- Hong Kong

- /

- Commercial Services

- /

- SEHK:3316

Top Asian Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As global markets navigate the potential for interest rate cuts and shifting economic conditions, Asian stock indices have shown resilience, with China's recent rally highlighting investor optimism. In this dynamic environment, dividend stocks in Asia can offer a stable income stream and potential growth opportunities, making them an appealing consideration for investors seeking to balance risk and reward.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.75% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.60% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.70% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.69% | ★★★★★★ |

| NCD (TSE:4783) | 4.65% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.03% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

| Daicel (TSE:4202) | 4.39% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

Click here to see the full list of 1048 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Binjiang Service Group (SEHK:3316)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Binjiang Service Group Co. Ltd. offers property management and related services in the People’s Republic of China, with a market cap of approximately HK$6.89 billion.

Operations: Binjiang Service Group Co. Ltd.'s revenue segments include CN¥2.19 billion from Property Management Services, CN¥1.26 billion from Value-added Services, and CN¥528.80 million from Value-added Services To Non-property Owners.

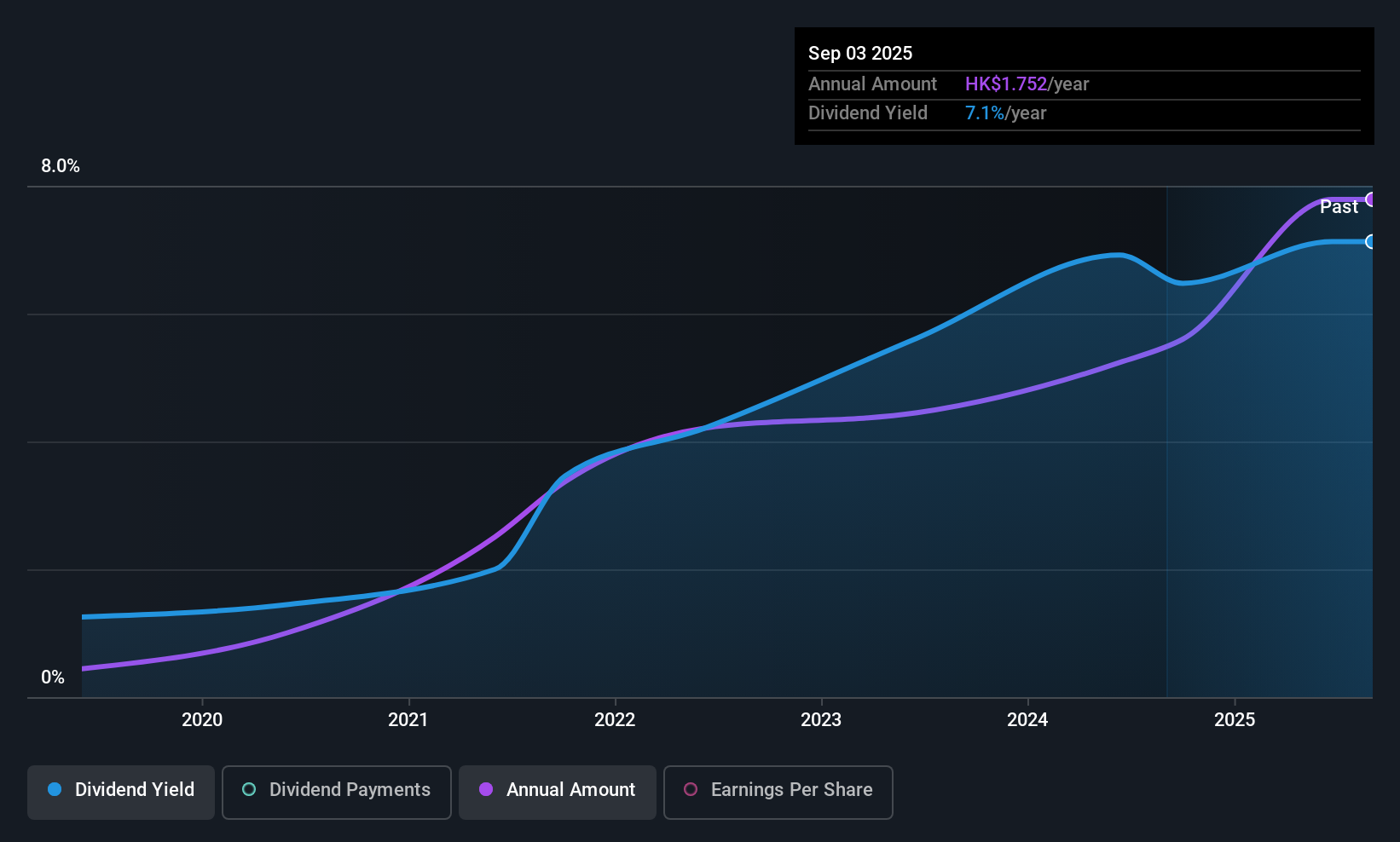

Dividend Yield: 7.0%

Binjiang Service Group's recent earnings report shows a rise in sales and net income, reflecting solid performance. However, their dividend history is marked by volatility and unreliability over the past six years. Despite this, the current payout ratio of 75.6% indicates dividends are covered by earnings, while a cash payout ratio of 82.5% suggests coverage by cash flows as well. Trading at a significant discount to estimated fair value, it offers good relative value compared to peers.

- Delve into the full analysis dividend report here for a deeper understanding of Binjiang Service Group.

- Insights from our recent valuation report point to the potential undervaluation of Binjiang Service Group shares in the market.

Kodensha (TSE:1948)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kodensha Co., Ltd. operates in the construction industry in Japan and has a market capitalization of approximately ¥22.08 billion.

Operations: Kodensha Co., Ltd. generates its revenue primarily from Electrical Installation Work, amounting to ¥31.06 billion, and Product Sales, contributing ¥9.51 billion.

