- Japan

- /

- Electronic Equipment and Components

- /

- TSE:2469

How Much Did Hibino's(TYO:2469) Shareholders Earn From Share Price Movements Over The Last Year?

Even the best stock pickers will make plenty of bad investments. Anyone who held Hibino Corporation (TYO:2469) over the last year knows what a loser feels like. The share price has slid 54% in that time. Notably, shareholders had a tough run over the longer term, too, with a drop of 40% in the last three years. It's down 3.4% in the last seven days.

See our latest analysis for Hibino

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

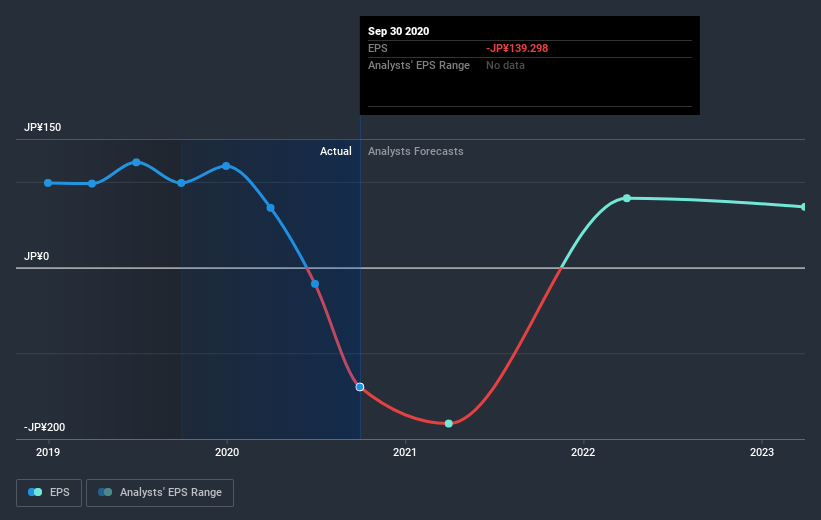

During the last year Hibino saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. However, there may be an opportunity for investors if the company can recover.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Hibino's key metrics by checking this interactive graph of Hibino's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 10% in the last year, Hibino shareholders lost 54% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Hibino better, we need to consider many other factors. Take risks, for example - Hibino has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

If you’re looking to trade Hibino, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hibino might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:2469

Hibino

Designs, sells, installs, and maintains audio equipment in Japan and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives