Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Nippon Kodoshi Corporation (TYO:3891) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Nippon Kodoshi

What Is Nippon Kodoshi's Net Debt?

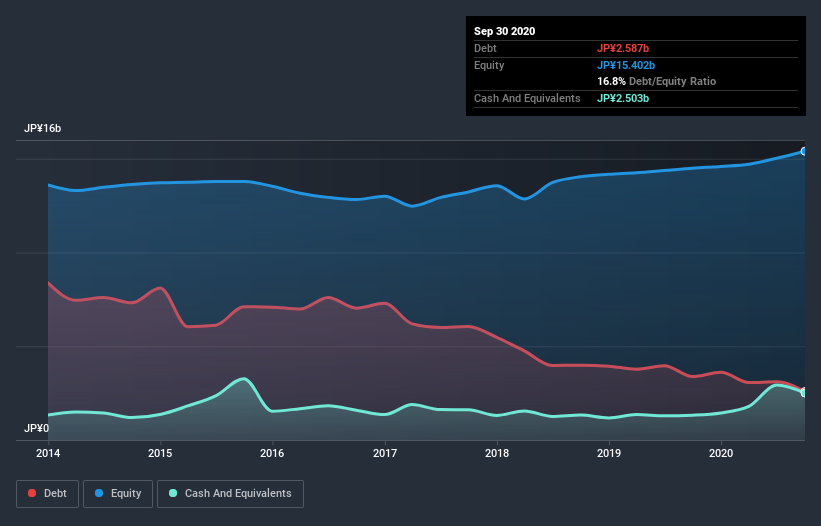

As you can see below, Nippon Kodoshi had JP¥2.59b of debt at September 2020, down from JP¥3.39b a year prior. However, it also had JP¥2.50b in cash, and so its net debt is JP¥84.0m.

How Healthy Is Nippon Kodoshi's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Nippon Kodoshi had liabilities of JP¥3.31b due within 12 months and liabilities of JP¥2.91b due beyond that. Offsetting this, it had JP¥2.50b in cash and JP¥3.13b in receivables that were due within 12 months. So its liabilities total JP¥589.0m more than the combination of its cash and short-term receivables.

Given Nippon Kodoshi has a market capitalization of JP¥27.4b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. But either way, Nippon Kodoshi has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Nippon Kodoshi has barely any net debt, as demonstrated by its net debt to EBITDA ratio of only 0.028. Humorously, it actually received more in interest over the last twelve months than it had to pay. So there's no doubt this company can take on debt as easily as enthusiastic spray-tanners take on an orange hue. In addition to that, we're happy to report that Nippon Kodoshi has boosted its EBIT by 67%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Nippon Kodoshi can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Nippon Kodoshi actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Nippon Kodoshi's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. It looks Nippon Kodoshi has no trouble standing on its own two feet, and it has no reason to fear its lenders. To our minds it has a healthy happy balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Nippon Kodoshi that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Nippon Kodoshi or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nippon Kodoshi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:3891

Nippon Kodoshi

Manufactures and sells separators in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026