

- Ibiden Co., Ltd. recently enacted a board resolution to introduce a progressive dividend policy, announce a commemorative dividend of ¥10 per share, affirm an interim dividend of ¥20 per share, and proceed with a stock split along with related amendments to its convertible bonds terms.

- This combination of shareholder-focused initiatives highlights Ibiden's commitment to enhanced dividend stability while balancing capital allocation and growth investments through 2031.

- We'll explore how the newly introduced progressive dividend policy is reshaping Ibiden's broader investment narrative for shareholders.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is IbidenLtd's Investment Narrative?

Owning shares in Ibiden calls for a belief in its ability to capture growth from high-value, next-generation electronics while navigating Japan’s intensely competitive tech space. The recent board resolution introducing a progressive dividend policy, a commemorative dividend, a split, and convertible bond amendments clearly signals an intent to reward shareholders and signal long-term stability. However, in the short term, the news follows a period of unusually rapid share price movement, adding another potential catalyst as investors reassess value and reward policies against already high expectations for earnings growth and operational performance. The new capital allocation direction may also shift some risks: while the progressive dividend could boost market confidence, relying on consistent income growth raises the stakes for any earnings hiccups or margin pressure. This makes management’s ability to deliver on ambitious forecasts and navigate industry volatility a more urgent risk than before. In contrast, the newly progressive dividend approach means future earnings misses could create sharper downside reactions, something investors will want to keep in mind.

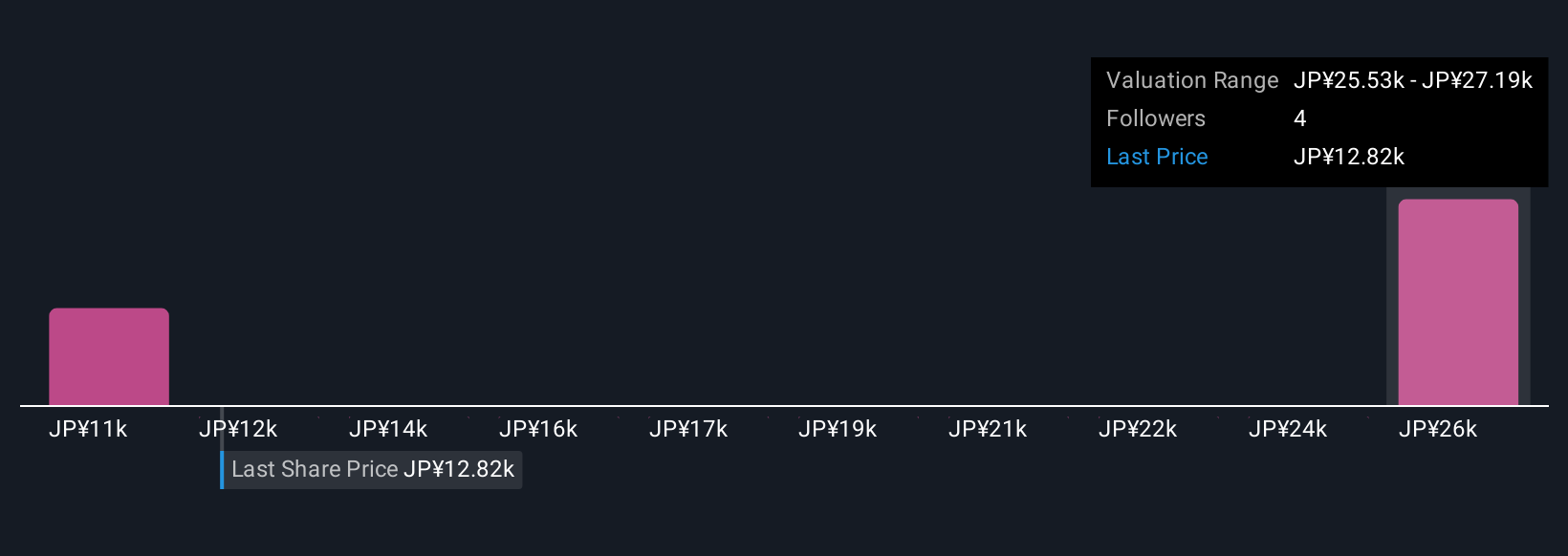

IbidenLtd's shares have been on the rise but are still potentially undervalued by 46%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on IbidenLtd - why the stock might be worth as much as 84% more than the current price!

Build Your Own IbidenLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IbidenLtd research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IbidenLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IbidenLtd's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4062

IbidenLtd

Manufactures and sells electronic and ceramics products in Japan, Asia, North America, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives