- Saudi Arabia

- /

- Trade Distributors

- /

- SASE:4146

Undiscovered Gems And 2 Other Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data releases, small-cap stocks demonstrated resilience compared to their larger counterparts, as major indices like the S&P 500 and Nasdaq Composite experienced declines. Amidst this backdrop of cautious market sentiment, investors might find opportunities in smaller companies that are often overlooked but have potential for growth. Identifying promising small-cap stocks involves looking for those with strong fundamentals and the ability to navigate current economic challenges effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Forth Smart Service | 21.94% | -8.16% | -16.02% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 15.25% | 15.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Jinghua Pharmaceutical Group | 0.90% | 5.39% | 47.06% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 2.80% | 17.08% | -4.11% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

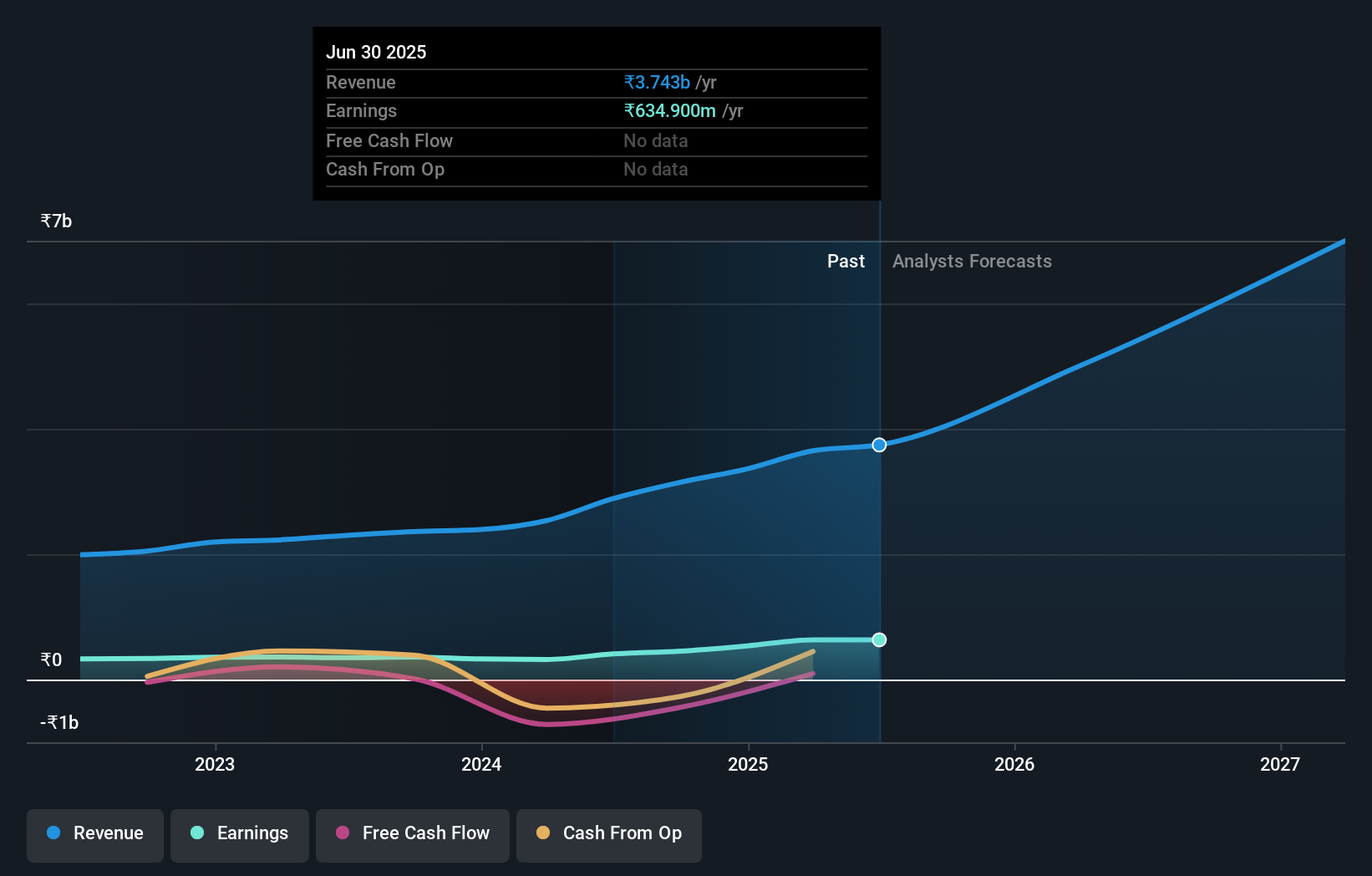

Paras Defence and Space Technologies (NSEI:PARAS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Paras Defence and Space Technologies Limited is engaged in the design, development, manufacturing, and testing of defense and space engineering products and solutions both in India and internationally, with a market capitalization of ₹42.77 billion.

Operations: Paras Defence and Space Technologies generates revenue primarily from its Defence Engineering segment, contributing ₹2.09 billion, and its Optics and Optronic Systems segment, adding ₹1.06 billion.

Paras Defence and Space Technologies, a dynamic player in the defense sector, showcases impressive financial health with a net debt to equity ratio of 10.6%, reflecting prudent fiscal management. Over five years, it has reduced this ratio from 58% to 14.4%, indicating strong debt management capabilities. Despite facing shareholder dilution recently, Paras reported robust earnings growth of 17.5% annually over five years and achieved a net income of INR 138.6 million in the latest quarter compared to INR 94.2 million the previous year. With high-quality earnings and well-covered interest payments at an EBIT coverage of 17.6x, Paras remains financially resilient despite not surpassing industry growth rates last year.

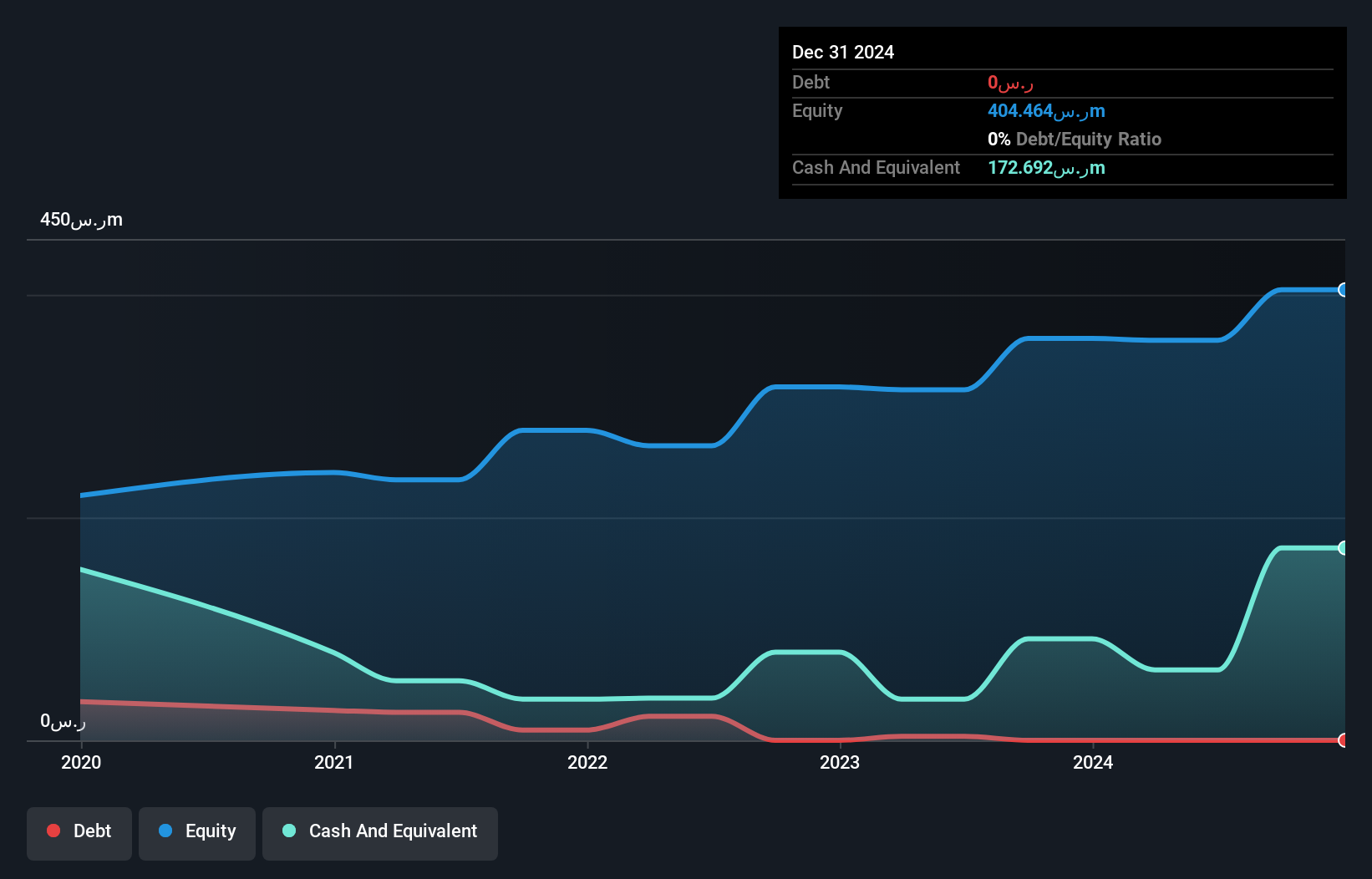

Gas Arabian Services (SASE:9528)

Simply Wall St Value Rating: ★★★★★★

Overview: Gas Arabian Services Company operates in the Kingdom of Saudi Arabia, offering products and services in automation, instrumentation, field services, mechanical, and piping fields with a market capitalization of SAR2.24 billion.

Operations: Gas Arabian Services generates revenue primarily from trading (SAR475.43 million), technical services (SAR350.50 million), and manufacturing (SAR25.90 million). The trading segment is the largest contributor to its revenue streams.

Gas Arabian Services, a nimble player in its industry, reported impressive earnings growth of 7.8% over the past year, surpassing the Trade Distributors industry's decline of 10.8%. The company is debt-free and trades at 66.7% below its estimated fair value, suggesting potential undervaluation. Recent financials show sales reaching SAR 481 million for the half-year ending June 2024, up from SAR 351 million a year prior. Net income also rose to SAR 45 million compared to SAR 35 million previously, with basic earnings per share increasing to SAR 0.29 from SAR 0.22 last year.

- Unlock comprehensive insights into our analysis of Gas Arabian Services stock in this health report.

Gain insights into Gas Arabian Services' past trends and performance with our Past report.

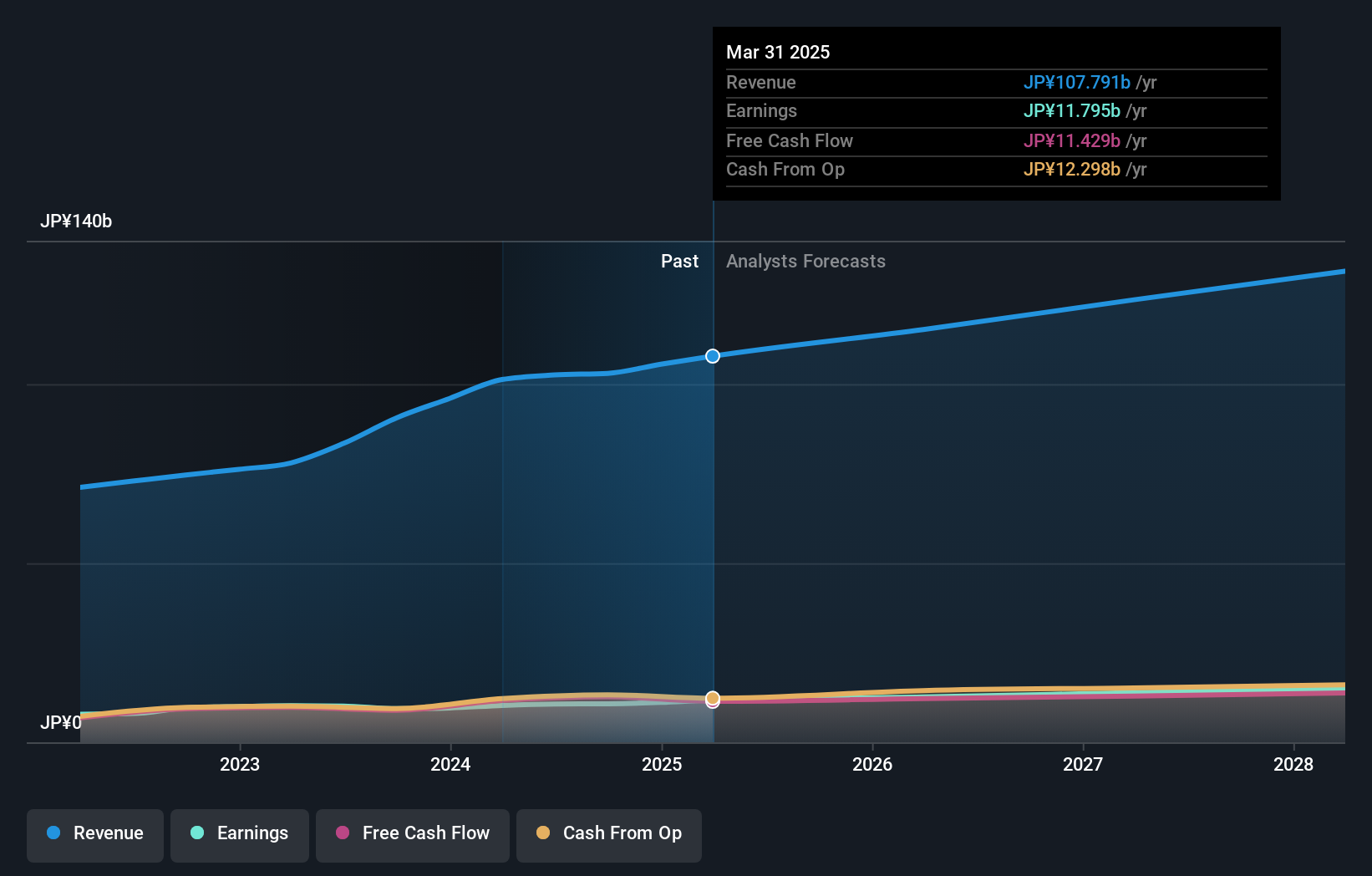

NSD (TSE:9759)

Simply Wall St Value Rating: ★★★★★☆

Overview: NSD Co., Ltd. offers IT solutions in Japan with a market capitalization of ¥259.47 billion.

Operations: NSD's primary revenue streams are derived from its Solution Business, generating ¥14.58 billion, and the System Development Business - Financial IT segment, contributing ¥31.50 billion. The IT Infrastructure segment adds another ¥12.13 billion to the total revenue.

NSD Co., Ltd. has been making waves with its impressive financial performance, highlighted by a 14.7% earnings growth over the past year, surpassing the IT industry's 10.1%. This company is trading at 1.8% below its estimated fair value, suggesting potential for investors seeking undervalued opportunities in the market. The debt to equity ratio has risen from 0% to 4.7% over five years, yet NSD's cash holdings exceed total debt, indicating a robust balance sheet position. Recently, NSD announced a share repurchase plan worth ¥1,700 million for up to 550,000 shares as part of their strategy to enhance shareholder value through February 2025.

Next Steps

- Access the full spectrum of 4741 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4146

Gas Arabian Services

Provides products and services for automation, instrumentation, field services, mechanical, and piping fields in the Kingdom of Saudi Arabia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion