- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3132

Investors Still Aren't Entirely Convinced By Macnica Holdings, Inc.'s (TSE:3132) Earnings Despite 26% Price Jump

Those holding Macnica Holdings, Inc. (TSE:3132) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

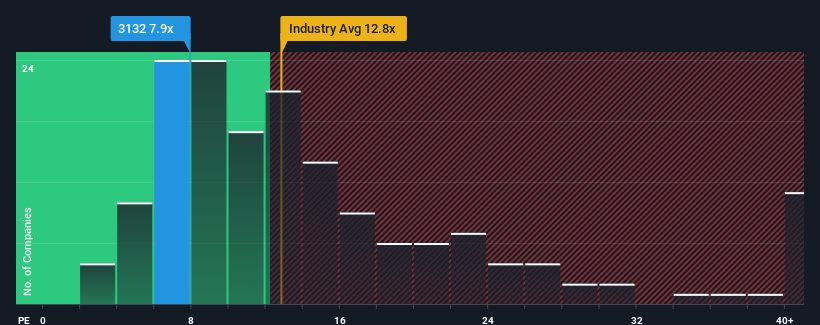

Even after such a large jump in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Macnica Holdings as an attractive investment with its 7.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Macnica Holdings' earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Macnica Holdings

How Is Macnica Holdings' Growth Trending?

Macnica Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 7.6%. Even so, admirably EPS has lifted 201% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 11% per year during the coming three years according to the three analysts following the company. With the market predicted to deliver 9.4% growth per year, the company is positioned for a comparable earnings result.

With this information, we find it odd that Macnica Holdings is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Macnica Holdings' P/E?

Macnica Holdings' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Macnica Holdings' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - Macnica Holdings has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Macnica Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3132

Macnica Holdings

Imports, sells, and exports electronic components in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives