- Japan

- /

- Auto Components

- /

- TSE:6995

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets react to the Trump administration's initial policy moves, U.S. stocks have surged to record highs, buoyed by optimism around potential trade deals and AI investments. In this dynamic environment, dividend stocks can offer stability and income potential, making them an appealing choice for investors seeking reliable returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

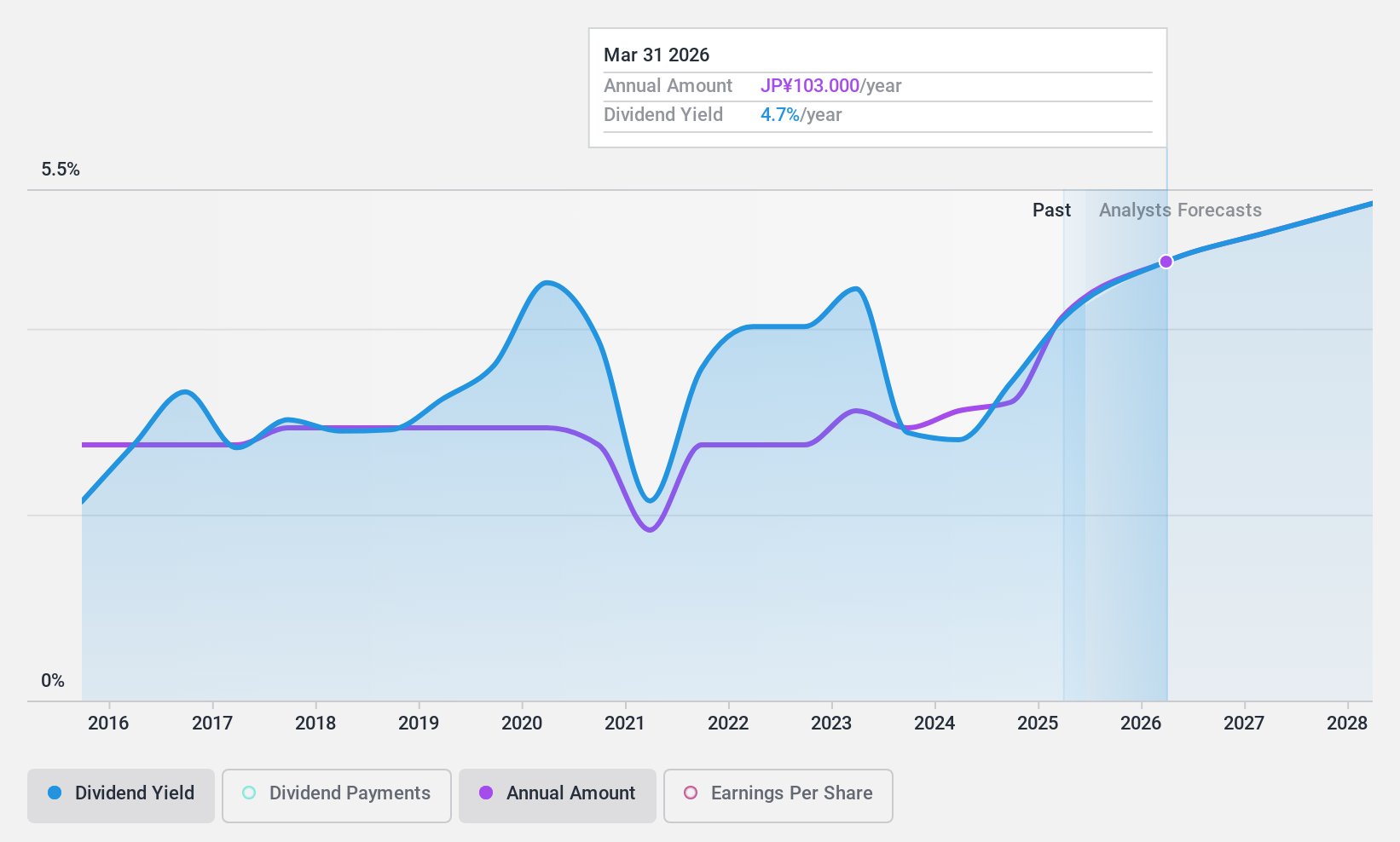

FTGroup (TSE:2763)

Simply Wall St Dividend Rating: ★★★★★★

Overview: FTGroup Co., Ltd. provides network infrastructure services in Japan and has a market cap of ¥35.48 billion.

Operations: FTGroup Co., Ltd.'s revenue is primarily derived from its Network Infrastructure Business, which accounts for ¥20.29 billion, and its Corporate Solutions Business, contributing ¥16.24 billion.

Dividend Yield: 4.5%

FTGroup offers a compelling dividend profile, with a 4.53% yield that ranks in the top 25% of JP market payers. The dividends have been stable and growing over the past decade, supported by low payout ratios—25.5% of earnings and 25.2% of cash flows—indicating sustainability. Recent share buybacks totaling ¥365.27 million further reflect strong financial health, enhancing shareholder value without compromising dividend reliability or growth potential.

- Dive into the specifics of FTGroup here with our thorough dividend report.

- Our expertly prepared valuation report FTGroup implies its share price may be lower than expected.

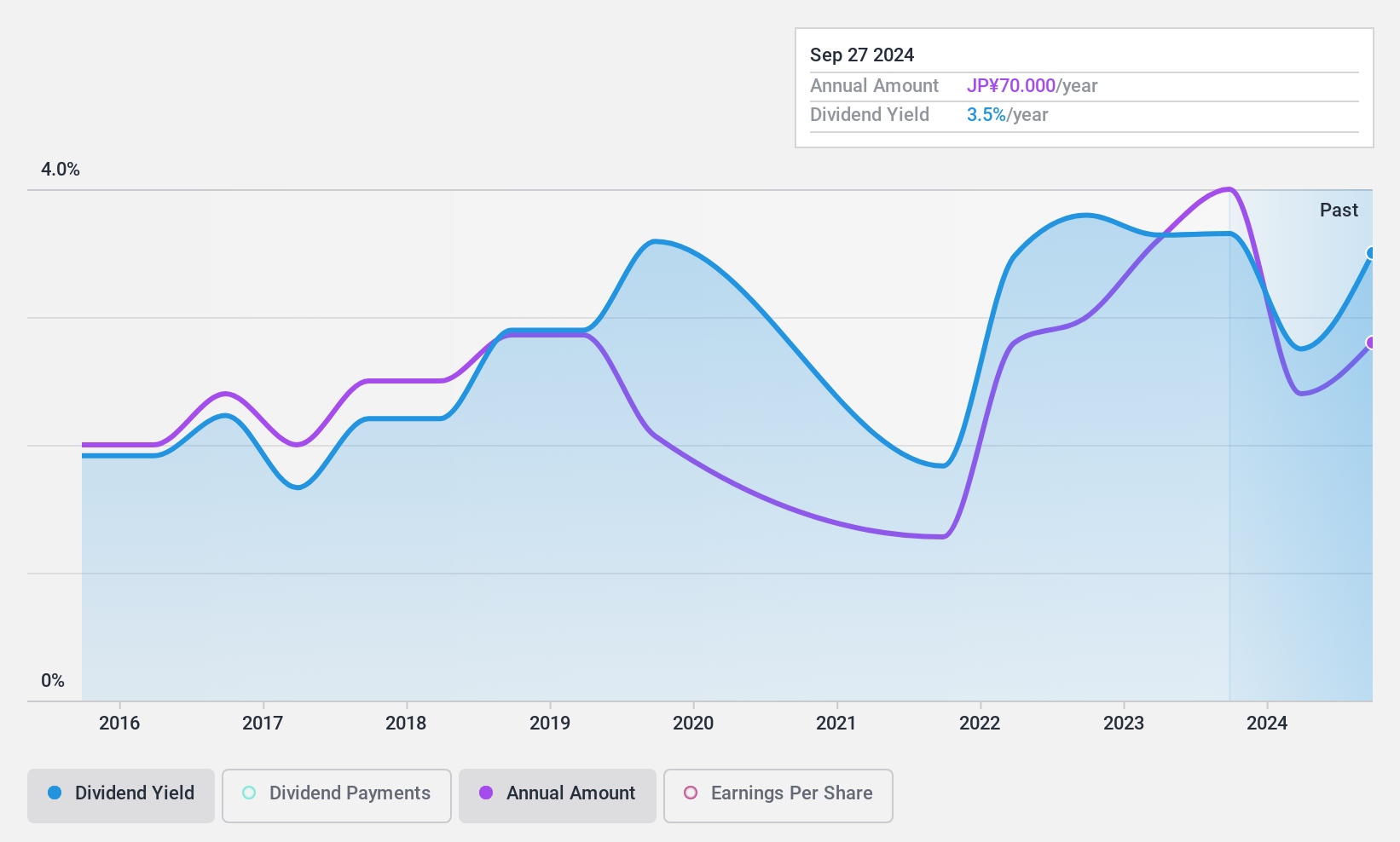

Sanyo Special Steel (TSE:5481)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanyo Special Steel Co., Ltd. and its subsidiaries manufacture and sell special steel products both in Japan and internationally, with a market cap of ¥103.63 billion.

Operations: Sanyo Special Steel Co., Ltd.'s revenue segments include Steel Products at ¥321.51 billion, Formed and Fabricated Materials at ¥18.30 billion, and Metal Powders at ¥5.40 billion.

Dividend Yield: 3.6%

Sanyo Special Steel's dividend profile presents mixed signals. While dividend payments are covered by earnings (50.9% payout ratio) and cash flows (24.1% cash payout ratio), the company's dividends have been volatile over the past decade, with a recent reduction from ¥35 to ¥20 per share for Q2 2024. Despite trading at 45.9% below estimated fair value, profit margins have declined, and the current yield of 3.61% is slightly below top-tier JP market payers.

- Click here and access our complete dividend analysis report to understand the dynamics of Sanyo Special Steel.

- The analysis detailed in our Sanyo Special Steel valuation report hints at an deflated share price compared to its estimated value.

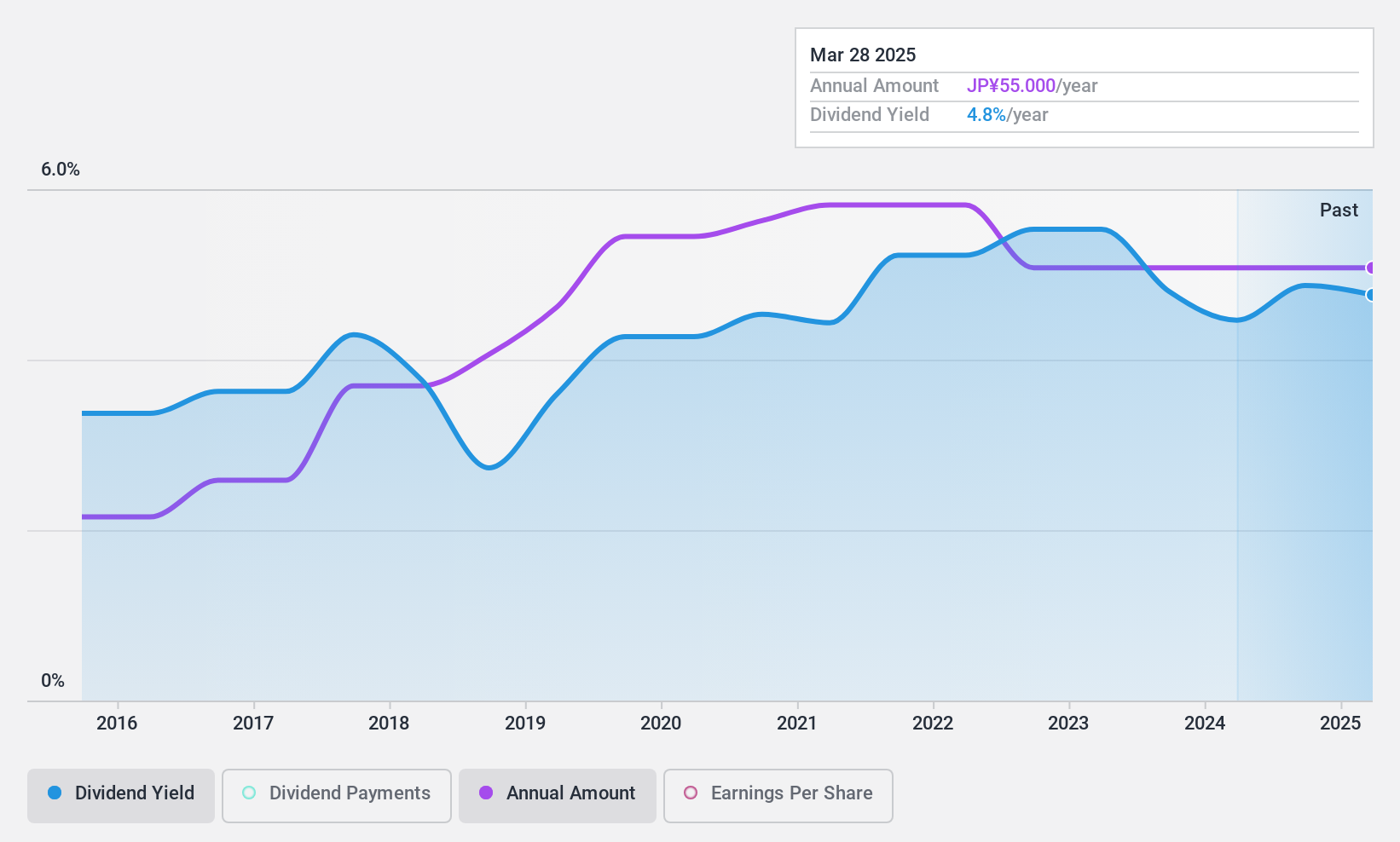

Tokai Rika (TSE:6995)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tokai Rika Co., Ltd. manufactures and sells human interface systems, controls, security and safety systems, electronics, ornaments, and home devices across Japan, North America, Asia, and internationally with a market cap of ¥190.26 billion.

Operations: Tokai Rika Co., Ltd.'s revenue is derived from its operations in human interface systems and controls, security and safety systems, electronics, ornaments, and home devices across various regions including Japan, North America, Asia, and other international markets.

Dividend Yield: 3.8%

Tokai Rika's dividend profile shows both strengths and weaknesses. The dividend yield of 3.84% ranks in the top 25% of Japanese market payers, and payments are covered by earnings (65.1% payout ratio) and cash flows (65.6% cash payout ratio). However, dividends have been volatile over the past decade despite recent growth, reflecting an unstable track record. The stock trades at 27.6% below its estimated fair value, though profit margins have decreased from last year.

- Click to explore a detailed breakdown of our findings in Tokai Rika's dividend report.

- Our valuation report unveils the possibility Tokai Rika's shares may be trading at a premium.

Next Steps

- Click through to start exploring the rest of the 1948 Top Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokai Rika might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6995

Tokai Rika

Manufactures and sells automotive parts in Japan, North America, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026