- Japan

- /

- Electronic Equipment and Components

- /

- TSE:2676

Takachiho KohekiLtd (TSE:2676) Has Announced A Dividend Of ¥58.00

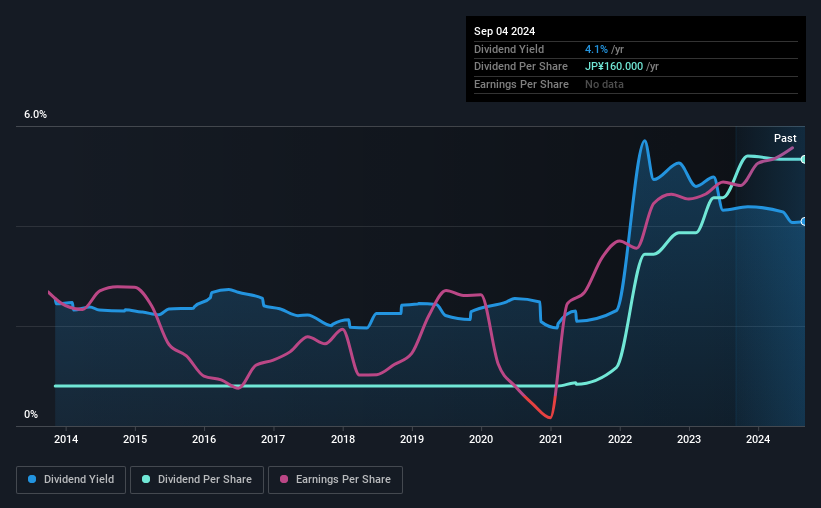

The board of Takachiho Koheki Co.,Ltd. (TSE:2676) has announced that it will pay a dividend on the 5th of December, with investors receiving ¥58.00 per share. This makes the dividend yield 4.1%, which is above the industry average.

See our latest analysis for Takachiho KohekiLtd

Takachiho KohekiLtd Is Paying Out More Than It Is Earning

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before making this announcement, the company's dividend was higher than its profits, and made up 94% of cash flows. This indicates that the company could be more focused on returning cash to shareholders than reinvesting to grow the business.

Earnings per share could rise by 18.6% over the next year if things go the same way as they have for the last few years. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 100% over the next year.

Takachiho KohekiLtd Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The dividend has gone from an annual total of ¥24.00 in 2014 to the most recent total annual payment of ¥160.00. This works out to be a compound annual growth rate (CAGR) of approximately 21% a year over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

Takachiho KohekiLtd's Dividend Might Lack Growth

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see that Takachiho KohekiLtd has been growing its earnings per share at 19% a year over the past five years. However, the company isn't reinvesting a lot back into the business, so we would expect the growth rate to slow down somewhat in the future.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We don't think Takachiho KohekiLtd is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for Takachiho KohekiLtd that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Takachiho KohekiLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2676

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026