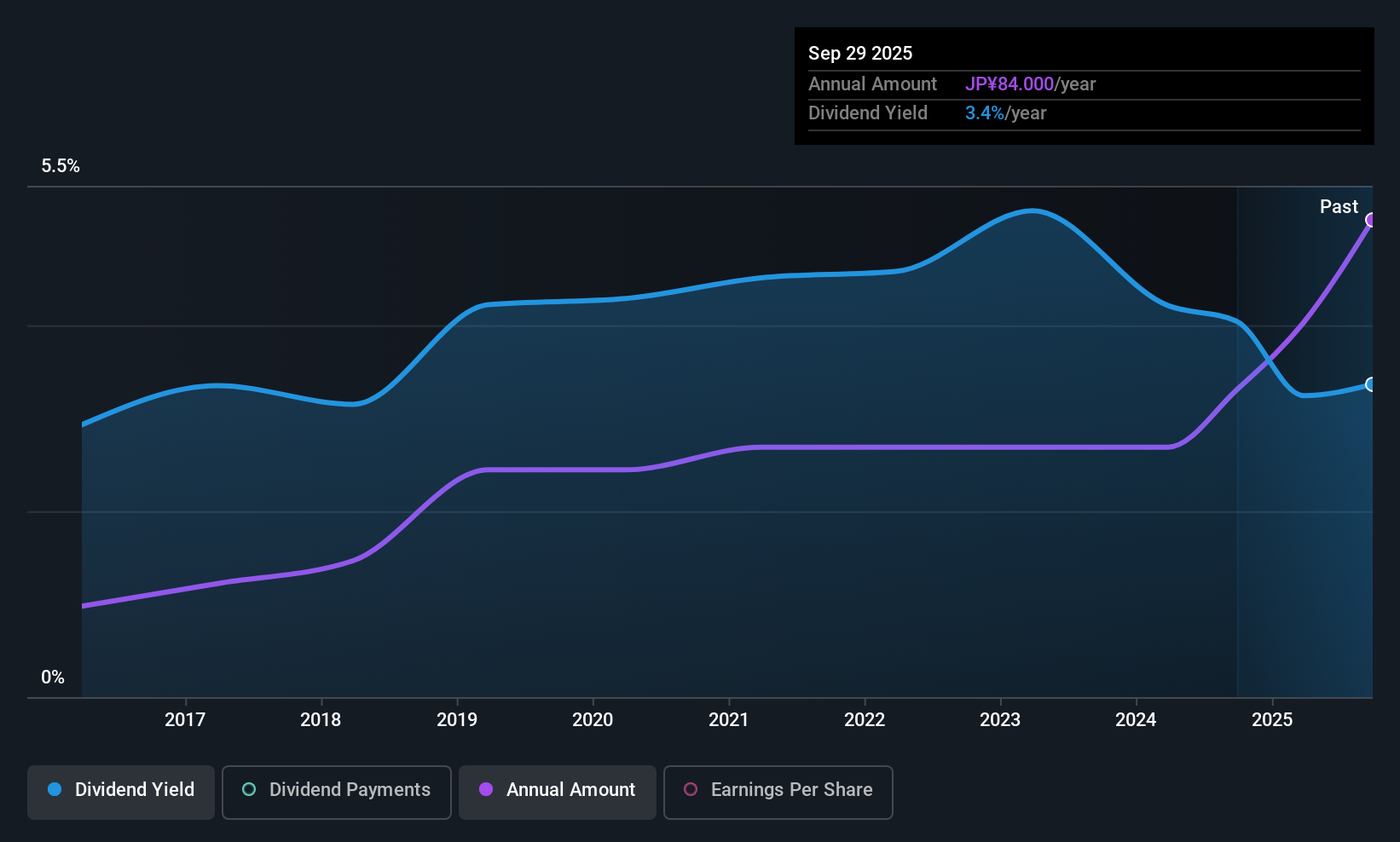

Dividend Yield: 3.3%

Kodensha's dividend payments are well covered by earnings, with a low payout ratio of 27.1%, and cash flows, maintaining an 80.1% cash payout ratio. Despite a decade-long increase in dividends, the payments have been volatile and unreliable. The current yield of 3.32% is below the top tier in Japan, but its price-to-earnings ratio of 8.1x suggests it offers good value relative to the broader market average of 14.5x.

- Click here and access our complete dividend analysis report to understand the dynamics of Kodensha.

- Our valuation report here indicates Kodensha may be overvalued.

FTGroup (TSE:2763)

Simply Wall St Dividend Rating: ★★★★★★

Overview: FTGroup Co., Ltd. provides network infrastructure services in Japan and has a market cap of ¥37.61 billion.

Operations: FTGroup Co., Ltd.'s revenue is primarily derived from its Network Infrastructure Business, which generates ¥19.02 billion, and its Corporate Solutions Business, contributing ¥15.77 billion.

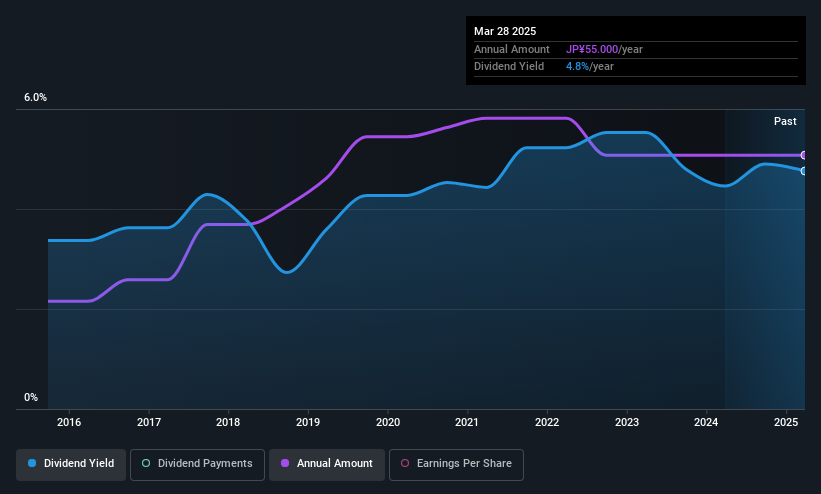

Dividend Yield: 4.3%

FTGroup's dividend payments are well-supported by both earnings and cash flows, with a payout ratio of 25.1% and a cash payout ratio of 30.8%. The company offers an attractive dividend yield of 4.35%, placing it in the top 25% among Japanese dividend payers. Over the past decade, FTGroup's dividends have been stable and growing, reflecting reliability. Additionally, the stock trades at a significant discount to its estimated fair value, enhancing its appeal for value-conscious investors.

- Get an in-depth perspective on FTGroup's performance by reading our dividend report here.

- Our valuation report unveils the possibility FTGroup's shares may be trading at a discount.

Taking Advantage

- Navigate through the entire inventory of 1048 Top Asian Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Binjiang Service Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3316

Binjiang Service Group

Provides property management and related services in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives