- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3132

Macnica Holdings (TSE:3132) Margin Decline Undercuts Bullish Growth Narrative Despite Strong Outlook

Reviewed by Simply Wall St

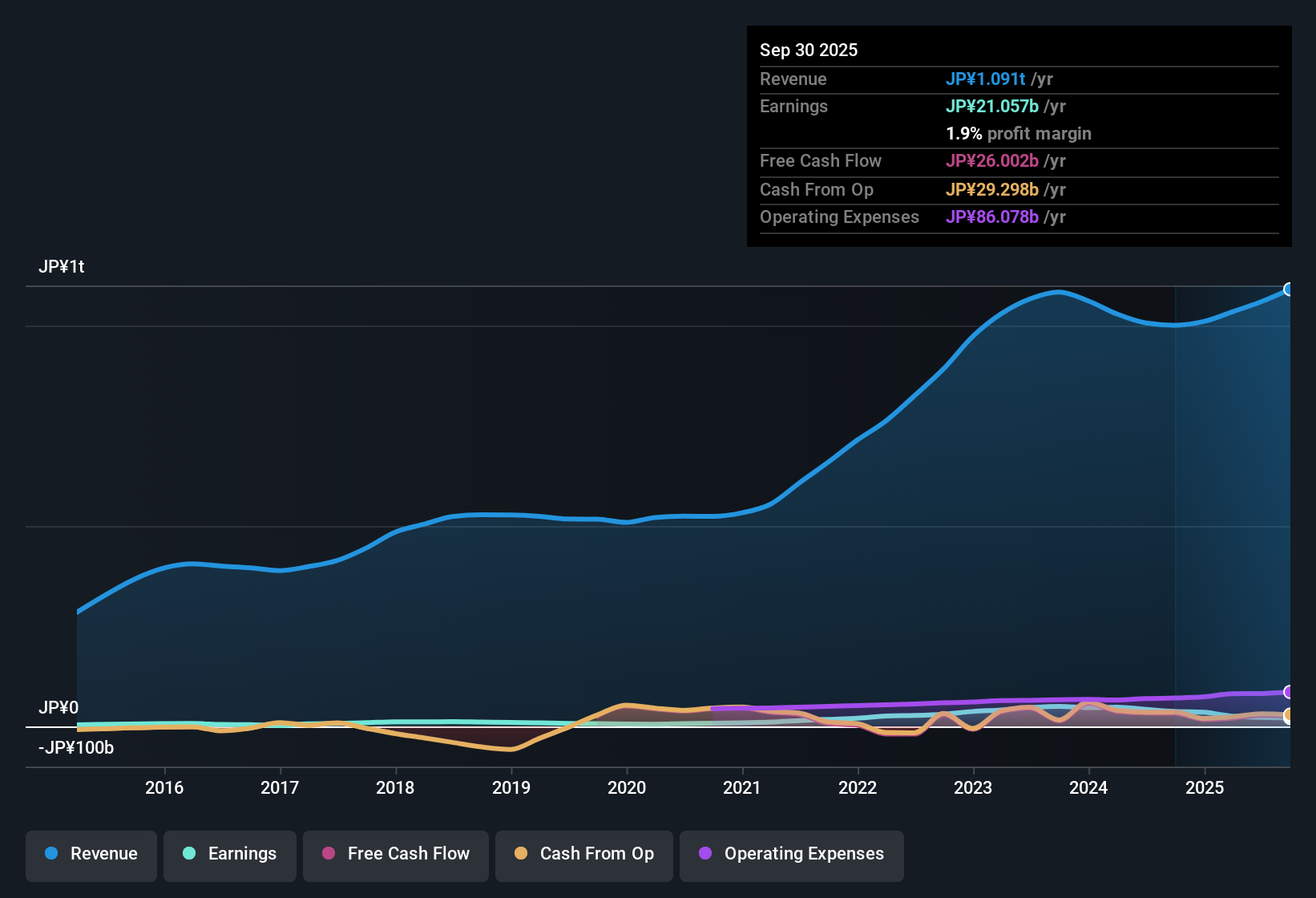

Macnica Holdings (TSE:3132) posted an annualized earnings growth rate of 16.5% over the past five years, with current earnings forecasts calling for a robust 29.98% per year increase. Revenue is projected to expand by 7.5% annually, well above the Japanese market’s 4.5% growth pace. While the company’s net profit margin has slipped to 1.9% from 3.7% last year, investors are watching a share price of ¥2,173 against an estimated fair value of ¥5,792.07, and noting a premium valuation with a Price-To-Earnings ratio of 18.4x compared to industry and peer averages.

See our full analysis for Macnica Holdings.The next section puts these figures up against the major narratives that have defined Macnica Holdings’ story. It highlights areas where the numbers echo the consensus and where they challenge community expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Shrinks to 1.9%

- Macnica Holdings' net profit margin stands at 1.9%, a fall from last year’s 3.7%. This narrows its earnings cushion as costs and market dynamics shift.

- Bears emphasize that this margin compression raises flags for future profitability, especially when compared to peers with lower Price-To-Earnings ratios and more stable margin profiles.

- This contraction may strain future dividend stability, which remains an ongoing concern for income-focused investors.

- The drop in margin, despite strong revenue growth, suggests that operational costs or pricing pressure could be challenging to reverse quickly.

DCF Fair Value Signal: Shares Trade Far Below Estimate

- At ¥2,173, Macnica’s share price remains well below the DCF fair value of ¥5,792.07, signaling a broad disconnect between market pricing and modeled intrinsic value.

- This scenario heavily supports optimism around the company’s long-term growth, since sustained earnings expansion of nearly 30% per year is an uncommon feat for companies trading this far below intrinsic estimates.

- The combination of a 16.5% five-year average earnings increase and a strong forecast reinforces the view that Macnica’s growth story is durable, even with short-term profitability headwinds.

- Bulls point to high-quality earnings trends as justification for a premium, arguing that such a discount to fair value is rare in Japanese tech.

Premium P/E Signals Sector Confidence, But at a Cost

- Macnica trades at a Price-To-Earnings ratio of 18.4x, above both the industry average of 15.2x and peer group at 13x, making it notably more expensive relative to other players in the space.

- This premium valuation, paired with margin slippage, invites caution. Investors are effectively paying up for expected growth that now faces pressure from falling net margins and ongoing debate about income sustainability.

- Some analysts note that sector enthusiasm for technology distributors remains high due to global digitalization. However, the gap in multiples may leave less room for error if profitability dips further.

- The higher P/E reflects investor willingness to bet on above-market growth rates, but leaves Macnica more exposed to market disappointment should execution falter.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Macnica Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Macnica Holdings' impressive growth outlook, its shrinking profit margin and elevated valuation raise concern about the company’s future dividend stability and income reliability.

If safeguarding your payout stream is a priority, check out these 2002 dividend stocks with yields > 3% to discover businesses delivering stronger and more secure yields for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3132

Macnica Holdings

Imports, sells, and exports electronic components in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives